Coronavirus hardship hits Westpac mortgage holders

105,000 mortgage account holders representing $39bn have lodged requests to hit the pause button on loan repayments.

Nearly a tenth of Westpac’s home loan deposit book has been placed on hold from customers needing to access the bank’s coronavirus support measures.

Australia’s second-largest bank said 105,000 mortgage account holders representing $39bn worth of lending balances, had lodged requests to hit the pause button on loan repayments, because of financial hardship induced by COVID-19.

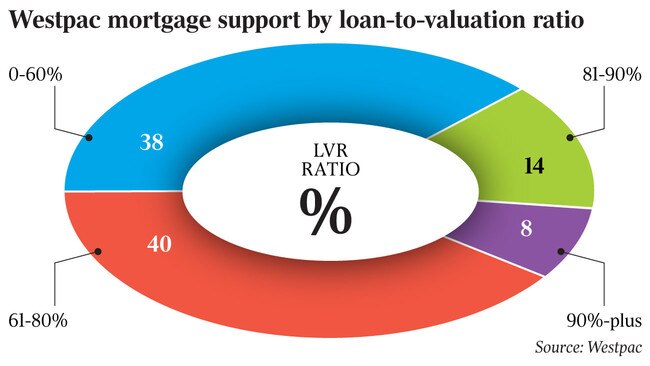

The repayments which represents 9 per cent of Westpac’s total home loan book, coincides with the release of the bank’s interim results which booked a cash profit plummet of 70 per cent, sparked by financial inflictions caused by the pandemic.

Its latest figures add to the already growing number of more than half a million Australians opting into financial hardship programs, including deferring loan repayments.

Data from the Australian Banking Association indicates over 320,000 homeowners and 170,000 business loan customers have already applied for financial relief, equating to approximately $6.8bn worth of repayments.

Westpac’s chief executive Peter King said the economic impacts of the pandemic are likely to persist, with no respite until at least the end of the year.

“Business and consumer confidence have fallen sharply,” Mr King said.

“A sustained recovery cannot be expected until the December quarter, although we expect caution to prevail well into 2021,” Mr King said.

Mr King noted that the bank’s economists are forecasting the unemployment rate to peak at 9 per cent by June, and would have been much higher if the JobKeeper payment scheme was not introduced.

Financial support measures have also been extended to its personal loans and credit card customers, with Westpac being the only major bank to implement a three-month interest rate and principle fee freeze on the respective lending products.

Westpac’s COVID-19 support package figures also highlighted that 31,000 of its business loan customers have sought relief, representing $8bn of its business loan book.

Twenty per cent of business support applications have come from the property and property services industry, while 13 per cent has come from the retail sector.

The bank’s New Zealand operations revealed 15,000 of its customers have lodged applications for mortgage relief, totalling to $NZ6bn ($5.7bn). Approximately 1500 of its NZ business customers have requested temporary business overdrafts, equating to a value of $NZ2.8bn.

Westpac’s economists predict Australian house prices are expected to fall for the remainder of 2020, particularly in Melbourne and Sydney.

It is also forecasting an earlier recovery of the Australian economy compared to the rest of the world, due to China being at the tail end of its pandemic shutdown.

“While the rest of the world is also facing significant economic disruption, Australia’s exports will likely benefit from the recovery in the Chinese economy,” Mr King said.

“Unfortunately, ongoing international travel restrictions will continue to flatten inbound tourism and impact foreign student arrivals.”

A Westpac spokeswoman said 90 per cent of its branches in Australia remain open to assist customers wanting to apply for coronavirus financial support.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout