‘Wait until 2026’: Warning as rental crisis approaches

If you’re a renter and think things are bad now the message from experts is it is set to get worse. The real crisis will be in three years.

If you’re renting and think things are bad now, the message from experts is it’s set to get worse.

The indicator is in little-discussed data on new apartment approvals which have plunged to their lowest levels in decades.

Apartments represent a large part of the rental housing pool.

In Victoria alone, Australian Bureau of Statistics figures released in June reveal just 137 apartments were approved for construction statewide in February.

The last time figures dropped below that level was January 2007, when just 37 apartments were given the green light.

Similar challenges are being faced around the country.

The exact combination of factors impacting housing supply differs, but the outcome is the same – near record-low multi-residential housing approvals.

Urban Development Institute of Australia national president Max Shifman described the decline as “particularly worrying” in the midst of a housing and rental crisis.

“The concerning thing is that record-low approvals right now only really show the full extent of the problem about 3 years from now, given the lag between approvals and completions,” he told news.com.au.

Mr Shifman said housing supply and more significantly rental supply was falling “well short of need”.

“This will only lead to one thing – continued growth in rental prices.

“The state governments need to simplify planning approvals, reduce unnecessary barriers that can come from local politics, and streamline time frames to increase certainty for the development sector.

“Developers need to be incentivised to spend their time and invest their capital, and be recognised for the important role they play in building the housing that people need.”

‘Red flag’

Director at RedBridge Group Australia Kos Samaras described the decline in approvals as a “red flag”.

“The dip is coming at the worst time,” he said.

“As the situation is worsening especially when it comes to supply, that supply issue becomes more acute because what was being approved three years ago is coming on the market now.

“Governments are talking about new stock. What they are saying is that this stock they are planning to build, renters won’t see it for some time.

“The situation is going to get worse before it gets better.”

His message to renters is to think “strategically”.

“To really think about where you want to live and where you want to work and prepare for things to get more difficult when it comes to supply.”

Rental stress corridors

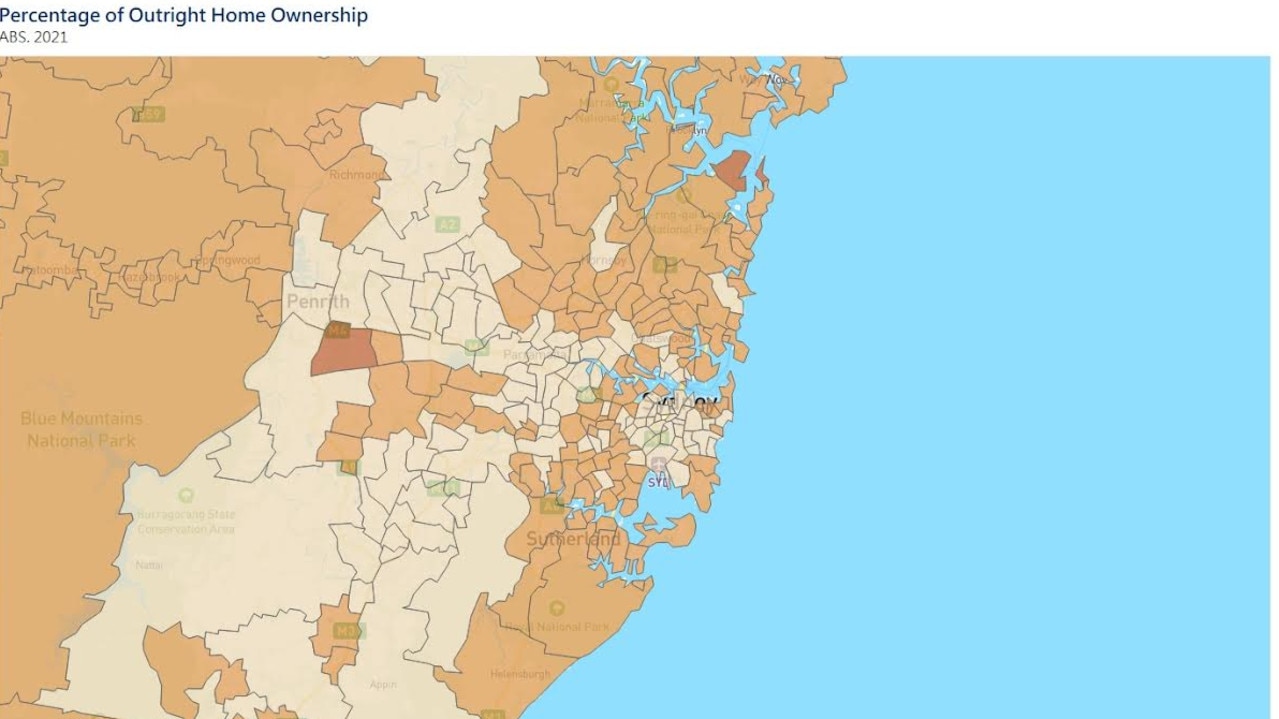

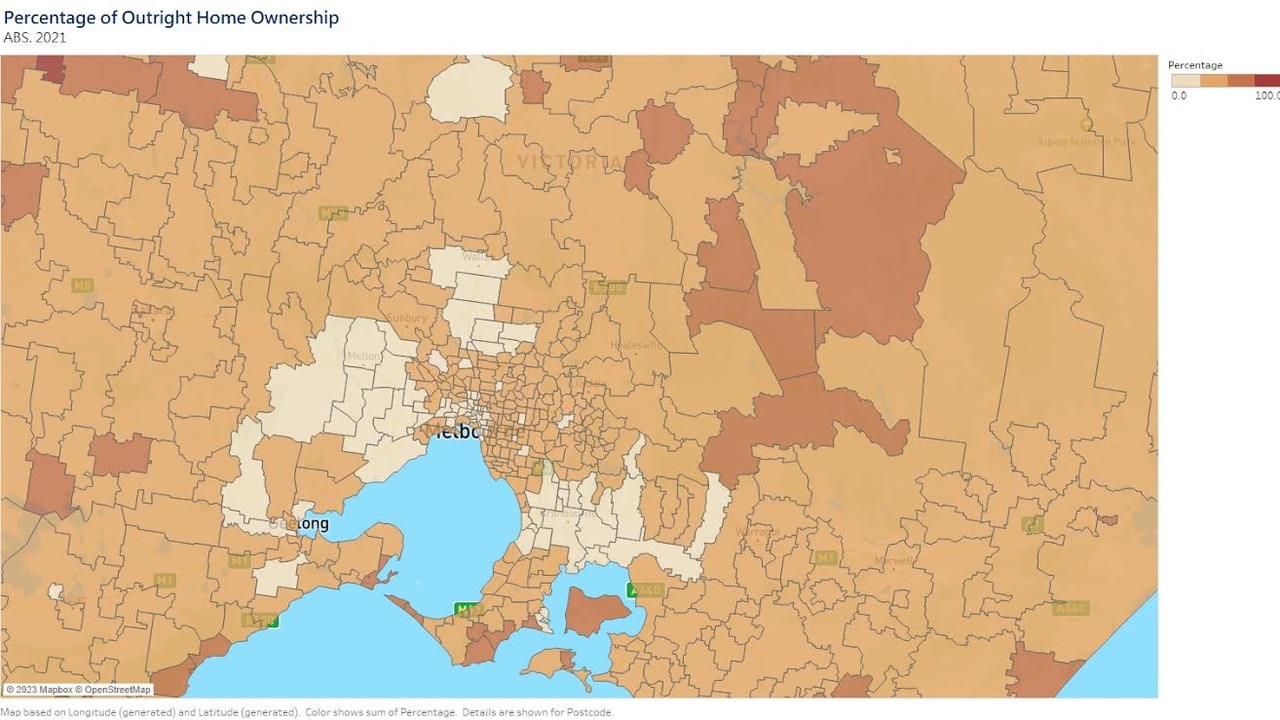

The dire warning comes as a new map reveals the key areas where mortgage and rental stress is being felt.

They include the electorates of Greenway and Werriwa in western Sydney, Blair in regional Queensland and seats like Lalor, Hawke in outer Melbourne and McEwen in rural Victoria.

Mr Samaras said those electorates are feeling the financial pain “most significantly” and predicted voters in those areas to be “volatile” at the next federal election.

“The voice referendum will be a test, where you might see people say, ‘I support First Nations people but this is giving me the screaming sh*** because I am about to lose my home,” he said.

Rental crisis

Renters are currently bearing the brunt of skyrocketing housing costs as rents soar across the capital cities.

Advertised rents rose by 2 per cent in the June quarter to sit at a median of $520 per week, according to the latest report from PropTrack.

That’s a rise of 11.8 per cent in the past year, with the median price of $465 per week in June last year.

In the past year, however, what renters are paying in capital cities has risen by a “staggering” 17 per cent in a year, led by Sydney and Melbourne.

“Rental markets continue to be extremely challenging for renters, with rents surging across much of the country amid strong demand and very limited availability,” report author Angus Moore said.

“This is especially true in Sydney and Melbourne, where weekly rents have increased significantly after falling in these cities during 2020 and 2021.”

Those hoping to find a cheaper price by moving into a unit will be sorely mistaken, with large increases in the cost of renting an apartment.

Sydney unit rents have risen by 19.0 per cent in the past year, followed by Melbourne at 17.5 per cent and Brisbane at 15.3 per cent.

carla.mascarenhas@news.com.au

.