‘Printing cash’: The hidden investment opportunity in gold price explosion

Gold prices have soared in recent times but there may be a heavily discounted opportunity hiding in plain sight that is literally printing cash, writes ASX Trader.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

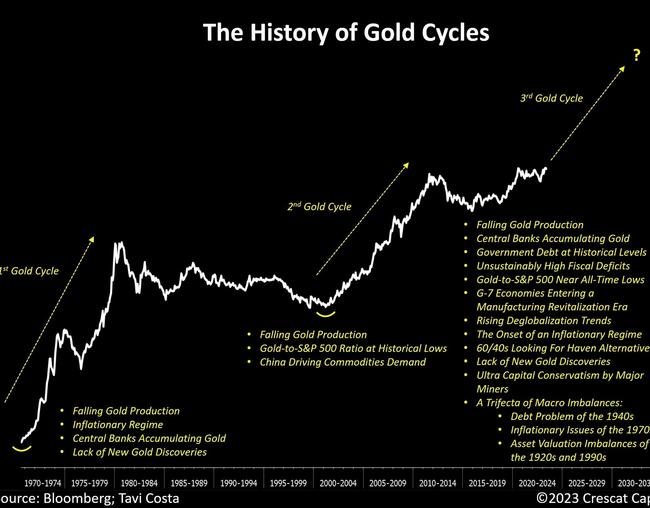

Gold has long been seen as a safe haven asset, especially during economic uncertainty, but there’s an even bigger opportunity hiding in plain sight.

As mentioned in last week’s column, gold is historically cheap compared to stocks, attracting savvy investors.

But there’s a closely-linked industry which is operating like a money printing machine - gold mining stocks, which are historically undervalued compared to gold itself.

Why gold miners are so cheap:

Gold mining stocks have lagged gold prices, creating a possible rare investment opportunity.

Typically, when gold prices rise, gold miners - companies that extract gold - tend to benefit even more.

However, this time, miners are trading at a significant discount to the metal.

Many gold miners, particularly in Australia, have been quietly making significant profits and are in a stronger financial position than most realise.

The Australian advantage: Selling gold at record prices:

Australian gold miners have a unique advantage: the combination of strong gold prices and a weaker Australian dollar.

Since gold is priced in US dollars globally, Australian miners benefit from higher local conversion rates, effectively selling gold at record-high prices in Australian dollars (AUD).

This dynamic has created massive profit margins for Australian mining companies, allowing them to generate strong cash flows, maintain healthy balance sheets, and even offer attractive dividends to shareholders.

Take Evolution Mining (EVN) as an example - one of Australia’s top gold miners.

The company expects its total cost to produce gold (known as All-in Sustaining Cost, or AISC) to be between AUD$1,475 and AUD$1,575 per ounce in FY25.

This cost includes everything from mining and refining to ongoing expenses.

With gold currently priced at AUD$4,616 per ounce, Evolution Mining is making a strong profit on every ounce of gold it sells.

Simply put, Australian gold miners are operating like money-printing machines.

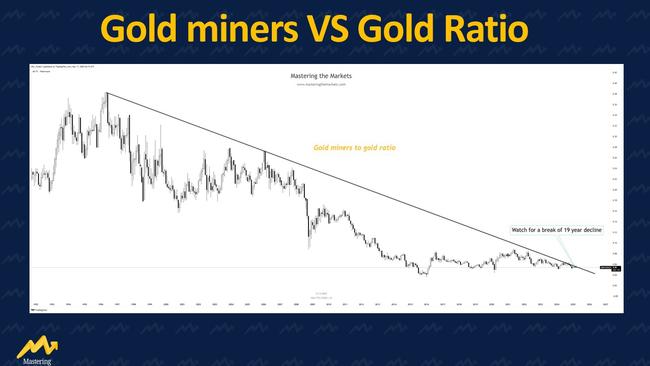

As seen in the attached graph, gold miners have been in a 19-year downtrend against gold. The key question now is: Will it break the declining resistance and start a new bull run?

Why gold miners outperform in a gold bull market:

Gold mining stocks tend to rise faster than gold itself in a bull market due to their built-in leverage.

Here’s why:

1. Operational Leverage: When gold prices rise, mining companies earn more per ounce, while many of their costs remain fixed. This means higher gold prices directly boost their profit margins.

2. Market Sentiment Shift: When investors recognise the value gap between gold and miners, capital quickly flows into mining stocks, pushing prices higher.

3. Hedging Strategies: Some mining companies use financial strategies to protect against downturns while still benefiting from rising gold prices.

Historically, when gold miners have been this undervalued relative to gold, it has led to major rallies in the mining sector.

We are now seeing the early stages of what could be a significant re-rating of gold stocks.

Additionally, as shown in the chart, the GDX Gold Miners ETF has just broken through a key price barrier and is now entering uncharted territory not seen since July 2019.

Context is key here - these are monthly candles, reflecting the bigger picture.

However, on the daily timeframe, prices look quite extended, so a short-term pullback could be on the cards.

The investment opportunity:

For those interested in gaining exposure to gold, mining stocks offer a way to participate in the sector with the potential for amplified returns.

However, they can also be more volatile than gold itself.

Historically, when mining stocks have traded at a significant discount to gold, they have, at times, outperformed in the years that followed.

In Australia, gold miners benefit from favourable currency dynamics, which have supported strong financial performance.

If market conditions remain supportive, this could create an interesting scenario for companies with solid fundamentals.

As the market adjusts to changing valuations, well-managed mining companies may be positioned for potential growth.

Final thoughts:

Markets tend to correct inefficiencies over time, but in the short term, price discrepancies can arise.

Currently, gold miners - particularly in Australia - are receiving less attention despite notable developments in the sector.

If market dynamics shift and this valuation gap narrows, gold mining stocks may experience further growth.

Looking at historical trends, gold miners have previously traded at higher valuations.

If similar patterns emerge in the future, it could present interesting opportunities.

Could gold miners be a sector worth watching?

While gold and gold miners appear relatively undervalued, there is another asset class that, from a historical perspective, is even more discounted.

Stay tuned for next week’s column to explore what it is.

DISCLAIMER: The content set out in this article provides general information only and should not be taken as professional advice from the publisher or author. The publisher does not endorse or recommend any product or investment opportunity referenced in the article. You should get advice specific to your circumstances before making any investment or other financial decisions.

More Coverage

Originally published as ‘Printing cash’: The hidden investment opportunity in gold price explosion