Family hit with $370,000 medical bills after son’s Bali motorcycle accident

A young man was holidaying with friends in Bali when the accident unfolded.

An Adelaide mum has issued a chilling warning after she was hit with more than $370,000 in medical fees after her son fell off a motorcycle while on a holiday with friends in Bali.

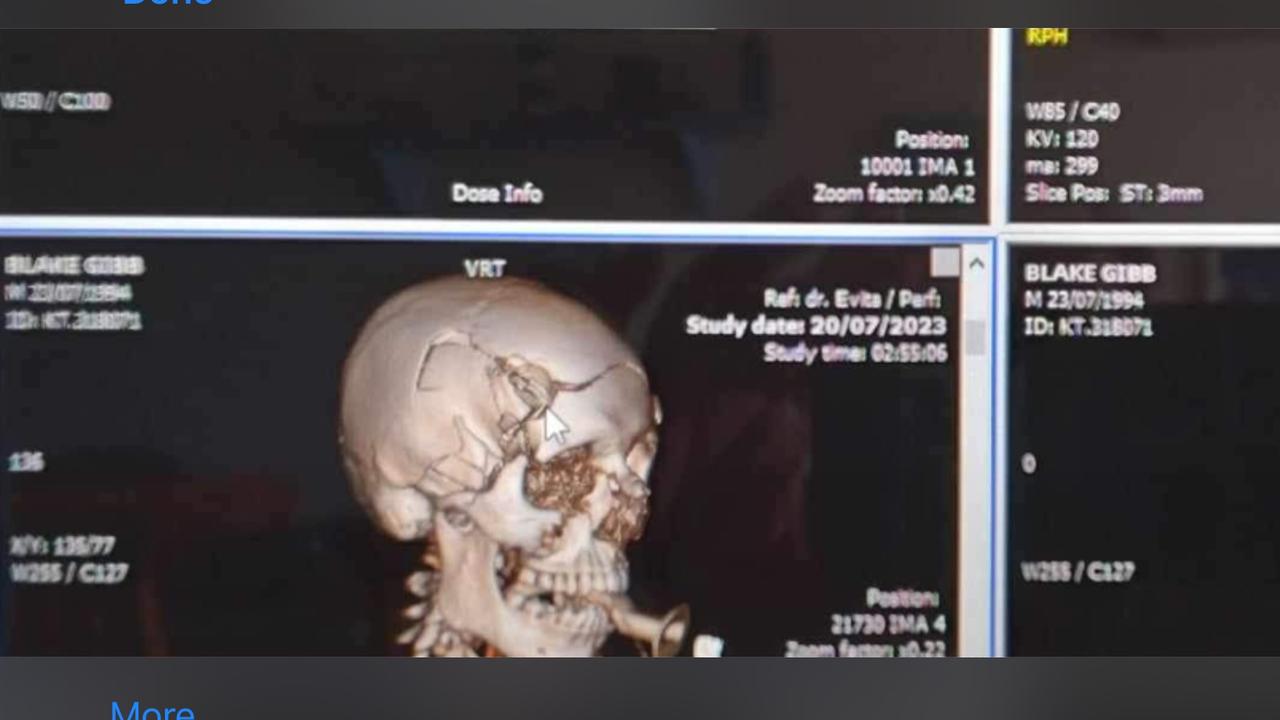

Blake Gibb, 30, was holidaying with two friends in Indonesia’s Lombongan Island when the horror incident unfolded.

He had been riding a scooter when he overshot a turn and slammed into a cement wall.

He suffered severe facial and brain injuries, which required emergency lifesaving surgery at the International Medical Centre in Bali, before he was Medevaced back to Australia.

However, because he didn’t add the $7 motorcycle coverage policy when selecting his travel insurance, his family will have to pay for his extensive surgeries, which his mum Rosslyn Gibb believes will be about $370,000.

“His friends got him to a medical centre and they phoned us up at 1am looking for $4000, because you have to pay upfront,” Ms Gibb said.

“They had to transport him by boat to get to from Lombongan Island to Bali … and then he got Medivaced from Bali to Adelaide.”

At the time, Ms Gibb remembers signing a document which said the family would be responsible for the hospital fees if the insurance claim failed, but she didn’t think any of it at the time.

Shortly after arriving back to Australia, the family were told by Freely, which is owned by the CoverMore group, they wouldn’t be covering Mr Jedd’s medical care.

“When you’re in that sort of emergency, you’ll do all you want to,” he said.

“I wasn’t going to stay in Bali and hope. They said to us: ‘We’ve told the Medivac people, they must take him back to Australia because he’s not going to make it’”.

Now as her son recovers from his extensive injuries at the Royal Adelaide Hospital, his family have started a GoFundMe to help shoulder the costs.

Freshly out of a facial reconstruction surgery as of Tuesday, Mr Briggs will hopefully be moved to the Intensive Care Unit for a few weeks, before moving to a neurological ward and then rehab.

“They said at the end of two years, you’ll know how much function he’ll get back,” he said.

“He’s whispering, but we can’t always hear it, and his right side is working, so it’s just all an uphill battle. One step at a time.”

Although friends, family and complete strangers have bandied around to raise more than $35,000 in just two days, Ms Gibb warned other travellers to “read the small print,” when taking out a travel insurance policy.

“He would have paid the whole lot if he had thought about it, but he’s not covered because he didn’t click the box to say: ‘Yes, he would (ride a motorcycle),’ and he didn’t call the insurer before his trip,” she said.

In a statement, a spokesman from Freely said the company was “pleased we could help Blake Gibb return to Australia after his serious motorcycle accident in Bali. And we wish him the best possible recovery.

“Freely cannot comment any further on the individual or specific details of Blake’s case due to our privacy commitment.

“Purchasing motorcycle/moped coverage as an ‘add-on’ to a travel insurance policy is common practice in Australia.

“Freely’s add-on or ‘boost’ for motorcycle/moped can be easily added to your travel insurance policy when you first purchase it or at any time during your trip before you get on a motorcycle or moped.

“This is clearly explained on our website, www.freely.me and on the Freely app. When travellers to Bali are purchasing our policy, they are presented with information specifically asking if they would like to add motorcycle/moped cover.”

NCA NewsWire has contacted Freely for additional comment.