Beware the person with a deal to sell you an asset in an industry forecast to lose $US252bn ($391bn) this year and the person with the most to win if the deal collapses.

This week both have been front and centre backing Paul Keating’s favourite horse — self-interest — just days after Warren Buffett declared he has sold all his airline stocks.

Virgin administrator Vaughan Strawbridge, with a straight face, circulated a sales pitch for Virgin forecasting earnings before interest, tax, depreciation and amortisation of $1.2bn on revenues of $5bn in 2022. Last year, the company reported EBITDA of $460.8m on revenues of $5.8bn and, while issuing the sales pitch, Strawbridge was doing his best to shake as much spare cash as he could given free cash flow when he arrived was just $30m.

He has reportedly built it up to $100m now but is still seeking to raise $200m in debt to bolster the airline pre-sale, weighed under with $6.8bn in debt.

In walks Alan Joyce in Qantas’s centenary year promising $19 Melbourne to Sydney Jetstar flights when flying starts again, and reminding us he is sitting on a $3.5bn cash pile.

At a stated cash burn of $40m a week, that gives him 88 weeks to play with before he has to start loading more debt on to his 20 Boeing Dreamliners.

When flying starts again is anyone’s guess, but it’s getting closer and Joyce figures there will be pent-up demand to fly domestically, which is two-thirds of his earnings and four times as profitable as his international flights.

Once again Joyce has timed his pronouncements to perfection for his myriad stakeholders, most of whom would do better if Virgin investors ran a mile.

When Joyce starts telling you he wants to make sure the domestic tourism industry is alive and well and he’ll do his bit by slashing airfares, he no doubt means it — but he also means he wants the Qantas staff and shareholders to be making bucketloads of cash in the process.

Faced with a red-hot competition regulator, backed by government demands for a two-airline market and ready to jump at the first misstep, you can’t blame Joyce for talking up cheap airline fares as well, especially as the Virgin consortiums work out their dance partners.

In the meantime, staff stand-downs continue from the end of May until the end of July and, while Virgin runs the gauntlet, just how the economy looks in six months is anyone’s guess.

Aurizon verdict nears

The full Federal Court is due to hand down its decision on Wednesday on the ACCC appeal against Justice Jonathan Beach’s decision in the Aurizon-Pacific National case.

The PN acquisition of Aurizon’s Acacia Ridge terminal was approved after it offered a belated undertaking of open access.

Separately, the ACCC has added to its meagre merger review list, and is looking at the $100m acquisition of Ellex Medical’s eye laser business to French-based laser giant Lumibird.

The deal is a big one for the Adelaide-based Ellex with a market value of just $69m.

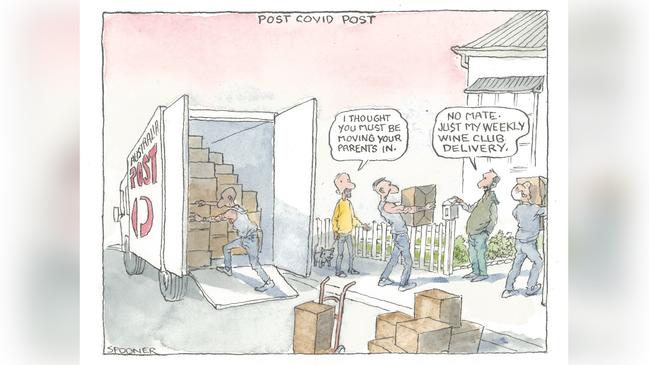

A lot like Christmas

Australia Post is in the midst of an unprecedented boom in parcel delivery, with 90 per cent year-over-year growth and regular days of over two million parcels a day.

This is the level of activity normally enjoyed only at Christmas, underlining the boost to business as the growth in parcel revenues rise by some 65 per cent.

Most chief executives are working out how to make do in a flat market, but CEO Christine Holgate is working through daily volumes for which she normally spends a year to prepare.

Holgate, like her counterparts running the big supermarkets, is being run off her feet.

She has added 750 people this year with 500 going into parcels and 200 into the call centre.

Pre-pandemic, Australia Post employed 35,000 people directly and another 45,000 contractors.

It used to run nine freight planes through Qantas but this has increased to 17 to keep up with demand, which is also helping to keep afloat Qantas and trucking operators like Linfox. Not only is the number of parcels increasing, they are getting bigger, with wine volumes increasing dramatically, as shown by one centre in Sydney last weekend handling 136,000 cases of wine.

Letter volumes are, unfortunately, falling almost as fast, with volumes now at 50 per cent of levels a decade ago, with the number of posties the same. Which explains why they are now working more on delivering parcels, and why Holgate recently won approval to wind back letter deliveries to every second day to help divert staff.

In the month of March, Australia Post delivered 3.3 million more parcels than it did in March two years ago. The statistics come as the NAB online sales index showed a 21.8 per cent increase in March on year-ago levels.

The increase in online traffic has helped to keep some retail businesses operating in the middle of the shutdown. In April, a million more people shopped online than a year ago and 212,000 shopped online for the first time.

In an interview, Holgate said the pre-crisis online share of retail sales in Australia was about 11 per cent, half that in the UK and about 25 per cent of Asia.

But the dramatic change caused by the crisis would push Australia’s share up to UK levels.

That, combined with the push by retailers for payments by card and not cash, is helping to fast-forward the move to a cashless society.

In the six months to December, Australia Post’s parcels division posted a 13 per cent increase in revenues to $2.7bn, with profits up 12 per cent to $193m.

Letter revenue fell 9 per cent to $1.1bn, with a loss of $87m.

Based on the virus’s impact, parcels will report a handy boost, which should also increase the dividend paid to the federal government.

Former parcels boss Bob Black has gone back to the UK and will not return, but his job is effectively being filled by three people, who will take control of their respective divisions.

Rod Barnes will run the parcel delivery operations, John Cox the group-wide IT and Gary Starr the international sales and operations.

The latter is doing it tough right now with international business down some 75 per cent on inbound services.