Huge question over whether Peter Dutton will offer tax cuts

Aussie couples are getting slugged $7000 a year in extra income tax, according to new analysis of Labor’s tax cuts.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Liberal leader Peter Dutton has warned Australian couples are getting slugged $7000 a year in extra income tax, on average, since the Albanese government was elected. But it’s not clear he plans to do anything about it.

Even though the government sloshed out $69 billion in income tax cuts under the revised Stage 3 reforms that increased relief for low and middle income earners, bracket creep has ensured workers are still paying more tax.

For singles it amounts to just over $3500 on average per worker, and for couples it’s around $7000, depending on your income.

What is bracket creep?

Bracket creep occurs when rising incomes cause individuals to pay an increasing proportion of their income in tax, even though there may not have been changes to tax rates and thresholds.

In theory, that allows governments to collect more income tax before periodically handing bracket creep back to workers under the guise of “tax cuts”.

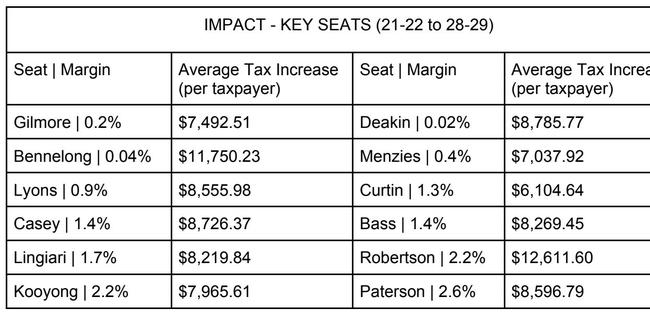

A new analysis of Parliamentary Budget Office and ATO data prepared by the Liberal Party has now revealed that Labor’s Stage 3 tax cut changes have failed to lower taxes for Australian households, with taxes on the rise due to inflation and bracket creep.

Under Labor, the average amount of tax paid by Australians has gone from 23.7 per cent of incomes in 2021-22 to an all-time high of 26.1 per cent in 2023-24.

Opposition treasury spokesman Angus Taylor pointed to the figures on Monday to highlight what he calls the “mismanagement of this Labor government and how it’s trashed Australians’ standard of living”.

“The unprecedented collapse in standards of living, the biggest of any of our peer countries,” Mr Taylor said.

“$3500 of extra personal income tax is being paid and over a 30 per cent increase in the price of groceries.”

Asked if he was putting the figures out to flag a new round of income tax cuts if the Coalition were to win the election, Mr Taylor didn’t answer the question neatly.

“Well, we’ve been very clear that we’ll re-establish the fiscal guardrails that include a tax to GDP cap, something that we had in place when we were in government and that Labor got rid of as soon as they came to power,” he said.

“I mean, this is how you manage the economy. You set yourself basic rules, you move to them over time, you make sure you are continually working towards that. That is not what we’ve seen under Labor.”

Asked a third time if that would mean income tax cuts from the Liberals, Mr Taylor replied that “everyone on our side of politics believes in lower, simple-efficiency taxes, James. That is absolutely fundamental.”

“But are you going to do anything about it?’’ he was asked.

“Well, I know you want me to announce our election policies on your program this morning. But the best thing to do about it, the most important thing and the first thing you’ve got to do is beat inflation,” Mr Taylor said.

“We’ll see what’s in the budget, but we will always fight for lower, simpler taxes for Australians as we last did in government with Stage One, Two and Three tax cuts.”

Big barriers to tax cuts

There are several barriers to offering tax cuts. The first is fears that such cuts could fuel inflation and put upward pressure on prices and interest rates.

The second is the magnitude of the cost of tax cuts compared with the impact, given even modest weekly tax cuts could cost billions.

Liberal frontbenchers have told news.com.au that while inflation pressures were easing, the question was how much room there would be in the budget to provide meaningful relief.

To do so, the Liberal Party probably needs to find a bucket of cash in the budget that it can oppose to fund tax cuts.

Angus Taylor has ‘humiliated himself again’, government claims

But Treasurer Jim Chalmers has hit back at the claims, insisting that “his dodgy numbers don’t include more than $20 billion in tax cuts that Australian workers are receiving in 2024-25 alone.”

“The Shadow Treasurer was ‘dead opposed’ to our tax cuts for every taxpayer, and now he’s pretending they don’t exist,’’ Dr Chalmers said.

“It’s a good thing he plans to visit marginal seats this week, the more they see of him the better. He should go to every marginal seat and tell millions of Australians he did not want them to get a tax cut at all.

“Of the many helpful things Angus Taylor has said, he outdid himself last week when he said ‘the best predictor of future performance is past performance’.

“It’s the clearest signal yet that Peter Dutton and the Coalition would attack Medicare, cut cost-of-living help, and push wages and living standards down, because that’s what they do.”

The Treasurer will hand down the budget on March 25, and after spending big on Medicare, there are no signs he will offer tax cuts either.

Originally published as Huge question over whether Peter Dutton will offer tax cuts