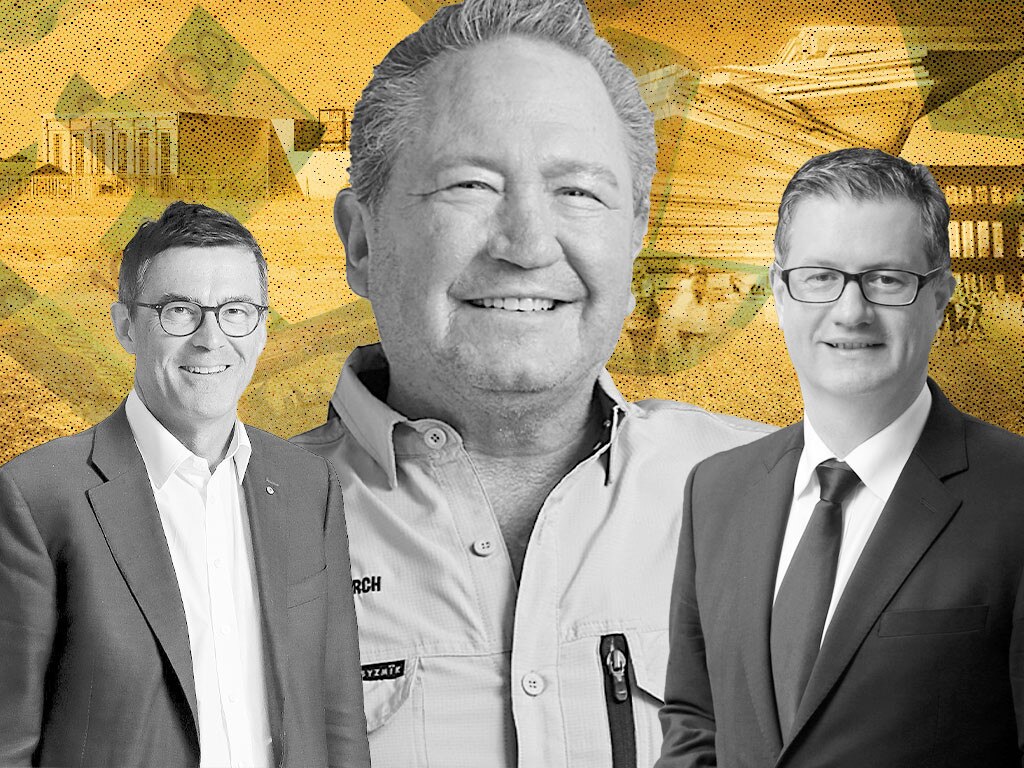

Bega swoop: Behind Andrew ‘Twiggy’ Forrest’s bet on Aussie milk

The $108m swoop on Bega Cheese is a classic move by the mining billionaire, who hasn’t stopped for breath since unleashing his green hydrogen vision onto the world.

Days out from Christmas, multi-billionaire Andrew ‘Twiggy’ Forrest was quietly buying shares in Bega Cheese just as everyone else was rushing for the exits in the dairy major.

The $108m swoop is classic Forrest, who hasn’t stopped for breath since unleashing his green hydrogen vision onto the world through the sprawling Fortescue Future Industries.

Bega is a play on both agriculture and iconic Australian brands, which hits the sweet spot for the mining billionaire.

Indeed, Bega’s Vegemite business could sit nicely next to Forrest’s prized RM Williams boot brand.

In reality, the deal, which sees Forrest’s private Tattarang group emerge with a 6.6 per cent stake in the dairy company, was engineered by John Hartman, who has been eyeing the east coast player for some time. He started buying some 4 million Bega shares from November 10.

Then came last week’s price crash where Bega dropped 10 per cent in a session after warning about excessive heat in the milk supply market made the stock too good to resist. Hartman, the chief investment officer of Tattarang, moved quickly to snap up a further 16 million shares across two days.

Even working for one of the richest people in the country, Hartman knows his boss does not like to lose money.

On Tuesday night Hartman contacted Bega’s executive chairman Barry Irvin to flag a notice was to be lodged on Wednesday showing that Forrest is now his biggest shareholder.

But it is understood Hartman came with a message of peace, painting Bega as a long-term strategic investment for Tattarang, which also has interest in beef farms and aquaculture.

There are also similarities to Forrest’s $12m move on stockfeed processor Ridley this year where he picked up an initial 5 per cent stake, which he has since slowly moved to 6.5 per cent.

Hartman, who is currently on a post-Christmas break, on Wednesday said: “Tattarang is committed to investing in Australian businesses and brands that showcase the best of our country to the world.”

Still, the nagging fear is Forrest could be looking for something a bit more.

With no substantial holders outside of Nathan Parkin’s and Matt Nacard’s Ethical Partners Funds management (5.7 per cent), Bega’s share registry is wide open. The top 10 investors hold a combined 36 per cent and several of these include passive index funds.

Bega doesn’t want to go the way of the strategically challenged a2Milk.

Rather, under the grounded Irvine, Bega is becoming more Fortescue as it tries to move up the value chain. There’s also a sense of Bega, the plucky Australian challenger, taking on the global giants New Zealand’s Fonterra and Canada’s Saputo.

The timing as comes just as Fonterra is looking to offload its $1bn Australian business through a private sale or stock market listing. This puts Forrest where he likes to be – at the table during industry consolidation.

In Australia Fonterra has the biggest share of the milk processing market. It operates eight manufacturing sites and has more than 1600 staff. Bega is the number two player followed by Saputo and French giant Lactalis, which owns Pauls.

There is a lot of upside for anyone to take that prize and Bega with a $1.7bn market cap can’t do it alone if it wants to become Australia’s own Fonterra.

Then there’s Forrest who is the new impact investor. In recent months he represented a very public road block for Brazilian meat processor JBS, which was attempting to acquire salmon producer Huon Aquaculture for $425m.

Forrest had heaped intense pressure on the salmon farmer to speed up sustainable farming practices. Forrest demanded better environmental standards from JBS in exchange for his stake while also making a tidy profit on his initial Huon investment.

Nor has Forrest taken his eye off mining, recently edging out BHP in a battle for Canadian nickel explorer Noront Resources.

Forrest is making a big bet on nickel – used in lithium-ion batteries and energy storage systems. He has amassed stakes in Mincor Resources, Poseidon Nickel and Panoramic Resources. This also puts him in the box seat for any green-driven consolidation in the sector. At the same time he has been creeping up the share registry of Western Areas to build a 6.3 per cent stake in that miner. This comes as IGO (the former Independence Group) and Western Areas are looking to push ahead with a $1.1bn nickel merger.

Currently there is furious land grab underway in the dairy industry. Supply is being squeezed as no processor wants to be left short into 2022, which means prices at the farmgate are running at record highs.

At the same time total milk output has fallen as some dairy farmers have pivoted to less labour intensive beef and lamb where profit margins are much higher.

Adding pressure, rival operators say Fonterra doesn’t want to be caught short milk going into its possible sale process and has been prepared to pay up big to lock in supply.

Bega is feeling the squeeze of the higher milk prices as well as cost blowouts from a Covid-induced supply chain squeeze.

One bright spot has been the last year’s $560m Lion Dairy and Drinks acquisition, where cost savings from combining the businesses are so far coming in ahead of plan.

It is tipping normalised earnings of between $195m to $215m this financial year, which is still up from $141.7m for financial 2021.

A recent in-depth series on Forrest by my colleagues Nick Evans and John Stensholt noted that Tattarang made a net profit of $252m for the year to June 30, up from $105m in 2020. Net assets, which includes the RM Williams brand, increased by $965m during the year.

While Forrest’s mind is focused on creating a new green global economy he can’t resist the lure a of seat at the agriculture table.

johnstone@theaustralian.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout