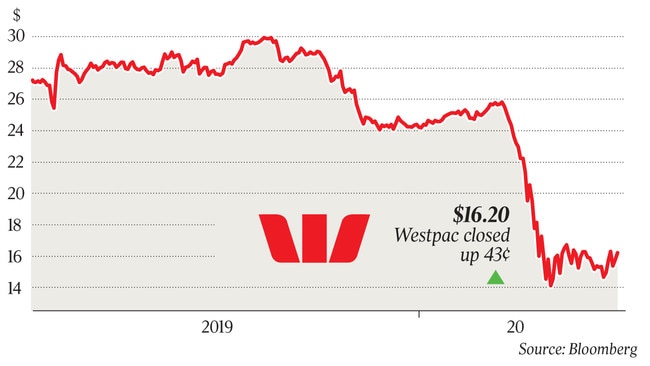

Investors shrug off Westpac dividend deferral

Investors have given Westpac a cautious thumbs-up for its half-year result.

Investors have given Westpac a cautious thumbs-up for its half-year result, with the bank outperforming the broader market and most of its peers despite deferring its dividend and pre-announcing significant provisions and remediation charges.

Rounding out the major-bank interim profit reporting season, Westpac announced on Monday a 70 per cent slump in cash profit to $993m.

Macquarie Research analyst Victor German said the impact of the charges on Westpac’s profit was “abnormally large”, but it was mostly pre-announced and expected by the market.

“With key underlying trends not being dissimilar to peers, we see scope for Westpac to partly unwind its 10 per cent relative discount to (its historical average),” Mr German said.

“However, beyond this, we believe Westpac needs to improve its underlying performance, consolidate system and deliver efficiency benefits to outperform peers.”

Westpac has been heavily marked down not because of COVID-19, but also because of multiple transgressions of anti-money-laundering legislation, for which it has made a $900m provision. The bank and financial intelligence agency Austrac are due to present an agreed statement of facts to the Federal Court on May 15.

In a stronger market on Tuesday, Westpac shares lifted 43c, or 2.7 per cent, to $16.20. National Australia Bank was the standout, up 3.2 per cent at $16.99, while ANZ gained 1.9 per cent to $16.45 and Commonwealth Bank was 1.6 per cent higher at $60.85.

Goldman Sachs said Westpac and the sector did a good job in managing its net interest margin in the face of lower cash rates, and its provisions looked strong compared to peers. While value was emerging, Goldman said it remained neutral on the stock because of its capital challenges.

Citi said dividends would resume at the full-year result, with the bank concentrating on building a capital war-chest to satisfy the Australian Prudential Regulation Authority.

This would provide more than enough capital to withstand a realistic estimate of losses. “With more capital raises unlikely, the stock will likely be priced on its prospective dividend yield,” the investment bank said.

UBS analyst Jon Mott said Westpac’s underlying numbers were slightly better than expected, with most of the bad news already announced.

Mr Mott said the establishment of the specialist business division, including wealth management, life insurance, automotive finance, general insurance and the Pacific operations, was a good move.

JPMorgan said Westpac looked inexpensive and well-provisioned, like its rival ANZ.

However, the bank’s revenue growth looked “anaemic”, which justified a neutral recommendation.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout