Could platinum be to 2025 what gold was to 2024? The charts and smart money think so

While most investors have been focused on gold hitting record highs, another precious metal is quietly preparing for a major move.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

While most investors have been focused on gold hitting record highs, another precious metal is quietly preparing for a major move: platinum.

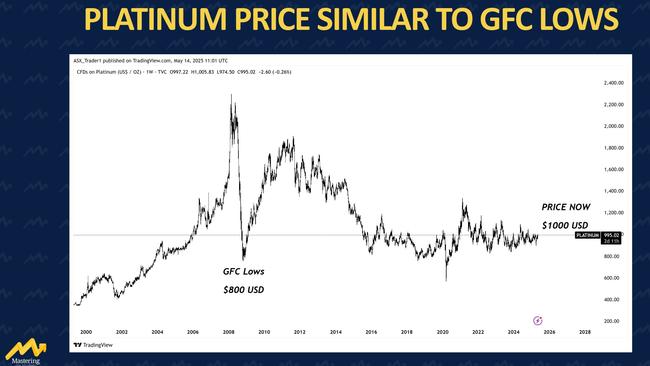

Platinum is still trading near levels last seen during the bottom of the 2008 Great financial crisis, but a combination of tight supply, growing demand from clean energy industries, and historical price relationships suggest this metal could soon take off.

How money flows in precious metals

In every bull market for precious metals, capital tends to move in a predictable order. First, it flows into gold as a safe haven. Once gold has made its move, silver, known for its higher volatility, usually follows. Finally, investors look for opportunities in the lesser-known metals like platinum and palladium and so on.

Right now, we’re at that stage. Gold has already broken out to new highs. Silver is gaining momentum. And platinum, still lagging – as seen in the chart below – may be next.

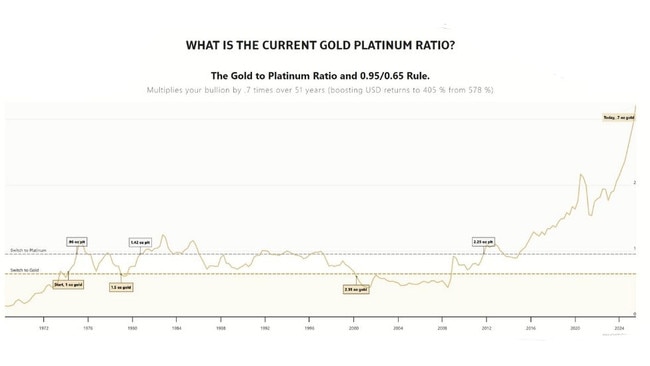

The platinum-to-gold ratio is flashing a historic buy signal

The gold-to-platinum ratio measures how many ounces of platinum are needed to purchase one ounce of gold. This ratio helps investors assess the relative value of these two precious metals.

-A higher ratio indicates that platinum is undervalued compared to gold.

-A lower ratio suggests that platinum is overvalued relative to gold.

Historically, when the ratio exceeds 0.95, platinum is considered undervalued; when it drops below 0.65, platinum may be overvalued.

As of May 14, 2025:

-Gold is trading at approximately $3226.11USD per ounce.

-Platinum is trading at approximately $988.65USD per ounce.

This results in a gold-to-platinum ratio of about 3.26, indicating that platinum is significantly undervalued compared to gold. Such a high ratio suggests a potential opportunity for investors, as platinum may offer more value relative to gold at this time.

Smart money already knows

Over the past month, I asked a dozen bullion dealers a simple question:

“If you could only hold one precious metal right now, what would it be?”

80 per cent said platinum.

They’re watching the same ratios. They’re seeing the same charts. But most importantly, they understand where the real undervaluation lies. In their view and mine, platinum is the gold of 2024.

Supply is tight, and demand is growing

Platinum supply is under pressure. Most of it comes from South Africa, where mines are facing major problems like power shortages and shutdowns. At the same time, not many new mining projects are starting up.

Meanwhile, demand is increasing, especially from industries making clean energy technologies. Platinum is used in hydrogen fuel cells, which are becoming more important in the move to greener energy systems.

The chart is building a bullish case

From a technical analysis point of view, platinum looks like it’s forming a base. A weekly close above $1000USD could kick off a new rally. If it can close above $1200USD on a monthly chart, that would confirm the start of a major long-term uptrend. Some analysts even suggest prices could head toward $3000USD over the next few years.

How to Get Exposure to Platinum

There are several beginner-friendly ways to invest in platinum:

• Physical bullion: Buy platinum bars or coins from trusted dealers. This provides direct ownership but comes with storage and insurance considerations.

• ETFs physical platinum (ASX: ETPMPT) offers simple exposure to platinum prices via an exchange-traded fund backed by physical metal.

• ASX-listed companies: Investors can also gain exposure through mining or exploration companies involved in platinum group metals (PGMs): Zimplats (ZIM) – One of Africa’s top platinum producers; Platinum Group Metals Ltd (POD) – Junior explorer with PGM focus; or Chalice Mining (CHN) – Large WA-based nickel-copper-PGM discovery.

As always, assess your risk appetite and research each company before investing.

Why platinum’s whisper might become a roar

In markets, value rarely screams, it whispers. And right now, Platinum is whispering to anyone willing to listen.

With deeply discounted prices, technical strength building, and strong sentiment from those in the know, this overlooked metal may just be the most compelling opportunity in the precious metals space.

Smart investors don’t chase, they accumulate. And platinum, at current levels, may be the ultimate accumulation play.

More Coverage

Originally published as Could platinum be to 2025 what gold was to 2024? The charts and smart money think so