Coles tips shift to private label

Coles chief executive Steven Cain will “double down” on his long-term strategy to lift sales derived from private label groceries.

Coles chief executive Steven Cain will “double down” on his long-term strategy to ratchet up the proportion of his sales derived from private label groceries as the supermarket braces for the economic impact of the pandemic that is likely to see households tighten their spending.

Mr Cain told The Australian that businesses being closed and rising unemployment would create an even greater hunger for value-priced groceries, led by home brand, and that Coles must prepare for large sections of its customer base looking to save money.

“We have to be prepared for that. Clearly there are people who will get back to whatever they were doing before, particularly when they are allowed back to work and when they are allowed back to school, but there’s going to be a large part of the Australian customer base who are going to be short of money and will be lucky to save wherever they can.

“Now I don’t think food will be the first port of call by the way. People are saving money on travel, they are saving money on holidays, saving money not going out. Obviously the banks are helping people, and the utilities as well. It’s not armageddon but we need to prepare ourselves for some belt-tightening.”

Releasing the retailer’s third-quarter sales performance on Wednesday, which showed panic buying through March and April had pushed Coles to its highest ever sales growth of 13.1 per cent in terms of same-store sales, Mr Cain noted customers were increasingly looking for value as well as ingredients for home cooking as restaurants were closed and households tried to stretch their budgets.

The demand for private label should continue to grow after the health crisis passes and Coles would be accelerating its efforts in this category.

“We expect own brand sales to continue to grow particularly in the environment where — I read an article yesterday saying half of the population of workers had their hours reduced in some shape or form, were unemployed or seeking allowances — if that is the case or anything like that is the case then clearly value is going to go to the top of the agenda.

“We are very conscious that value will be high on the public agenda.

“Which is why getting back to a full specials (promotional) program is a priority for us and we will also be doubling down on growing our own-brand offer.”

However, during the third quarter the normally strong convenience category, ranging from sandwiches to ready-made meals, fell flat as consumers preferred to cook from scratch and the flood of daily office workers looking for lunch almost totally disappeared.

“It is certainly not growing at the moment … you can’t sell a sandwich to save your life at the moment because (there are) not many people at the office.

“I think from a convenience point of view that won’t return to growth until people are busy at work again and busy at school again, so obviously a lot of our convenience meal offers are for busy households that didn't have the time to cook, to some degree there will probably be more working from home going forward than there was pre-COVID.”

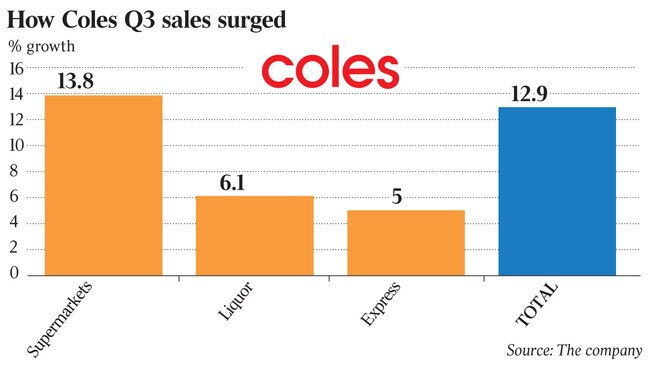

Although Coles reported total supermarket sales up 13.8 per cent to $8.23bn, it was below the expectations of some analysts, who were tipping almost 20 per cent gains. Same-store liquor sales were up 7.2 per cent and its express petrol stations and convenience stores reported like-for-like sales growth of 4.3 per cent.

The petrol station and convenience stores are now tipped to post pre-tax losses for the period, driven by the slump in petrol prices and vastly fewer cars on the road as people stay at home.

Total sales for the quarter across the Coles group were $9.226bn, up 12.9 per cent or 12.4 per cent. Shares in Coles ended the day down 4.4 per cent at $15.51.

There was a bump in liquor sales as the nation’s pubs, hotels and restaurants remained closed because of the health crisis and shoppers consumed more alcohol in the home, but the quarter was dominated by weaker liquor sales due to the summer bushfires and the resulting smog that blanketed large parts of the country and put a stop to many social occasions.

During the quarter, Coles saw an increase in basket size, which was partially offset by a decline in transactions driven by social-distancing measures.

In the fourth quarter Coles expects higher costs from responding to COVID-19 with measures such as additional roles in store to ensure a safe environment and additional cleaning and security.

Liquor is expected to continue to experience elevated sales as long as restrictions on hotels, pubs, clubs and venues remain.

Evans & Partners analyst Phil Kimber said sales were being affected in “many different ways — with some key trends being fewer trips but bigger baskets, fewer promotions but also less impulse/ value-added purchases”. They were missing out on impulse buys because “customers don’t want to dwell in supermarkets”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout