Home loan relief calls push $6.8bn

More than half a million Australians have hit pause on $6.8bn worth of loan repayments in the past six weeks.

More than half a million Australians have hit pause on $6.8bn worth of loan repayments in the past six weeks, outpacing industry expectations as the nation struggles through the coronavirus shutdown.

More than 320,000 homeowners have put mortgage repayments with the big four banks on hold, while 170,000 businesses have opted to defer repayments, figures from the Australian Banking Association show.

Almost 37,000 other loan repayments, such as personal loans and credit cards, have also been deferred.

The figures come as Westpac on Monday is expected to reveal a heavy hit to first-half profit after setting aside about $1.6bn to cover bad debts linked to the COVID-19 impact.

ABA chief executive Anna Bligh said the number of people seeking relief due to the impact of the economic shutdown was “staggering”.

“When banks announced this they did expect there would be very high levels of demand, but this is beyond expectations and the requests are still coming in,” Ms Bligh told The Australian.

“They are performing a role as shock absorbers in the economy and these figures tell you the size of the shock to date.”

Commenting on concerns about what will happen after the six-month reprieve comes to an end, Ms Bligh suggested lenders would continue to work with distressed borrowers.

“From the outset banks said that depending on how COVID-19 evolved, if the six-month period needed to be extended they would certainly look at doing so and talk to APRA about managing that,” she said.

“At this stage, things look positive for a return to a more open economy, but there’s no doubt that we’re not going to return to 5 per cent unemployment in six months, in which case banks will be looking to work with APRA about the treatment of these deferrals and the circumstances in which they can extend them to customers.”

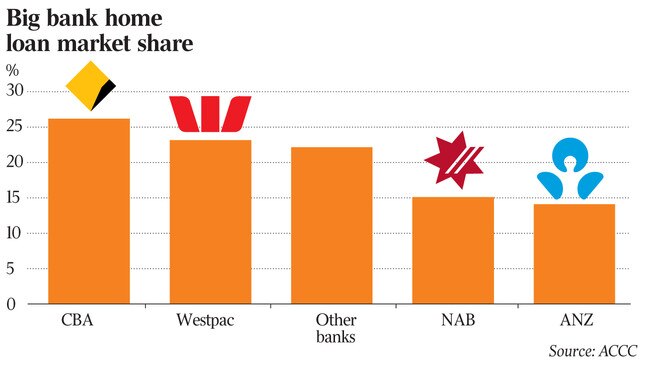

ANZ last week told the market it had to date received 105,000 home loan deferral requests due to the crisis. This compares with 80,000 at Commonwealth Bank, while NAB has so far put more than 70,000 home loan repayments on hold. Westpac is expected to reveal similar numbers when it delivers its first-half results on Monday.

ANZ chief executive Shayne Elliott last week dismissed expectations of a V-shaped recovery to the crisis, warning that some businesses would never recover.

The lender’s half-year result was marred by a $1.7bn charge for provisions, including a $1.3bn “economic provision” as it braces for a surge in bad debts stemming from the fallout.

NAB, meanwhile, has set aside just over $800m for expected losses linked to the pandemic.

Westpac chief executive Peter King last week said the world was going through “a once in a lifetime health and economic crisis”. He said Westpac was committed to assisting as many customers as possible through the shutdown period.

As the major lenders are inundated with deferral requests, they are also injecting funds into the economy, providing $45bn in new loans and a further $6bn through increases to existing loans and credit facilities.

Unlike in the global financial crisis, when the financial sector’s weakness was exposed, the coronavirus crisis showed it came into the COVID-19 pandemic in a position of strength, Ms Bligh said.

“The strength of Australia’s banks has allowed the industry to step up and play a key role in helping, not only our customers, but supporting the recovery of the Australian economy, through one of the most challenging periods in our lifetimes,” she said.

The higher-than-expected take-up of repayment relief from borrowers comes as non-bank lender Firstmac revealed just over 5 per cent of mortgage holders in its $12.8bn loan book had applied for hardship arrangements.

Firstmac managing director Kim Cannon said the hardship numbers were less than the “optimistic” forecasts of 6-9 per cent, and well below the level that may result in deferred residential mortgage-backed securities (RMBS) coupon payments to investors. “Investors have been on tenterhooks waiting for this information to see if Australian RMBS are in trouble so this is a huge piece of good news for them,” Mr Cannon said.

“This data will give confidence back to investors so they can keep investing in RMBS knowing that the level of hardship is very manageable. It is just a small fraction of what our RMBS could withstand.”

The lower-than-expected hardship figures were due to Firstmac’s strong prime loan book, as well as its approach to working with borrowers and government measures to mitigate the financial impact of the shutdowns, Mr Cannon said.

“At the start of this crisis we rejected a one-size-fits-all approach to hardship and resolved to work with each customer individually,” he said. “We redeployed a lot of staff into our hardship team, expanding its size eight fold, but the result was that many hardship applicants have chosen to continue making some level of repayments that they are comfortable with, leaving them better off in the long run.”

Amid expectations of rising mortgage defaults, ratings agency Moody’s last week placed six of non-bank lender Bluestone’s non-conforming RMBS on review for a downgrade.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout