New Westpac chief Peter King calls for quick reforms to help revive economy

Westpac chief Peter King has called for quick decision-making and a round of reforms to kickstart economic activity.

Westpac chief executive Peter King has called for quick decision-making and a round of reforms to kickstart economic activity during the COVID-19 crisis, including retaining the National Cabinet to guide and expedite the recovery.

His comments came as the pandemic’s fallout led to Westpac deferring a first-half dividend decision and reporting that cash profit tumbled 70 per cent to $993m. That marked the lowest interim profit in almost two decades, marred by an expected surge in loan losses and a regulatory penalty of at least $900m.

Mr King expects a “V-shaped” recovery for the Australian economy next year, buoyed by the federal government’s stimulus of more than $200bn and the central bank’s funding facilities.

“The National Cabinet has been quick in decisioning, it has been consistent across the states and we certainly think that would be a positive thing to carry from managing the health crisis into the next stage for managing the economy,” he told The Australian.

“Once the government is clear on what activity it wants to stimulate then it can target, whether it’s tax reduction or investment incentive or some other policy, to get the activity going.

“What I am advocating for is that once the decision is made we can get action happening within the economy quickly. That’s the most important thing.”

Westpac expects Australia’s economic output to contract 8.2 per cent in the year ended June 30, but finish the calendar year down 5 per cent. It is pencilling in gross domestic product recovering to 4 per cent growth in 2021.

The bank anticipates unemployment will peak at 8.8 per cent this year, while property prices will slump 15 per cent.

“As there is a gradual unwind in social distancing requirements, activity will come back for a large part of the economy,” Mr King said. “That compares to historical recessions where often it is not clear what the pathway out is, and the economy has to be restarted. The big levers of interest rate and fiscal usage have been pulled, micro reform is also really important, and particularly co-ordination.”

Westpac last week outlined impairment and other charges of $2.23bn pre-tax on earnings, including a $1.6bn hit related to expected COVID-19 loan losses. An additional $1.43bn in after-tax writedowns and provisions was earlier disclosed, including the $900m it put aside for an anticipated financial crimes penalty.

Westpac joins ANZ and Bank of Queensland in deferring a dividend decision, while Insurance Australia Group on Monday warned there was “limited scope” for the insurer to make a final dividend payment.

Sources told The Australian the banking regulator had in recent weeks stepped up its push for banks and financial services companies to defer decisions on dividends, helping to conserve capital to help keep credit flowing across the economy. That follows guidance issued by the Australian Prudential Regulation Authority on capital last month.

National Australia Bank last week announced a $3.5bn capital raising, which gave it scope to pay a dramatically lower interim dividend of 30c a share.

Westpac has paid two dividends every year since 1983, including when it almost collapsed in the early nineties.

“There is a fine balance (on banks paying dividends) … our view of the banks first and foremost is they need to have a strong capital position,” said Australian Foundation Investment Company’s Geoff Driver.

“We are in uncharted territory at this point in time, but I suspect the scars of the GFC would have taught them a lot of lessons,” Mr Driver added.

He said AFIC was slightly underweight the banking sector as it acknowledged the challenges facing the industry.

“We recognise they are facing much greater regulatory and economic difficulties,” he said. “There are a section of stakeholders and shareholders that are looking for dividends.”

Retail investors account for just under 50 per cent of Westpac’s shareholder register. But unlike ANZ, which will provide an update on dividend plans in August, Westpac did not outline a timetable, suggesting payment considerations could slip to its full-year results in November.

The bank’s common equity tier one capital ratio came in at 10.8 per cent for its half year, above the banking regulator’s “unquestionably strong” threshold. Westpac is yet to tap the Reserve Bank’s $90bn term funding facility, announced as COVID-19 started to grip the economy.

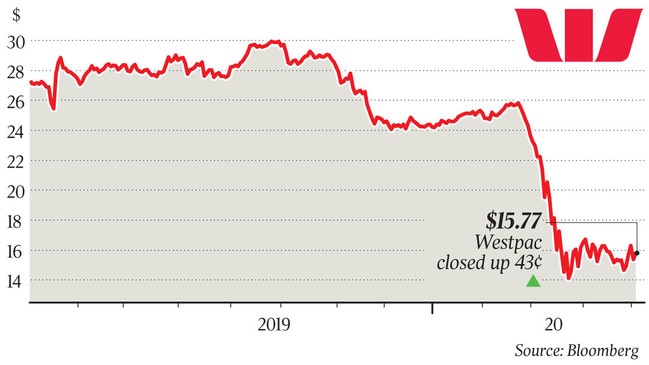

After declining early on Monday, Westpac’s shares recovered to end the session 2.8 per cent higher at $15.77, outpacing the S&P/ASX 200’s 1.4 per cent gain.

Westpac’s results came as analysis of the major banks’ reporting season showed a combined slump of almost 43 per cent in interim profits from continuing operations, including Commonwealth Bank, which has a June 30 year end. For the six months ended March 31, Westpac’s return on equity plummeted to 2.9 per cent, from 10.4 per cent a year earlier. Excluding notable items, return on equity was 6.7 per cent.

Citigroup analysts questioned the bank’s modelling, particularly on estimated loan losses. “Similarly to peers, losses look light relative to economic assumptions,” they said.

But S&P Global Ratings said Westpac’s dividend deferral and core business strength provided “a good buffer” to absorb higher loan loss provisions.

The bank also broadened a sweeping strategic review that may see it exit businesses including wealth platforms, superannuation, investments, general and life insurance and auto finance.

Westpac, like its rivals, also faces pressures from record low interest rates, but was able to maintain margins and attract strong deposit flows, which were up 6 per cent.

Westpac’s net interest margin — what it earns on loans less funding and other costs — edged up one basis point to 2.13 per cent from a year ago, and was steady from six months earlier.

The bank would not give guidance on margin pressure for its latter half.

Westpac’s four business units all posted lower interim cash earnings, with the institutional bank’s result plummeting 68 per cent versus a year earlier. The consumer bank recorded the smallest decline with earnings down 14 per cent.

Net interest income rose 3 per cent, while non-interest income, which reflects fees, fell 2 per cent. The bank’s first-half operating expenses climbed 22 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout