Accused crypto scammer bought the royalty rights to 20 songs

An accused scammer spent his alleged profits on usual mansions and cars, but he was a big fan of one particularly unconventional asset.

An accused scammer was allegedly working in a broader operation when he took over mobile phones to steal money he used to buy a house, Ferrari, and the royalty rights to 20 songs.

Pennsylvania man Anthony Faulk, 23, was arrested last Wednesday in connection to a scam operation spanning several states in the US.

It’s alleged Mr Faulk used his ill-gotten gains to buy a five-bedroom, 430 square metre house, complete with a pool and even its own basketball court.

The house was bought for almost $A1.4 million, which might not sound like all that much to some readers in Australia’s larger capital cities but is more than ten times the median house price in Mr Faulk’s home town of Latrobe, Pennsylvania.

RELATED: Twist in $200 million crypto scam

He also allegedly used the proceeds to buy a Ferrari 488 Spider, three other cars, jewellery including a “Bust Down” Rolex Presidential Day-Date watch, and the royalty rights to 20 songs.

A Bust Down watch is one that has been covered and filled with diamonds.

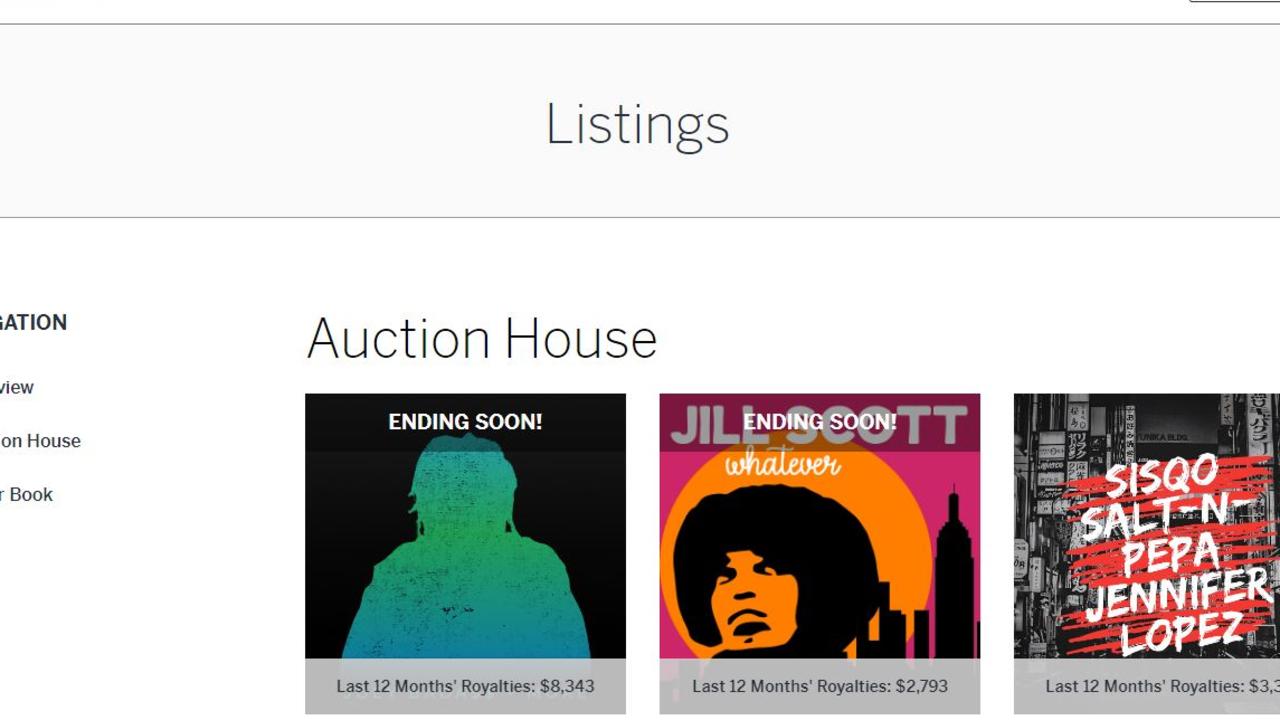

Mr Faulk allegedly purchased the royalty rights using dirty money through the website Royalty Exchange.

The site allows users to bid on the royalty rights to songs, an investment the website states provides income that’s “hard to beat”.

Unfortunately, the indictment documents list only the names of the songs and not the artist they’re credited to, but tracks from big names like Pitbull, Ludacris, and Future appear to be among them.

He’ll be forced to forfeit all of those assets if found guilty.

RELATED: New Ferrari’s staggering numbers

Mr Faulk has been charged with conspiracy to commit wire fraud and interstate communications with intent to extort. He’s been released on a $US250,000 bond ($A363,000) and is due to face a San Francisco court in January.

His arrest came as a result of an FBI investigation that also nabbed two other accused scammers at the start of the year.

RELATED: Aussies at risk from costly phone scam

Ahmad Wagaafe Hared from Tuscon, Arizona, and Matthew Gene Ditman, from Las Vegas, Nevada, were indicted in January for charges of conspiracy to commit computer fraud and abuse, conspiracy to commit access device fraud, extortion, and aggravated identity theft.

The two men were both aged in their early 20s.

The accused scammers used a technique known as SIM swapping to gain access to digital wallets belonging to Silicon Valley executives and investors of cryptocurrency companies.

After gaining access the scammers allegedly transferred the contents of those wallets to their own.

The group is also accused of calling victims up and trying to extort them.

Like many scams, both modern and vintage, SIM swap grifts rely heavily on social engineering.

It’s a far cry from the fervent mashing of keyboards in dark rooms often used to illustrate computer hacking on screen, but it can also achieve better results, given people can be much easier to trick than computers.

Scammers will send phishing emails or exploit the personal data you post online to learn basic information, then use charm and deception to trick telco companies’ customer service representatives into thinking they’re you.

They then convince the telco to port your mobile phone to a different SIM card.

Once that happens you’ll lose network access on your phone, which for many is the first sign they’ve fallen victim.

By that point it’s already too late.

Anyone with a mobile phone can be hit by SIM swap scam. Earlier this year, for instance, Twitter CEO Jack Dorsey embarrassingly had his own Twitter account hacked through a SIM swap scam being used to exploit a service that let users send a tweet via text message from the phone linked to their account.

Would you invest your allegedly stolen money in royalty rights? Let us know which song you’d buy in the comments below.