The dark truth about your pizza

THERE’S not much better than kicking back with a just-delivered pizza. But your guilty pleasure is hiding an uncomfortable truth.

LIKE most great wars, the pizza wars started partly by accident.

The year was 2014, and Domino’s and Pizza Hut were both positioning themselves in a strategic struggle for the Australian pizza market.

Pizza Hut had decided to cut prices to $4.95. Dominos reportedly found out and made a plan to respond in kind. At the last minute, Pizza Hut began to get cold feet, with an internal email suggesting a price of $5.95 instead. But by then it was too late.

The big winners of the war were pizza lovers. Cheap pizzas flowed thick and fast. But the disappointing thing about crazy low prices (disclosure alert: I love crazy low prices) is someone generally pays the price.

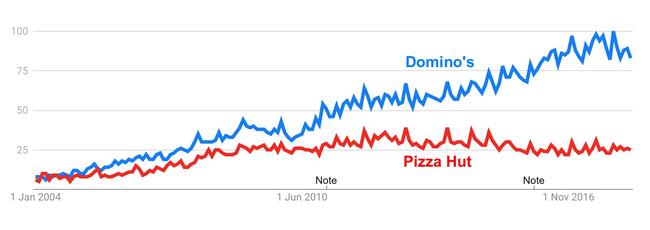

As far as the two companies go, Google Trends data suggest Domino’s won the war. Search interest has surged compared to Pizza Hut. But that victory has come at a cost.

Last week, we got a new glimpse into just how much turmoil the pizza wars caused, when a Pizza Hut franchisee and a Domino’s franchisee both made their stories public. Their tales of woe showed up among a glut of horror stories from franchisees all over the sector sent in to a Senate inquiry into franchising.

THE HUT GETS HIT

Lynette Bayakly and her husband Fred bought a Pizza Hut franchise in 2013 from the franchising company, called Yum! Foods. The franchisee doesn’t get to set the price of pizzas, Yum does. And they cut prices sharply.

“Our sales went through the roof when Yum reduced pizzas to $4.95 each,” Ms Bayakly wrote in her submission to the Senate inquiry.

As anyone who understands business knows, sales aren’t everything. In fact, if you’re making a loss, the more you sell, the more money you lose. Ms Bayakly describes the situation as Yum “forcing us all to sell pizzas below cost”.

“We were struggling to physically keep up with producing orders. On a Friday night we would do 80 per cent of our day’s sales in a very small window of time,” Ms Bayakly writes. “Our delivery estimate time could blow out to two hours and people would still be ordering.”

Lynette and Fred stopped paying themselves, and after they personally built up $80,000 in owed wages, it became clear the store had to close.

“We began this franchising journey with high hopes and the expectation we would need to work hard to reap the rewards. We knew it takes time to build a business from scratch and we were prepared for that. We were not prepared for a change in leadership of the franchise that ushered in sheer insanity,” she writes.

Later franchisees banded together and brought a court case against Yum! Foods over $5 pizzas but the legal system found in favour of the company,

News.com.au sought comment from the company that franchises Pizza Hut, but the brand was recently sold by Yum to a private equity company called Allegro Funds. A spokesperson for Allegro said the actions of the previous franchising company had nothing to do with them.

SOME DOMINO’S FALL TOO

Buying a Domino’s franchise in Sydney was a huge move for Kamran Talebi, who had previously worked for two decades in the IT and telecommunications industry. He had high hopes, but as the pizza wars heated up, he too found himself caught in the crossfire.

Mr Talebi paid a deposit for the franchise in May 2014 and took over his store in September 2014, by which time the $5 pizza war was on in earnest.

“As a result of this new offering, we witnessed a dramatic rise in Food and Labour cost which in return eroded the profit of the business that we purchased,” writes Mr Talebi in his submission to the Senate inquiry.

“The price cut was initially supposed to be temporary, but before long, Dominos made it permanent. Even if that shaved profits for the stores, the extra sales were great for Dominos franchising company because they get a payment from some of the suppliers to the stores for goods sold, called a rebate.

“Our expenses went up in running this campaign meaning we had less profit,” writes Mr Talebi, “but Domino’s Pizza Head Office increased their profit because they were collecting royalties, marketing fees, and rebates on the supply chain increase due to the increase in sales.”

It is important to hear both sides, so I rang Domino’s to hear what they had to say. “In the two years after the Cheaper Every Day $5 value range was introduced, the average profitability of a Domino’s store increased by more than 30 per cent to $137,000 per store, on a fully managed and staffed basis,” a Dominos spokesperson told news.com.au.

“Since introducing a $5 value range, Domino’s stores have increased customer numbers, sales and profitability. Value range pizzas are profitable individually and, in addition, contribute to a larger average order, with customers typically adding other pizzas or sides, including drinks, to their orders.”

I believe that’s true, on average. But of course not every franchise is the same, and a marketing strategy that raises profit in one area might work differently elsewhere.

Eventually, after two years of operation, Mr Talebi decided to sell the “loss-making” pizza shop, and began a war of his own, taking on Domino’s pizza in a range of public forums. He has also made it very clear he would like to be called as a witness and give evidence at the senate inquiry.

They may have changed shape, but the Pizza wars are not yet over.

Jason Murphy is an economist. He runs the blog Thomas the Think Engine.