Flight paths diverge as bidders outline Virgin plans

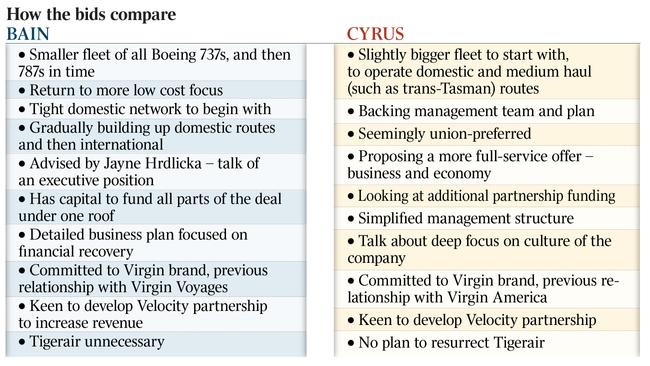

Key differences are emerging between the rival bids for Virgin Australia from US firms Bain and Cyrus Capital.

Key differences are emerging between the parties vying to bring Virgin Australia out of administration, with Bain focused on a leaner, lower-cost but high-tech airline and Cyrus seeking to maximise employee numbers and develop company culture.

Both US companies have until next Monday to lodge their final binding bids ahead of a decision by administrator Deloitte on June 30.

Virgin Australia went into voluntary administration on April 21 with debts of $6.8bn after repeatedly trying but failing to secure financial assistance from the federal government.

Under Bain, it is expected Virgin Australia will re-emerge as a smaller airline with a reduced fleet and a tight domestic focus following a strategic plan that will differ in some key ways from that put forward by Virgin chief executive Paul Scurrah.

Fewer employees and a model closer to the airline’s low-cost origins are likely, with a single aircraft domestic fleet of Boeing 737s.

In time, the carrier would reinstate some international flights, most likely using cost-efficient 787-9s.

A source close to the administration process said Bain provided financial security and a “very deep and developed business plan, using the resources of Bain Consulting and Bain Capital”.

“Bain has capital to fund all parts of the deal under one roof,” said the source.

“They have a detailed plan for the recovery but it may start with a slightly smaller airline and all that comes with that.”

Another source said Bain would make a significant upfront investment in the airline, especially in technology, which differed to what was proposed by Mr Scurrah.

In contrast, Cyrus is looking at additional partnership funding to get its bid across the line and is keen for federal government support, despite weekend comments by adviser Jonathan Peachey that it could make the bid independently.

Virgin’s administrator, Deloitte’s Vaughan Strawbridge, last week wrote to Prime Minister Scott Morrison warning that the sale of Virgin Australia could collapse without government help, in particular the extension of the $1500 a fortnight JobKeeper allowance. On Tuesday a Cyrus spokesman said the firm supported the “important points” the administrator raised in his letter.

“It is not clear how quickly Australia’s economy will recover from the impact of COVID-19 and the near-term outlook for the aviation industry in Australia remains highly uncertain,” he said.

“Government support measures have helped cushion the blow that the pandemic has dealt to the aviation and tourism sector and would undoubtedly be helpful in supporting their recovery and the broader economy.”

Cyrus’s proposal for a reinvigorated Virgin Australia was described as “more high level” than Bain’s, in terms of a larger fleet and broader network, including short and medium haul routes.

The firm has engaged a former Queensland Labor Party official to negotiate with unions, who are pushing for the airline to hold on to as many of its 9000 remaining employees as possible.

Evaluating final bids

ACTU president Michele O’Neil said unions would be evaluating the final bids against the metrics of job numbers and full protection and payment of employee entitlements.

“We want to be very clear: we are prioritising protecting workers’ jobs and entitlements in this process,” Ms O’Neil said. As well as committing to more aircraft and therefore the retention of more employees, Cyrus has pledged to retain Mr Scurrah as part of a simplified management structure. Cyrus had also spoken of a deep focus on company culture, a source said.

“Cyrus brings a lot of experience to the Virgin aviation brand, and what worked so well in America,” said the source, who was across both bids.

“Jon Peachey is a very experienced former Virgin executive and was there from the start of Virgin America.”

Both bids align in their unwavering support for the Virgin brand, thanks to other joint ventures with the Virgin Group.

Bain Capital is the leading partner in the Virgin Voyages cruise line, and Cyrus teamed up with the company on Virgin America and more recently, British regional carrier Flybe.

Bain and Cyrus are also keen to make much more of the Velocity partnership following the bold decision to buy back a 35 per cent stake for $700m, funded by junk bonds.

One investment banker working for a government client who has been in contact with both bidders several times a day over the past week said Bain was “throwing everything” at its bid.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout