What happens the year after house prices soar in Australia

There have only been two other property price booms which exceeded the one Australians experienced last year. This is what happened next.

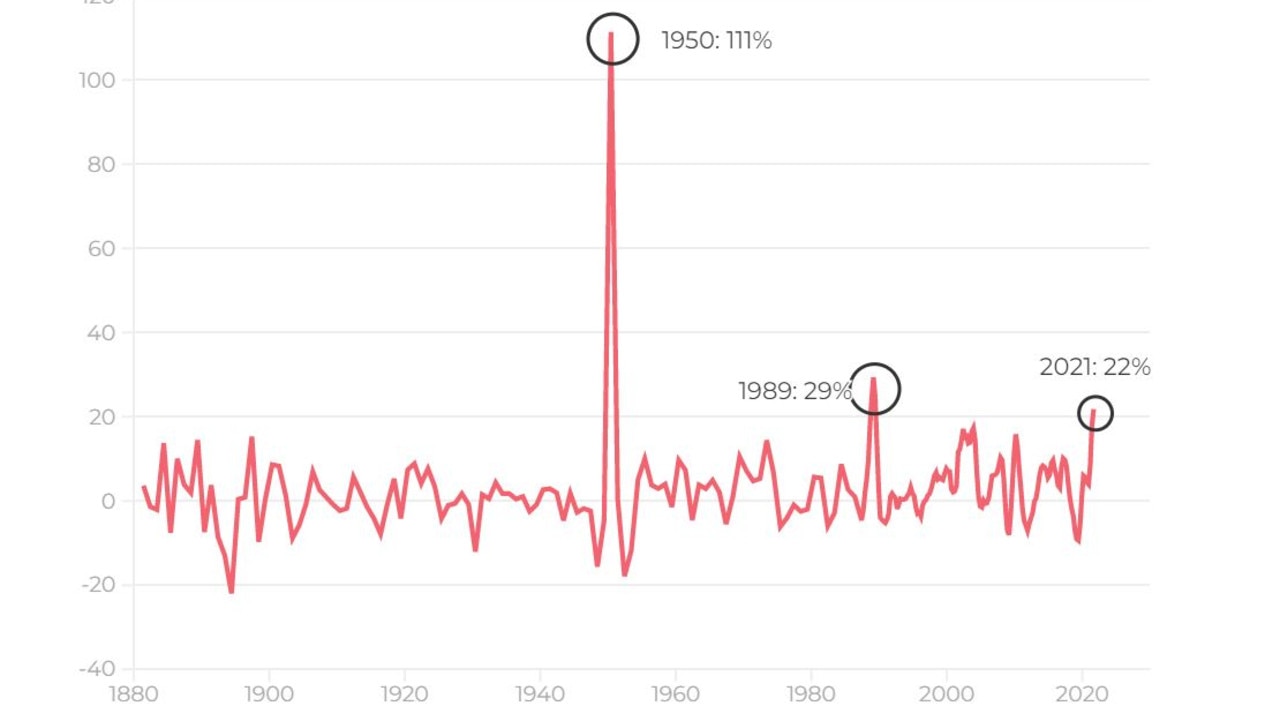

There have been only two other periods in the past 140 years when house prices in Australia have risen more sharply than in 2021.

Last year Australian homeowners enjoyed staggering increases to the value of their properties amid the coronavirus pandemic. Some homes increased in value by more than $1 million, realestate.com.au reports.

In capital cities, dwelling values surged by more than 20 per cent and it was even higher in regions, where prices jumped by 25 per cent. Overall, the increase was around 22 per cent.

The only other periods when house prices (not including units) exceeded this growth also occurred during unique circumstances.

In an article drawing on historical work done by economist Nigel Stapledon, REA reports the first and biggest boom occurred in 1950 when prices skyrocketed by 111 per cent after the end of wartime price controls.

The Commonwealth Government had placed limits on rent and house prices during the Second World War and this kept price increases to around 10 per cent above a certain set value.

This was much lower than inflation, which hovered around 30 per cent in the 1940s.

Once these controls were lifted in 1950, prices doubled (with growth adjusted for inflation), which was seen as a one-off “catch-up”.

The second boom came in 1989 after a range of regulations in the finance industry were removed and this improved people’s access to loans, pushing prices up by around 29 per cent.

PropTrack economist Angus Moore told news.com.au prices in the late 80s also reflected a general economic boom during the decade, which ended in the “recession we had to have”.

Such steep price increases during both booms were unsustainable and growth eventually dropped back down.

Ready to buy a new home? Read Compare Money's guide to buying a home at auction >

Mr Moore said the 1980s boom inflated many asset markets, not just residential property.

However, he pointed out during the recession that followed, bank losses mainly impacted commercial property, although residential property was also affected.

“We had a big recession and that necessarily had an impact on people’s ability to service their mortgages, unemployment went up and that obviously had a big impact on house prices,” he said.

When it comes to the most current boom, Mr Moore said he didn’t think there would be a significant downturn in the immediate future.

He said record low interest rates were one reason why prices had grown so much in 2021 but experts didn’t expect these to rise until later this year or next year.

“Our expectation is we will continue to see growth over 2022, it will be slower than 2021 but prices will continue to grow,” he said.

“Once we start getting towards 2023, interest rates are likely to start rising, which might cool demand and this might see prices flatten or even decline a little.”

Mr Moore said they had not yet set a forecast for 2023 but still expected 6-9 per cent growth in prices this year in capital cities.

Mr Moore said he thought Australia had learnt the lessons of the global financial crisis in 2008.

“Certainly in the United States, we saw rapid growth (in house prices) and then a substantial decline during the financial crisis,” he said.

“I think we’ve heeded the lesson of that experience, which is that loosening lending standards can cause massive increases to house prices and this can also have problematic after effects.”

In Australia, Mr Moore said the Australian Prudential Regulation Authority (APRA) had been focused on lending standards and these had been tightened in 2021.

“So we’re unlikely to see the sort of problems that the US saw in 2008.”

Mr Moore also believes the popularity of regional properties should continue to some extent as the shift to remote work will be a permanent change, with employees allowed to work from home for at a few days a week.

However, he believes some people may also be drawn back to inner city areas.

“Some who have moved to regional areas will move back to cities,” he said.

“Living in the city has benefits like access to cafes, restaurants and sporting activities.

“Those things have been significantly curtailed because of Covid but they will start to return.

“That will bring people back to the inner city because it will become a more attractive place to live again.”