ASX Trader: Why we’ll likely never see low interest rates again this lifetime

This chart shows why we’re unlikely to see ultra-low interest rates again with history suggesting we may face 40 years of rising rates which could reach up to 8 per cent, writes ASX Trader.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

It’s highly unlikely interest rates will return to the historic lows we saw in 2021 – at least not in our lifetime.

And history suggests we could be in for 40 years of rising rates which could reach up to 8 per cent.

The Reserve Bank of Australia provided some much-needed cost of living relief last week by cutting rates for the first time in four years.

But if you’re expecting rates to drop significantly again, you may be in for a reality check.

The reason?

Bonds typically follow a 40 year cycle, and history suggests we are now in a rising phase where rates could continue increasing for decades, possibly reaching up to 8 per cent.

If you look at historical interest rate movements, the pattern is clear.

Rates bottomed out in 2021, when I secured a mortgage at an incredibly low 1.94%.

Before that, the last major bottom was in the early 1940s, when rates were suppressed due to World War II.

After that, interest rates climbed for 40 years, peaking in 1980 when Boomers were paying a staggering 17 per cent on mortgages.

Then came a 40-year decline, leading to the ultra-low rates of the 2020s.

But that cycle appears to be over.

We are now in the rising phase once again, meaning rates are likely to trend higher over the coming decades.

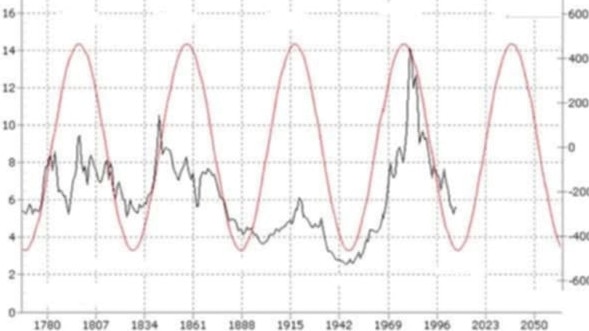

The two charts illustrate this.

Interest rates follow long-term cycles, typically lasting around 40 years, as seen in Example A (below), which dates back to the 1700s.

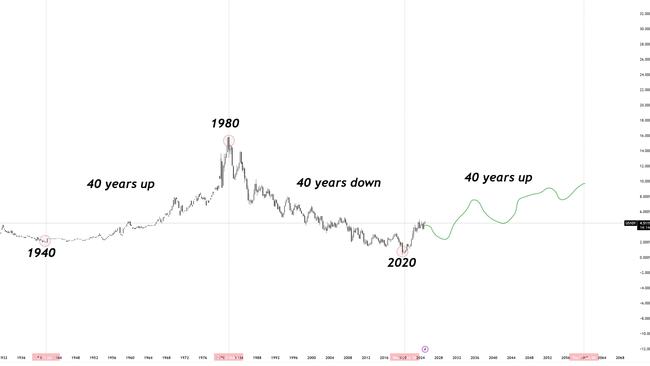

More recent data, seen in Example B above (the US 10-Year Treasury Yield), reinforces this pattern – showing the early 1940s bottom, the 40-year uptrend, the 1980 peak, and the subsequent decline.

That long-term downtrend has now likely ended.

Key resistance levels have broken for the first time in four decades and market structure suggests a shift toward an upward trend.

The global economy has likely entered a new rising rate cycle, meaning that while the RBA may implement periodic cuts, the long-term direction appears to be upward.

However, while history provides insight, the global economy has evolved considerably since the 1970s.

Central banks are navigating a fine line between controlling inflation and avoiding economic collapse.

Yes, there will be rate cuts – but don’t expect below 2 per cent

This doesn’t mean rates will rise in a straight line.

There will be rate cuts along the way, particularly during economic downturns or recessions. However, it’s unlikely these cuts will return rates to the ultra-low levels of the past.

Even if central banks lower rates temporarily, the broader trend is likely upward.

The likelihood of rates dropping below two per cent again in our lifetime is slim.

Several structural forces are supporting higher inflation, including government debt, deglobalisation, and ongoing money printing – all of which make it less likely that we’ll see a return to cheap money policies.

History tells us inflation has never been tamed on the first attempt.

If past patterns repeat, inflation could persist, forcing central banks to keep rates elevated.

Could we return to 17+ per cent interest rates? Probably not.

But rates could climb back to 6-8 per cent, which would put significant pressure on borrowers.

Higher borrowing costs would likely impact households, businesses, and the broader economy – making debt far more expensive to service.

Any rate cuts that do happen should be viewed as temporary relief rather than a shift back to permanently low rates.

Government money printing: The key driver of higher rates

One of the biggest reasons for rising interest rates is the sheer amount of money printed by governments worldwide.

The flood of stimulus, bailouts, and deficit spending has fuelled inflation, forcing central banks to raise rates aggressively in an attempt to keep prices under control.

Unlike previous cycles, where rates were artificially lowered, today’s environment leaves little room for such intervention.

With record-high government debt and persistent inflation, central banks are unlikely to return to prolonged periods of near-zero rates without risking economic instability.

The RBA rate cut: Expected or premature?

This rate cut was no surprise – the decision came off the back of falling inflation data, with Q4 inflation reported at 2.4 per cent, down from 2.8 per cent in Q3.

Given this data, a cut was inevitable, either in February or March.

However, Australia’s quarterly data cycle means this is one cut based on delayed inflation data.

The RBA will now have to wait until April for Q1’s inflation figures to see if this decision was warranted or if they cut too soon.

The Australian economy continues to show strength, with a tight labour market and robust consumer spending, partly due to government tax cuts.

Unemployment remains low at 4.0 per cent for Q4 2024.

Consumer spending remains strong.

With strong economic performance, consumer spending, and a tight labour market, cutting rates too soon could reignite inflation, potentially forcing the RBA into future rate hikes.

It’s a delicate balance – and time will tell whether this was the right call.

How this key indicator predicts interest rates

A crucial signal for future rate movements is the US 10-Year Treasury Yield (US10Y).

This bond yield reflects investor expectations for inflation and monetary policy.

Historically, when the US10Y rises, global interest rates — including those in Australia — tend to follow.

When it falls, central banks may have the flexibility to cut rates.

Given its strong correlation with mortgage rates and borrowing costs, monitoring the US10Y can help investors and borrowers anticipate future rate trends.

If yields continue climbing, it signals a prolonged period of higher interest rates, reinforcing the likelihood that ultra-low rates are behind us.

What this means for you

If you locked in a low mortgage rate before 2022, you likely secured a deal that may never be seen again.

For everyone else, borrowing is likely to become significantly more expensive.

The era of cheap debt appears to be over, and we are entering a new normal of higher-for-longer interest rates.

While the RBA’s recent rate cut may seem like a turning point, it is more likely a brief pause within a broader multi-decade trend of rising rates.

The bottom line?

Don’t wait for ultra-low interest rates to return – they very likely won’t.

Borrowers and investors should start adjusting their strategies for a world where higher rates remain a key factor.

What does this mean for real estate and the stock market? Find out next week.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

Originally published as ASX Trader: Why we’ll likely never see low interest rates again this lifetime