Its stock price rose by 5.4 per cent on Thursday to $6.71 for the simple reason it had fallen 19 per cent this year heading into the result, and Joyce said enough to tell investors he was in good shape to handle the crisis.

China represents 2 per cent of Qantas’s international network and international travellers are just 8 per cent of domestic travel, so the impact is not as bad as the market had feared.

Transparency works well in dealing with the market but in reality Joyce, like the rest of us, has no real idea just how the coronavirus cards will fall beyond his line in the sand in May.

His comrade at Virgin, Paul Scurrah, faces the same operating market impact with the added uncertainty that one of his major shareholders, China-based HNA, is reported to be facing a government takeover.

That may trigger the sale of its 20 per cent stake in Virgin, and recent history has shown the other holders like Singapore, Nanshan and Etihad are either unwilling or unable to mount a full bid.

Lendlease has a ban on travel to and within Asian and is discouraging all non-essential international flights and encouraging video conference calls, even in Australia.

Qantas has about 80 per cent of the corporate market and 60 per cent overall, so if more follow Lendlease’s move the losses will be greater.

Qantas is cutting capacity to Asia by 15 per cent and domestic capacity by 2 per cent.

That is some good news for Scurrah.

The bottom line is the Australian economy weakened in February in the wake of the bushfires, and just as it was putting its head above water, the virus struck.

Qantas employs 30,000 people and so far the capacity cuts will affect 700, with the initial impact being managed by holiday leave and the like.

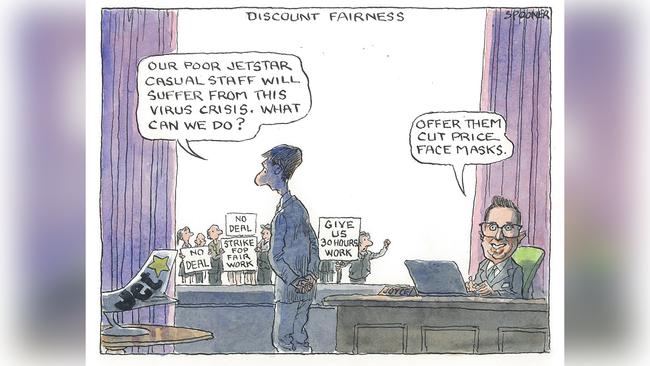

But the warning bells are ringing. Jetstar unions and the pilots negotiating over terms for the long-haul flights to London should be hearing them.

This time around the facts are on Joyce’s side of the table. He has a wage bill of $4.3bn a year, a weak economy and uncertainty over the coronavirus, with capacity already cut and workers on notice. And history shows he won’t be backing down on pay rises.

Yet Qantas is in good shape.

Returns at 18.4 per cent are evidence of a well-managed company in a well-behaved duopoly and are up from 16.2 per cent in 2015. Returns peaked near-term in 2016 at 22.7 per cent.

International posted an operating margin of just 3.2 per cent, compared to 14.4 per cent at Qantas domestic and 10 per cent at Jetstar. The loyalty division was the star performer, with earnings increasing by 12 per cent at $196m as the company expands its aligned businesses to sell you pet insurance and private health funds.

Origin’s plight

The reason why Canberra is now banging the drum about reliable power is that wholesale electricity prices are falling thanks to the flood of renewable power via home panels and the like.

That is not great news for the wholesale energy suppliers like Origin, which reported a $197m fall in profits to $599m partly due to the 26 per cent fall in earnings at its energy markets division to $484m.

Last year renewable capacity of 1800MW came on line, representing 3 per cent of the market and more than the capacity of the closed Hazelwood generator.

Over the past six years 4000MW of coal has gone and renewables now represent 21 per cent of the market, up from 4 per cent in 2014.

Origin’s Frank Calabria is negotiating a new LNG contract price with Sinopec, which owns 25 per cent of his 37.5 per cent-owned APLNG and buys 84 per cent of the output.

Under the terms of the five-year deal there is no independent arbiter, so if talks fail then they stick to present prices and negotiate again in five years’ time — but this time with an arbiter.

It all makes for interesting talks between joint venture partners.

Punters enjoy a Coke

There are some stocks the market seems to want to do well and Coca-Cola Amatil is one of these, as shown by the 7.1 per cent increase in the stock price to a seven-year high of $12.89 on Thursday after arguably the best profit report in Alison Watkins’ six years with the company.

The Australian beverages group reported growth for the first time in seven years with Coke No Sugar a runaway success, and Indonesia bounced back with growth in some previous strugglers like Sprite and Fanta.

In the second half Australia was up 4 per cent to $208m and Indonesia 29 per cent to $45.1m in earnings before interest and tax. For the year these divisions were down 0.1 per cent and up 14.3 per cent respectively.

One half doesn’t change the world but the resurgence of a powerful brand gives you hope.

One in five non-alcoholic drinks sold in Australia is a Coca-Cola brand. The extensive distribution system helps.

Over the last 12 months the stock has risen from $8.33. Heading into the results it had outperformed the market in total shareholder returns by a stunning 63 per cent.

At last Watkins has delivered some evidence to back the faithful.

Another to defy the normal market scepticism was Lendlease, which heading into Thursday’s numbers had outperformed the market by 16 per cent despite a tough economy and its troubled engineering division.

Chief Steve McCann is finalising the sale of the division to Acciona but what impressed the punters was the company’s house operation: its development pipeline is firing big time with a development pipeline totalling $112bn, up from $76bn at last count.

McCann calls Lendlease “the global urbanisation partner of choice” that creates “the best places in key global gateway cities”.

Net profit was actually down in the half but the development pipeline number was the swing factor to send the stock up 7.3 per cent to $18.70.

The company is regarded in headhunting circles as a college company because of the sheer weight of quality people who learn the ropes behind its doors.

The house that the late Dick Dusseldorp created has trained Mirvac’s Susan Lloyd-Hurtwitz, former Suncorp boss Michael Cameron, his successor at GPT Bob Johnston, Scott Charlton at Transurban, Stockland chair Tom Pocket, Charter Hall chair David Clarke, former AMP infrastructure guru and now corporate director Phil Garling, Resolution Capital’s Andrew Parsons and AMP’s Carmel Hourigan, to name but a few.

The secret, being like Macquarie Bank, is to give young people a chance, back them and let them run.

When Qantas boss Alan Joyce talks down the economy it’s normally a negotiating tactic for union talks. But this time it’s for real, with the coronavirus hitting an already weak market and potentially costing the airline up to $150m.