The Covid-19 pandemic has been the scourge of Crown Resorts in 2020 as it closed the doors of its casinos and forced thousands of its staff onto government assistance.

On Thursday morning it became an unexpected blessing.

The first virtual annual meeting in the company’s history, supposed to be the most anticipated ever after the devastating findings of the Bergin inquiry, turned into an affair completely devoid of emotion.

Unlike their worst moments in the Patricia Bergin’s witness box over the past four weeks, Crown’s directors — led by chair Helen Coonan — were completely back in control.

The voice of shareholder activist Stephen Mayne was nowhere to be heard. Instead his usual series of questions were submitted in writing and read to Coonan by company secretary Mary Manos.

Even the directors themselves were nowhere to be seen. Their photographs were displayed at the start of the meeting, but thereafter only their voices were heard when they were invited by the chair to answer questions. There was none of the usual theatre of aggrieved investors looking the directors in the eye, no raised voices, no shareholder rants.

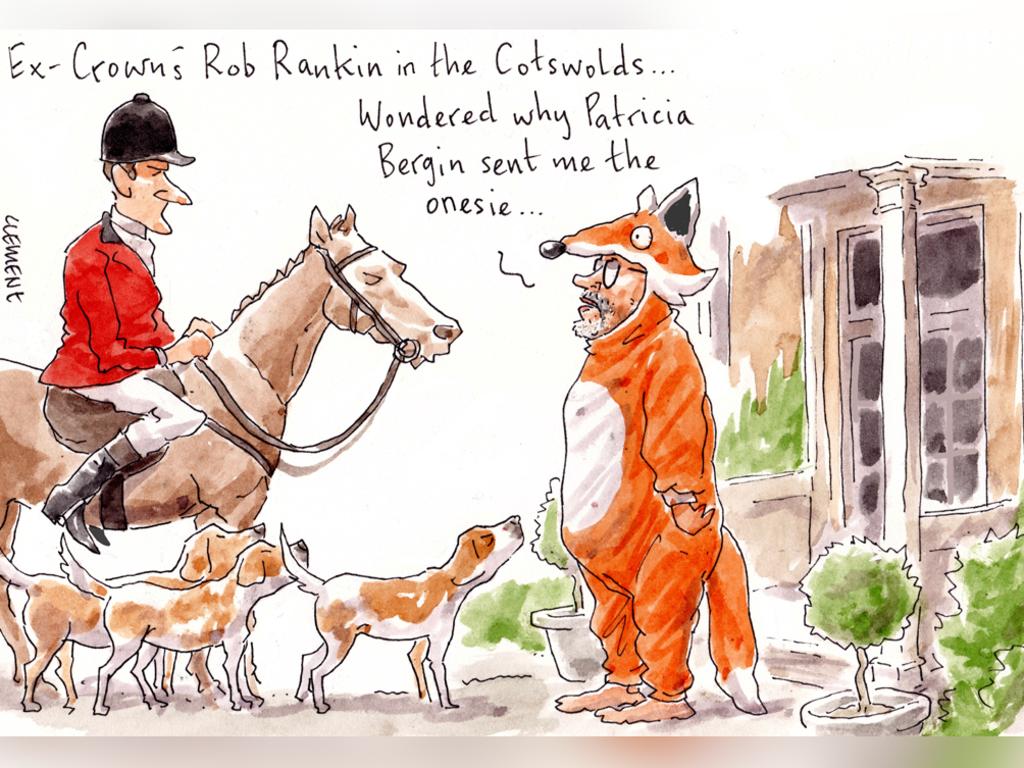

Even the director who arguably lost most credibility during his disastrous appearance at the inquiry, former AFL boss Andrew Demetriou, was able to calmly blame poor legal advice for his foolish decision to read from prepared notes during his appearance. It was the perfect circuit breaker for Crown.

Still, the message for Coonan and her board was clear. Investors are angry, highlighted in the unprecedented protest votes against the three directors for re-election: Jane Halton, Guy Jalland and John Horvath.

The damage would have been worse if US fund Blackstone, which owns 10 per cent of Crown and has applied to the NSW gaming regulator for approval to increase its interest, voted against them.

.

And Horvath and Jalland would have lost the vote if James Packer didn’t vote his 37 per cent shareholding in favour of their re-election. Jalland was the one he was most determined to save.

Only Horvath decided to fall on his sword, confirming what he told the Bergin inquiry last week that he expected to be part of a “board renewal process” and would only remain a director “for a relatively short period”. One wonders now why he bothered to go through the process.

Halton said that she also considered resigning given the proxy vote against her, but thought that overall she had “sufficient support” from shareholders.

More than 75 per cent of the votes cast were in her favour and she is believed to be resolved to work with Coonan to drive cultural change within Crown.

Jalland, who is the chief executive of Packer’s private company Consolidated Press Holdings, apparently gave no such thought to resigning, but acknowledged what he called the “significant and serious” protest vote against him — 41.39 per cent. He also acknowledged CPH offered one olive branch to investors after major questions during the inquiry about its influence over Crown and conflicts of interest by abstaining from voting on the remuneration report, which ensured Crown sustained a first strike.

The Crown board took decisive action this week in terminating a services agreement with CPH and a controlling shareholder protocol mechanism, both of which have allowed Packer to receive confidential information about the company since he resigned as a director in March 2018.

Packer admitted in his evidence to the Bergin inquiry that the protocol had to go and that caps may be put on his future shareholding in the company.

What this means for the future roles of Jalland and CPH finance boss Michael Johnston, who declared at the AGM he should remain on the Crown board despite the cloud hanging over him from the inquiry, remains to be seen. Perth businessman John Poynton is also a CPH-nominee Crown director.

Coonan stressed at the meeting that nominee directors were commonplace in big companies to represent shareholders with significant equity and she pledged to carefully manage the relationship with CPH.

She has also previously backed Johnston remaining as a director. But Bergin is sure to have other ideas about that and a host of other critical issues when she releases what will be a damning report in February.

The financial crime and corporate regulators, Austrac and ASIC, will be reading it with interest.

None of the raft of reforms outlined to Crown shareholders at Thursday’s AGM went beyond anything revealed at the inquiry and did not include bowing to what appears to be Bergin’s biggest bugbear by putting back the opening date for Crown Sydney till after her report is released. Coonan and her board and staff can now only hope the former Supreme Court judge has heard and seen enough to convince her that Crown isn’t rotten to the core.