Insolvency wave in 2021 to hit retail, travel, construction and entertainment sectors hardest

The Australian economy is facing a wave of over 25,000 insolvencies and nearly 16,000 company administrations by September.

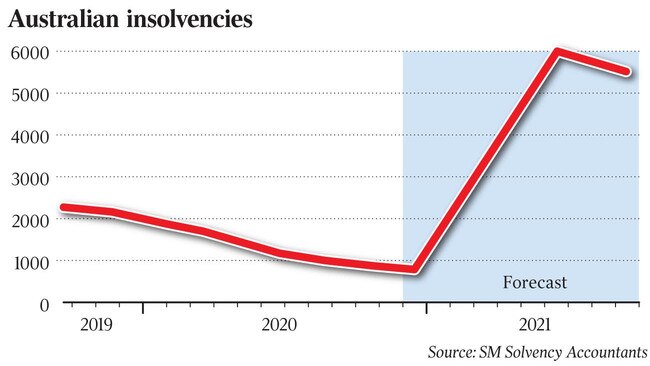

Insolvencies are expected to spike in coming months as Australian businesses exit temporary protections imposed in the early days of the pandemic.

SM Solvency Accountants projects 15,800 companies will enter external administration by September 2021. Personal insolvencies are expected to reach 25,500 by September, peaking in March.

SM Solvency Accountants partner Brendan Nixon said the backlog of insolvencies coupled with the tapering of economic support from the federal government would create a wave of insolvencies in 2021.

“There will be some bounce back with the economy but I think things will become clearer when businesses are forced to commit to operating again long term,” he said.

“There could be some tough decisions arising from when people realise things are not going to go back to how they were in 2019.”

The expected tsunami of insolvencies comes after many industry figures have sounded warnings of the consequences of pushing out debt protection to six months from 21 days before the COVID-19 pandemic.

The rate of business insolvencies collapsed almost overnight this year after the federal government extended economic support and increased outstanding debts required before creditors could initiate proceedings.

In the September quarter only 946 businesses went into external administration.

That’s less than half of the 2309 that went into external administration in 2019 at the same time.

ASIC data shows between 6278 businesses went into insolvency between October 2019 and October 2020.

Construction was the worst hit sector, with 1167 businesses going bust in that period.

This was followed by accommodation and food services, with 833 hitting a wall.

However, rates of insolvencies plummeted across 2020, with two-thirds of insolvencies taking place between October 2019 and March, when protections were imposed.

Speaking earlier this month to the House of Representatives economics committee, Reserve Bank governor Philip Lowe noted the “very low” rate of insolvencies.

“It’s going to rise,” he said, “businesses are going to fail, they’re going to have to restructure.”

Mr Nixon said the coming wave of insolvencies would be complicated by zombie companies that were already circling the drain in the early days of 2020.

“Some small businesses, as of March, were already insolvent,” he said.

“The fact they’ve continued trading means there’s some economic contribution but there‘s a credit risk from those companies transacting with good companies and entering into credit arrangements while being zombie companies.”

Mr Nixon said the pain from insolvencies and business collapses would be concentrated across a handful of industries.

He said many entertainment providers, while able to reap some relief from relaxed restrictions, had run up considerable debts in 2020 and may be forced to shut.

The retail sector is also likely to continue its run of collapses, with Mosaic Brands announcing it would shut up to 500 stores in the next two years, as well as Seafolly, Kikki K, Jeanswest, and Colette biting the dust in 2020.

Mr Nixon also said engineering companies could suffer as many major projects were scaled back and continued low population growth crimped construction.

Many travel agents and student agents were also likely to fold as borders remained closed and economic support was wound back.

“Generally those affected by international travel restrictions or reliant on high discretionary spending like luxury providers or goods or services will close,” Mr Nixon said.

“When the dust settles and people’s habits go back to a new normal there will be a clearer picture.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout