Airlines at ‘tipping point’, Qantas warns

The struggle to contain the coronavirus outbreak through travel bans and quarantine has the air industry at tipping point.

The struggle to contain the coronavirus outbreak through travel bans and quarantine has the air industry at tipping point with only the most disciplined operators expected to survive.

Outlining the Qantas Group’s response to the crisis, chief executive Alan Joyce predicted weaker airlines in the region would either “be consolidated or go out of business”, unable to withstand flight reductions and significant financial losses.

“Cathay (Pacific) has asked 27,000 people to take unpaid leave,” he said.

“They’ve cut 40 per cent of their schedule.

“Singapore Airlines has just made massive cuts to their schedule (and) other airlines may go bust.”

Mr Joyce outlined plans to cut 15 per cent of flights to Asia, along with 6 per cent of trans-Tasman services and 2.3 per cent of domestic flights.

He said the expected full-year financial impact of the coronavirus to Qantas was between $100m and $150m with a $122m saving on fuel costs tipped to soften the blow.

However, the losses would be deeper if the cutbacks extended beyond the end of May.

Late on Thursday Prime Minister Scott Morrison extended the travel ban for foreign nationals arriving in Australia from China for another week, saying that conditions in mainland China meant the restrictions needed to stay in place.

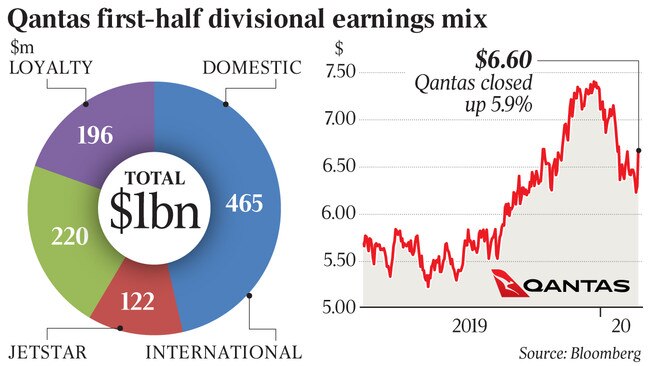

The move came as Qantas reported a $648m pre-tax profit for the first half of the 2020 financial year, down $87m or 6.3 per cent on the previous corresponding period. The fall was largely due to weaker demand and industrial action dogging Jetstar, which saw earnings sink 16 per cent to $180m.

As a result of the reduced services, the equivalent of 18 aircraft will be grounded, affecting 700 full-time roles through to the end of May. To avoid job losses, Mr Joyce said staff would be asked to take paid leave owed to them and any new recruitment would be frozen.

But Mr Joyce said there was enough leave available across the group’s 30,000-strong workforce to manage the 700-role surplus for a considerable time.

“We could double (the flight cuts) we have published today before we would need to consider that (laying people off),” Mr Joyce said.

“We’ve got leave balances that would enable us to go six months.

“The great thing about the group is it does have the financial strength to take the equivalent of 18 aircraft out of operation, to have 700 people on paid leave and still be able to manage that operation.

“That shows the good work that’s been made in the last few years and it comes back to our focus on 3 per cent pay increases.”

Mr Joyce said the outlook was less rosy for staff at Virgin Australia, following 750 job losses on the back of cost-cutting by CEO Paul Scurrah, in an effort to return the airline to profit.

The Flight Attendants Association of Australia confirmed talks were under way with management over the future of cabin crew sidelined by the end of Melbourne-Hong Kong services, and the soon-to-be axed Sydney-Hong Kong flights — a victim of the coronavirus.

Some crew members have volunteered to be deployed on domestic flights, while others are weighing up options of part-time work and leave without pay.

A Virgin Australia spokesman said pilots who operated those services were also being consulted in accordance with their enterprise agreements.

“This is still being worked through and has not been finalised,” he said.

He declined to comment on another potential crisis for the airline, with reports financially troubled major shareholder HNA Group is to be taken over by China and its airline assets sold off.

The situation was being monitored, he said, with more information expected at Virgin Australia’s half-year results next Wednesday.

Qantas’s Mr Joyce described the overall performance in the first half as “very positive” and said it showed Qantas was in a strong position.

“In the domestic market we dealt with some travel demand weakness and a structural change in our overheads from the sale of domestic terminals. Fundamentally Qantas and Jetstar both did well,” Mr Joyce said.

“Internationally, the growth in passenger revenue outweighed the impact of disruption in Hong Kong and a freight market affected by trade wars.”

Qantas International improved its earnings before interest and tax by $4m to $162m, and the domestic operations of Qantas and Jetstar achieved a combined $645m, down $47m due to higher airport costs and weaker demand.

Mr Joyce is holding firm in the face of ongoing industrial action at Jetstar, noting the 3 per cent annualised wage increase was above inflation and above what most companies are offering. “Our position on wages is crystal clear,” Mr Joyce said.

“No amount of industrial action will change our stance, because we can’t afford to lose our discipline on costs. That would ultimately have a very negative impact on jobs, and the challenges facing all airlines right now underscores why,” he said.

Qantas Loyalty was again the star performer for the group, increasing earnings 12 per cent to $196m, attributed to an overhaul of the frequent flyer program.

Domestic operations managed a 2.7 per cent improvement in earnings to $465m, while a 2 per cent decrease in competitor capacity helped the international business earn $162m.

The market responded favourably with Qantas shares closing up 5.9 per cent at $6.67, their highest level in almost a month.

A fully franked dividend of 13.5c a share will be paid to shareholders, along with an off-market share buyback of up to $150m.

Ian Chitterer of ratings agency Moody’s said Qantas delivered a “solid result given the headwinds in the first half, including weaker domestic demand, the sale of the domestic terminals, the unrest in Hong Kong, and the trade wars that affected freight”.

He said the cost reductions actions announced by Qantas, including reducing capacity, suggested the airline “is well positioned to manage through the coronavirus outbreak”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout