How Chris Hemsworth, Kayla Itsines and even Telstra are frontrunners in fitness app boom

Low cost and with celebrity-led content, fitness apps have ridden the pandemic wave to change the way we work out, attracting cashed-up investors.

As Chris Hemsworth returns to the screen as Marvel superhero Thor, thousands of fitness fanatics have been downloading his Centr workout app in an effort to replicate his bulging muscles.

Centr revamped its Power program to coincide with the premiere of Thor: Love and Thunder in an act that shows how far cross promotion has come from plastic toys being placed in Happy Meals to market the latest flick.

Health and wellness has been pulled sharply into focus during the past two-and-a-half years as Covid-19 has up-ended the way we live, work and play. Hemsworth, whose app has a valuation of $US200m ($297m) after it was snapped up by HighPost Capital, led by David Moross and Mark Bezos – the brother of Amazon billionaire Jeff Bezos – is not alone in capitalising on the craze.

South Australia’s Kayla Itsines and Tobi Pearce built a digital fitness empire – attracting a following of more than 55 million women across the globe on social media channels – before selling their Sweat app to US software giant iFit Health & Fitness for $400m last year.

This month, Richmond AFL star Dustin Martin announced he was ready to share his training and mindfulness tips via his own app, Drip. “To have the opportunity to share the things I’ve learnt and help others achieve their goals really excites me,” Martin said earlier this month.

And despite an increasingly crowded market, fitness apps are still attracting big money.

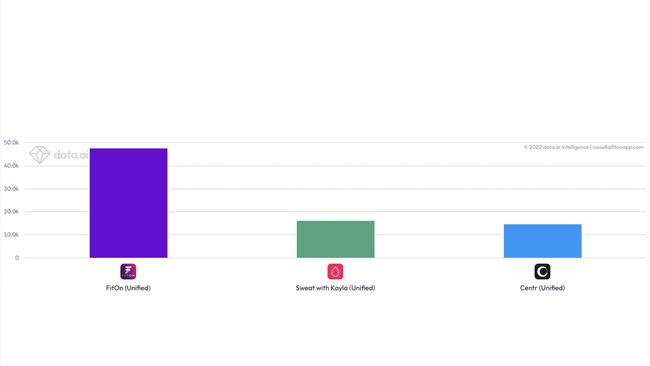

Telstra Ventures – one of Australia’s biggest venture capital firms, with more than $1bn under management – has led several funding rounds for Los Angeles-based FitOn, which in the past three months has had about double the downloads of Centr and Sweat, according to Digital.ai.

But, as gyms re-open after pandemic restrictions lift and more people socialise in fitness groups, the bubble has begun to burst – and sometimes spectacularly so – for some companies.

The market value of Peloton, the connected exercise bike manufacturer, has crumbled from $US50bn to $US2.81bn in the past 18 months as pandemic-driven demand collapsed and sales fell more than 40 per cent.

The valuation of iFit – which also owns Peloton rival NordicTrack – tumbled by 60 per cent to less than $US3bn earlier this year after a capital raising. The collapse in valuations of two of the world’s biggest players, combined with the rout that has hit tech stocks and the proliferation of fitness apps, might make investing in health start-ups seem a counterintuitive move.

But Telstra Ventures partner Yash Patel says fitness apps are in a different category to Peloton and NordicTrack.

I make a distinction between the companies in the fitness space – that is there are hardware players, then there are software and content players, and then there are ones that combine the two in a hybrid approach,” Patel said.

“Our investment thesis, from very early on when we led our investment in FitOn in a Series A (funding round) right before Covid hit in March 2020, remains true today and in many ways we feel validated by what’s happening now and, that is capital intensive hardware plays are not scalable in the same way that software and content plays are in the fitness space.

“The business models of NordicTrack and Peloton are kind of flawed; they’re quite capital intensive and inventory forecasting is very difficult to do.”

Apps such as FitOn, Centr and Sweat need very little equipment and workout instruction is available on existing mobile devices, Mr Patel added.

But with barriers to entry low, and apps competing with myriad free content – including scores of YouTube workout and yoga videos – another challenge arises in ensuring profitability.

“When we scoured the landscape, admittedly there’s a plethora of apps out there, but most of them were very low-quality content. FitOn was one of the only apps out there that had no paywall to begin with, so it was always free … and how they generate revenues is that there’s always going to be naturally ‘whale’ users that are high users that will subscribe to their premium service,” Patel said.

Hemsworth said his app was “carefully curated and integrated fitness, nutrition, and mindfulness programs, guiding beginners and more experienced users”.

HighPost also acquired gym equipment manufacturer Inspire Fitness to complement Centr’s content. “The combination of Centr and Inspire Fitness, two profitable high-growth businesses, presents a highly attractive opportunity to create a best-in-class fitness platform for health and wellness enthusiasts worldwide,” HighPost’s Moross said in March.

Another revenue stream is a partnership with health insurers.

Early in the pandemic. Bupa offered its members three months’ free access to former Bachelor star Sam Wood’s fitness program – with the aim of keeping people out of hospital and paying out expensive claims – and creating more customer value.

Australia’s biggest health insurer, Medibank, created its own Live Better app in 2019 and so far has about 500,000 members. It also features a platform, offering rewards to members who complete health initiatives, including Covid-19 vaccination, blood pressure and skin checks.

“We’re now looking to expand Live Better into other high-growth health and wellbeing markets,” a Medibank spokeswoman said.

The global fitness app market is valued at $US1.1bn and is expected to expand at a compound annual growth rate of 17.6 per cent from 2022 to 2030, according to Grand View Research.

This compares with an IBISWorld forecast for an annual growth rate for Australia’s gym and fitness centres of 1.3 per cent to $2.3bn in the five years to 2026-27 as it faces competition from digital services.

“Strong growth in online fitness operators has had a modest negative effect on demand for gyms and fitness centres,” IBISWorld’s Darcy Gannon said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout