King of tech giants shows little sign of surrendering the throne

While the bubble may have burst for many American success stories, Apple is on a seemingly relentless rise.

Faith in America’s technology giants has rarely been tested thanks to easy money flooding financial markets after the 2008 crash, the rapid mass adoption of the internet and, more recently, immunity to the impact of global lockdowns. But investor zeal is waning and there has been a seismic shift away from some of the largest global tech stocks since the start of the year.

Rapidly rising inflation and the prospect of a faster-than-anticipated increase in interest rates has caused a wholesale sell-off in stocks with high future earnings expectations baked into lofty valuations. Since the start of this year the S&P 500 has fallen by 12 per cent and the tech-heavy Nasdaq Composite index has declined by a fifth.

Quarterly earnings figures released in recent weeks have coincided with even deeper concerns: that there are more fundamental barriers to earnings growth. A warning from Netflix that it had lost subscribers for the first time in a decade last month caused the streaming giant to lose more than a quarter of its market value in one day. Meta, the owner of Facebook and Instagram, reported its slowest quarterly sales growth in a decade amid rising competition. Meanwhile, Apple has warned of a much bigger hit from supply chain disruption to come this year. Investors have been left wondering, has the bubble truly burst for these American success stories?

In the first of a series focusing on the opportunities and challenges facing three of America’s most largest tech stocks, we take a look at the king of the big tech companies, Apple.

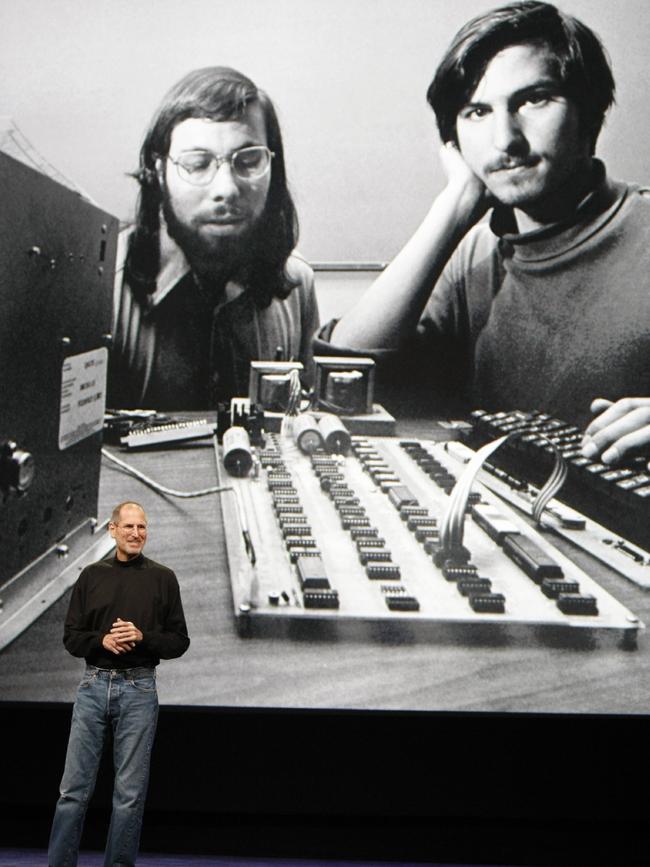

Earlier this year Apple fleetingly became the first company to reach a $4.24 trillion valuation, less than 18 months after vaulting the $2.83 trillion-mark. The iPhone maker, founded in 1976 by Californian college dropouts Steve Jobs and Steve Wozniak, has delivered the highest share price return of any member of the exclusive Faang club - Facebook (now Meta), Amazon, Apple, Netflix and the Google-parent Alphabet - over the past 20 years, totalling 45,155 per cent. An investor putting their money into Apple on the day of the stock market crash in early 2020 would have still almost doubled their money, despite the recent sell-off.

Analysts attribute Apple’s success to its brand strength, the deep inroads it has made into the Chinese market and an ability to reinvigorate a suite of products and services that has built a high customer retention rate. “It’s the most loyal customer base in the world,” said Dan Ives, an analyst at the US brokerage Wedbush. “Their success has been innovative product development and that develops a halo effect.”

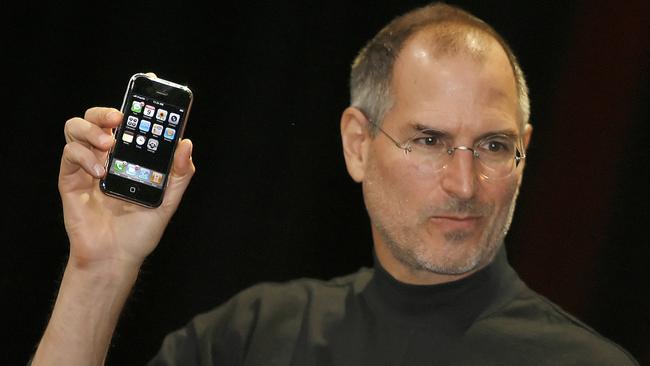

About 98 per cent of customers who purchase an iPhone, which accounts for more than half of revenue, go on to buy another when they come to upgrade their handset, Apple estimates. During the first three months of the year, a 5 per cent increase in iPhone sales indicated that the tech group was still enjoying the benefits of a supercycle in iPhone upgrades that began with the release of the iPhone 12 in late 2020.

Growth in Apple’s hardware sales is more impressive given the strength of prior year comparators, said one Apple shareholder. “Look how few companies have got through those comps, Netflix being a case in point, and have got through the pandemic period unscathed, and so far Apple is definitely one of those companies,” they said.

But great investor hope also lies in faster revenue growth from its higher-margin services business, which sells software through the App Store, online storage space via iCloud and generates subscription revenue through its music, television and fitness platforms. During the second quarter of the group’s financial year, the services business generated record sales, 17 per cent higher than the previous year. That helped to drive the 9 per cent growth in overall revenue for Apple during the three months to the end of March to $137.5 billion, well above the $133 billion that analysts had been expecting.

The services business is becoming an increasingly important part of investors’ earnings expectations because it contributes a bigger chunk of gross profits, said Jon Guinness, a fund manager at the asset manager Fidelity International, which invests in Apple. “It’s just doing this relentless march forward,” he added.

But analysts still forecast a slowdown in overall revenue this year to 8 per cent, from the 33 per cent growth recorded last year. The extent to which the pandemic and the release of the iPhone 12 pulled forward demand, adds a layer of uncertainty to where sales will land this year. “Historically when you have a big jump from the generation cycle then the following year there’s a slowdown,” said Chaim Siegel, head of US equity research at the stock market research specialist Elazar Advisors.

There is also the question of whether Apple can retain its pricing power when soaring inflation is squeezing consumer wallets. The uniqueness of Apple’s products means it shouldn’t lose those customers altogether, argued one investor. “The Apple purchase is not a fungible purchase and it’s something where you’ll wait and they’ll close that business later,” the investor said.

But there are other hurdles for Apple to surmount if it is to meet sales expectations, chiefly supply chain disruption and shortages of the semiconductor chips used to make hardware products. Almost half of Apple’s top suppliers are located in or around Shanghai, according to its most recently published list, a city under lockdown as part of the Chinese government’s zero Covid policy. “Going into earnings there’s always a fear that the China issues will taint the story,” Ives said. “Supply continues to be the issue for Apple, not demand.”

Luca Maestri, Apple’s finance chief, told analysts that the tech group expected to take a hit of between $5.7 billion and $11.3 billion during the present quarter due to supply shortages, particularly silicon, and factory shutdowns in China, a “substantially larger” impact than the group experienced during the March quarter. There is also the risk that a more pronounced slowdown in Chinese economic growth could hit demand in what has become a core market for Apple.

“They did say they don’t have a demand problem, but at some point if [people] can’t get out ... it could also slow the consumer there,” Siegel said. “The stock’s not trading down that much, so the market is handling it pretty well and thinking it’s a short-term thing but nobody knows how long this is going to last.”

Market data from the US investment bank Morgan Stanley is more optimistic. It estimates that the iPhone installed base share reached a record high of 23.3 per cent at the end of March, with year-on year market share gains the strongest since March 2019 thanks to strengthening retention rates and continued switching from Huawei phone users.

Ives believes Apple has been oversold, arguing that supply issues are largely out of the group’s control and that if demand for its products and services remains buoyant, the shares should re-rate. “We believe Apple can pass on price increases to consumers which makes them more Teflon-like in this rising inflationary environment,” he said.

Indeed, Apple’s shares have held water better than peers during the recent sell-off. The tech group still has an enterprise value equivalent to 6.9 times forecast sales and 20.6 times expected earnings this year. Investors are split on whether that fully takes into account risks further down the road.

“The big question mark for me is the valuation,” said Guinness. “Unlike Google, and unlike Facebook and unlike Amazon, Apple is at a very high multiple relative to its history.”

Another investor said, however, that while the shares do trade at a premium, there is no reason why they shouldn’t. “If you look at it through the lens of a mass affluent consumer brand business with an enormous installed base ... it’s a pretty exceptional asset,” they said.

Apple still trades at high stakes valuation multiples and ones that could result in Apple receiving harsher treatment if Chinese supply chain issues or flagging consumer spending trip up earnings growth. But there is no sign of rivals taking its crown just yet.

The Times

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout