Afterpay’s $39bn sliding doors moment at early US meeting

This week’s blockbuster Square deal – the largest in Australian corporate history – almost happened four years ago.

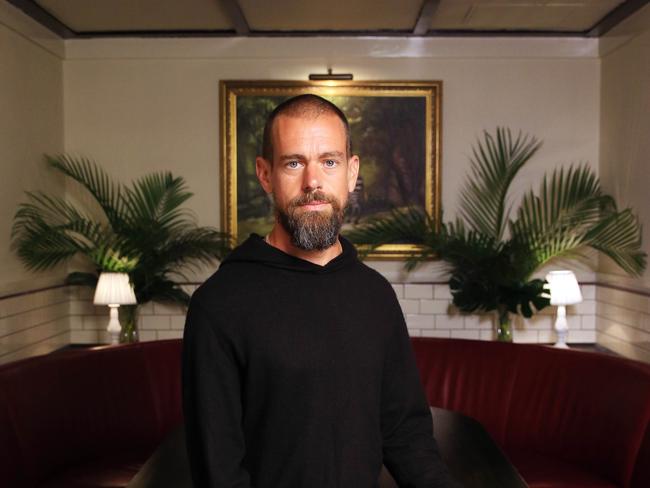

Afterpay’s blockbuster merger with Jack Dorsey’s Square could have happened four years ago, in one of the great sliding door moments in Australian technology, when a bright-eyed Nick Molnar took a meeting with top executives at Square’s San Francisco headquarters hoping to strike a deal around payments processing.

Molnar was introduced to Square’s top executives in 2017 by the US payments company’s then-Australian country manager Ben Pfisterer, who knew the advantage of a tie-up between buy now, pay later and payments processing was obvious.

Pfisterer, now the head of local payments start-up Zeller, says he could see the value in Afterpay’s offering years before the landmark $39bn deal was announced this week.

Square CEO Jack Dorsey on Monday lauded Afterpay’s “visionary” leaders, telling investors it had “been incredible to witness how effortlessly our conversations flowed around shared ideas and vision”.

But when Pfisterer, who ran Square’s Australian operations between 2014 and 2019, tried to introduce Afterpay to management in San Francisco, the welcome wasn’t as enthusiastic.

Pfisterer knew of Afterpay from working in the red-hot Australian tech start-up scene, and thought the like-minded companies would be a perfect fit.

“I had met Nick and Anthony [Eisen, Afterpay co-founder] previously in the Melbourne offices. I wanted to talk to them about processing their payments,” he tells The Weekend Australian.

“At that time I was lobbying [Square’s] C-level execs to take a look at this company, but when that meeting transpired the magnitude of what Afterpay was achieving wasn’t what it is today.

“I said bring this guy in, Nick Molnar, and we should look at it. The meeting was succinct and short and didn’t land.”

Dorsey was not at the meeting when Afterpay’s Molnar and Pfisterer both happened to be in San Francisco.

“There was a confidence that they could build their own functionality internally,” Pfisterer says. “I circled back a few times with the exec team to say this company is still growing, but the appetite just wasn’t there.”

When Afterpay listed in mid-2017, it debuted at $2.70 a share. Square’s proposed scrip acquisition detailed this week prices the Australian company at $126.21 a share – nearly 50 times the 2017 valuation.

Dorsey has long had an affinity with Melbourne, and Australia more broadly, visiting at least once a year and choosing Melbourne for Square’s first engineering hub outside of the US.

Australia is Square’s largest international market, and Dorsey says the country is a key market in terms of uptake from retailers that use the company’s white box to process payments, and for Square’s engineering muscle.

“The openness of individuals and sellers to adopt new technology very quickly is awesome, and that’s definitely different than what we find in the US which feels a lot slower,” Dorsey says.

“We continue to see a lot of talent come through. We’ve found resonance within the market and within the community here, and there’s a level of entrepreneurship you can see here.”

Pfisterer is moving on. His current start-up Zeller – which, like Square, has been rapidly stealing market share from the incumbents – was open in advertising its plans to offer rival BNPL platform Zip as a payments solution on its terminals months before their launch.

“Our view on it is that if a merchant wants something we should help facilitate that,” he says. “We don’t believe in closed ecosystems; our philosophy is about partnering with other businesses.”

That meeting in 2017 was one of numerous opportunities – and near-death experiences – Afterpay has survived on its way to becoming Australia’s most successful consumer technology company.

Afterpay co-founder Molnar was always a wily entrepreneur, but has consistently relied on partners to help fulfil his vision. In 2012 the university student’s jewellery website iceonline.com.au was performing well, bringing in $2m worth of sales a year, but one thing was frustrating him. Of every 100 people who would visit his website, only one shopper would actually make a purchase. That wasn’t a crazy statistic by e-commerce standards but it was crushing his margins, leading to an experiment in allowing customers to buy products online on lay-by, then pay them off over time.

His neighbour in Sydney’s waterfront Rose Bay, then-Guinness Peat Group chief investment officer Eisen, worked late nights on restructuring the assets of his company, noticing the windows lit across the street, and wondering what was keeping his fellow night owl up at night.

The pair met and quickly started a company that would eventually be the subject of the largest takeover offer in Australian corporate history.

“I’m 19 years older than Nick, and it was the very first experience that I had … which was the opportunity to engage in a partnership that was purely symbiotic,” Eisen told The Weekend Australian at a recent lunch event in Melbourne. “You have to be absolutely lucky sometimes.

“Sometimes you just get lucky with really good people. Nick and I have used up our nine lives, and there are quite a few instances where I’ve come home and said ‘this is it, it’s all over’.”

Afterpay’s “pay in four” model isn’t particularly innovative, but its app – used regularly now by 3.5 million Australians and 16 million people globally – is, especially if you ask the brains behind it, Melbourne-based studio Dovetail.

After the aborted meetings with Square in 2017, Afterpay formed a partnership with payments firm Touchcorp. Touchcorp provided the back-end payment systems that supported the Afterpay product, and would play a key role in the company’s future. Touchcorp, led then by the late Adrian Cleeve, served as the backbone for Afterpay’s technology but was also one of its largest investors in its early days.

In what was a rapid role reversal, Afterpay soon outgrew its early partner and investor, and the two companies combined in 2017, deciding they were stronger together.

Nobody knew it at the time, but the combined company Afterpay Touch would become the fastest-growing ASX-listed company in the nation’s history.

Just before the formal Touch merger, Afterpay tapped Australian development studio Dovetail to develop their iOS and Android apps.

Dovetail works with non-technical founders who may have domain knowledge and experience but no skills to build an app. Molnar and Eisen were a perfect fit for the type of people Dovetail wanted to help. After meeting with the Dovetail team, Molnar laid down a challenge at the project’s onset: “We need to launch a mobile app in 12 weeks.”

He knew Afterpay needed to be able to handle an influx of in-store purchases, and the company was starting to garner a fan club of loyal users who were putting increasing demands on its infrastructure.

This was an almost impossible time frame, according to Dovetail chief technology officer Toby Cox, given the app would need to allow for in-store shopping, a new channel for Afterpay.

“How does 16 weeks sound?” Dovetail executive Nick Frandsen had asked Molnar. Both parties left the meeting with a handshake and an agreement – the app would be developed in 12 weeks.

“Early on it was just a small crew of engineers and myself working late at night,” Cox says. “You don’t want to over promise and under deliver, so we were confident we could deliver something, but it was such an accelerated time frame.”

The app was initially kept under wraps, but Afterpay’s hungry fanbase soon found out and Molnar decided to change tack, kicking off a nationwide marketing campaign. Afterpay’s app went to No. 1 in Australia’s Apple App Store within 48 hours, overtaking the likes of YouTube, Facebook and Instagram.

“We were sleeping very little, and drinking a lot of Red Bulls,” Dovetail co-founder Ash Fogelberg says. “All the stats that Afterpay has published publicly show heavy engagement and retention of customers, and a large part of that is derived from the core value proposition and user experience with the app.

“It’s obvious now what Google should look like and Uber should look like, but in the beginning with Afterpay it wasn’t obvious.

“There were a lot of different paths you could have gone down, and we made some good decisions around keeping it really basic, keeping it focused around the customer, and keeping it simple.”

Afterpay almost didn’t survive its influx of customers in 2017. While Dovetail was busy building out the iPhone and Android apps, the company’s web infrastructure – its website for PCs, laptops and tablets – wasn’t able to handle the load during “Afterpay day” and other marketing campaigns, given it had quickly become one of Australia’s most visited websites.

Customers were becoming frustrated given the Afterpay website would crash every time traffic spiked. Dovetail got to work over a 72-hour period, labouring around the clock to build a website it said would handle not only Afterpay’s current load, but also allow it to pursue an aggressive global strategy.

As the Dovetail team tell it, they walked bleary-eyed into Afterpay’s offices on a Wednesday morning, showing the executive team a demo of its new website on a TV. Afterpay’s then-director of product, David Whiteman, looked at the Dovetail team and said: “Well guys, looks like you’re looking after the web platform now.”

Dovetail, which also has offices in Auckland and Sydney, still manages the design and development of Afterpay’s web and mobile properties, and claims that the Afterpay platform has maintained 99.999 per cent uptime despite more than 700 million server requests a week.

Afterpay is now responsible for transacting more than 10 per cent of all e-commerce transactions in Australia, and has cemented its place as one of the nation’s great tech success stories.

Dovetail has also greatly profited from Afterpay’s meteoric rise – its staff have shares in the company through Dovetail’s investment arm Dovetail Ventures, which invests in all the start-ups it works with, including Afterpay.

Dovetail’s team is of the belief that anyone can start a multimillion – or billion – dollar business, you just need a good idea and domain expertise. Someone else can build the app for you.

Molnar described his deal this week as a milestone for the Australian technology ecosystem.

“In terms of a partner to take this to the next level and realise what the global buy now, pay later opportunity represents, that was critical in our decision-making and I couldn’t be more proud.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout