Andrew Forrest buys $108m slice of Bega Cheese

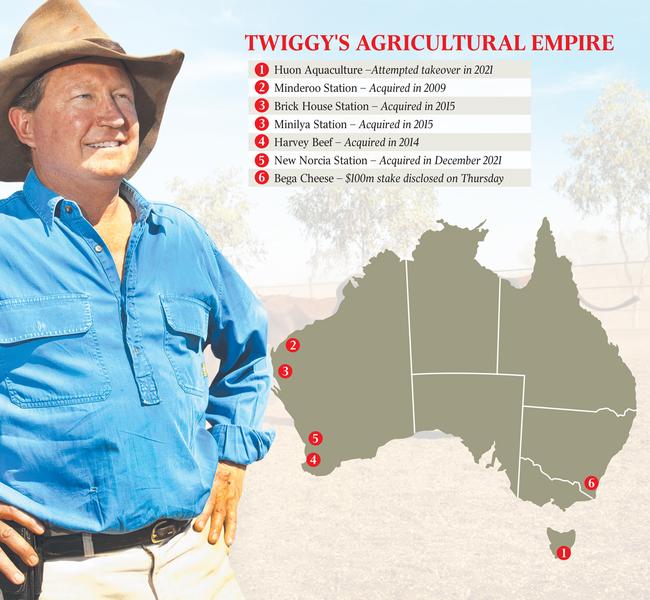

Mining billionaire Andrew Forrest has turned his attention to yet another agricultural asset, buying a 6.6 per cent stake in high-profile food manufacturer Bega Cheese.

Mining billionaire Andrew Forrest is setting up for a closer eye on the action within well-known food brands owner Bega Cheese after splurging more than $108.3m on building up a 6.6 per cent stake through his Tattarang group.

On Thursday, Bega Cheese issued a substantial shareholder notice detailing Tattarang AgriFood Investments, Forrest & Forrest and John Andrew Henry Forrest’s stake in the business through the purchase of more than 20 million shares between November 10 and December 29.

Shares in Bega, which has a market capitalisation of $1.6bn, surged 3.2 per cent to $5.50 on the news, making it the day’s second best performer on the S&P/ASX 200 Index.

“This is a long-term investment for the Tattarang Group,” Tattarang chief investment officer John Hartman said.

“Tattarang is committed to investing in Australian businesses and brands that showcase the best of our country to the world. Our investment in Bega Cheese Limited is part of this commitment,” he said.

Mr Forrest moved on the Vegemite, Pura Milk and Farmers Union owner days after Tattarang voted in favour of JBS Australia’s $550m purchase of salmon producer Huon Aquaculture, using its 18.5 per cent stake to force the Brazilian company’s commitment on environmental sustainability and animal welfare practices.

It also comes at a time when iconic Aussie pantry items owner Bega Cheese, which also has the Lion Dairy and Drinks business, is facing pandemic challenges in the form of lockdowns and supply constraints on top of its softening sales in the once-thriving China market for infant formula.

Shares in Bega dived 13 per cent to $5.04 on December 23 after it curbed normalised earnings expectations to between $195m and $215m for the 2022 financial year.

While the restrained guidance indicates a lift of about 63 per cent on the 2021 financial year earnings of $142m, it fell short on analyst expectations.

Ord Minnett analysts lowered their rating on the dairy group to “hold”, on the back of the news, giving its shares a price target of $5.40.

It is not clear if Tattarang cashed in on the $230m one-day wipe-out in what was Bega’s worst trading day since March 2020.

Bega is expecting upward pressure on farm gate milk prices to remain for the balance of the year, reflecting high global dairy commodity prices and limited supply.

But it was “comfortable with the overall operations” despite cost and pandemic pressures.

The cheese maker’s most recent annual results, posted in August, showed sales revenue had pushed past the $2bn mark following its $528m acquisition of Lion Dairy and Drinks during the year.

The acquisition saw Bega more than double its employee numbers, and created one of the largest cold chain distribution networks in Australia.

Executive chairman Barry Irvin said at the time that “the importance of consistent strategy and strong values is never more evident than in times of uncertainty”.

“Our capacity to be agile and change, while remaining confident in the core direction and strategy was again tested and on display (last financial year),” he said.

Meanwhile, the cashed-up Tattarang group has been on somewhat of an acquisition spree of late.

Earlier this month, its agri business division Harvest Road forked out around $40m to snap up the iconic New Norcia Farm in Western Australia’s wheat belt, expanding the group’s cattle and beef supply chain.

Tattarang has also in recent weeks acquired the 22-room Cape Lodge Hotel near Margaret River, positioning itself to capitalise on an expected rebound in local tourism.

In November, the Forrests’ vehicle bought the Gaia retreat near Byron Bay for $30m, and North Queensland’s Lizard Island for $42m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout