Homes in Sydney, Melbourne offered ‘rent free’ in huge shift

Landlords are throwing out enticing offers to bait new tenants, including free utilities and months of free rent, amid sweeping rental changes.

Landlords in Sydney and Melbourne are offering free utilities and up to two months of “free rent” for new tenants as the rental market comes off the boil following years of explosive rises in rents.

The attractive rental perks are being offered as experts reveal rents in the major cities likely “peaked” in 2024 and have been declining in some areas – particularly pricier suburbs.

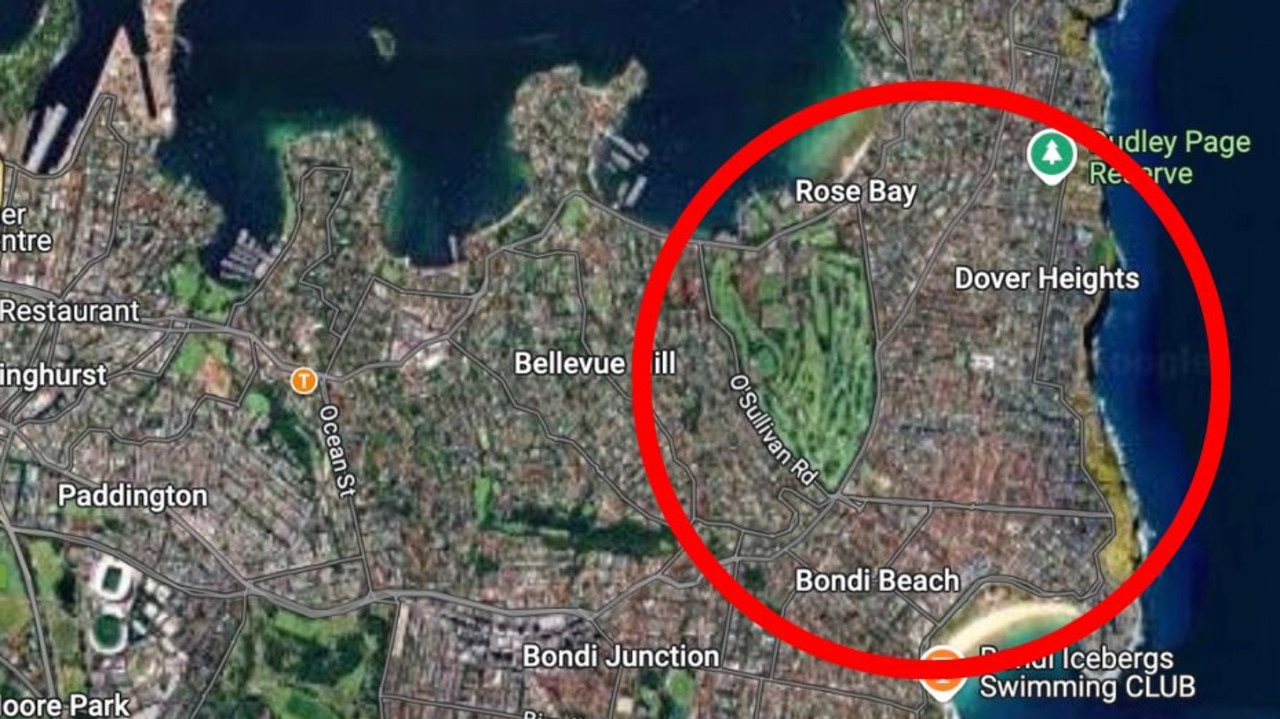

PropTrack figures showed some of the biggest rent falls over the October quarter were in Sydney’s eastern suburbs, where median rent on houses dropped 3.2 per cent over three months.

There were also median rental falls for units in the northern beaches (-2.5 per cent), the Ryde region (3.4 per cent) and, just outside Sydney, the Southern Highlands and Shoalhaven (3.5 per cent).

MORE: Best suburbs for home buyers in 2025

Melbourne’s inner south had the biggest declines in Victoria, with unit rents falling by an average of 1.8 per cent. There was a similar average fall within inner Melbourne.

Homes offered with rent incentives aimed at baiting new tenants have included a three-bedroom Mascot apartment with the first month of the lease “rent free” for those on a 12-month lease.

A four-week rent free period was also offered on an $894 per week rental in Sydney’s Kensington.

Tenants were offered a period of two weeks without rent for similar units in Penrith, Cabramatta, Lidcombe and Punchbowl, among others.

MORE: Seven housing myths holding buyers back

Homes offered “two weeks rent free” in Melbourne included units in Essendon, the CBD, Mernda and other suburbs.

Multiple homes in a building in Melbourne’s Fitzroy North were available with the first two months’ rent free, subject to special conditions.

The deals have come amid a gradual rise in vacancies that has given tenants much choice than a year ago, although the supply of rental accommodation across most areas still remains historically low.

Sydney’s vacancy rate, the proportion of the city’s total rentals available for lease, was 1.8 per cent at the end of December – up 40 per cent from the same period a year prior.

MORE: Best news for Sydney homebuyers in six years

The vacancy rate was below 1 per cent in parts of Sydney during the height of the rental boom in 2022 and 2023, the mark of an extreme rental shortage.

Markets where rents dropped late last year often included a higher share of up-market homes reliant on high discretionary spending from cashed up tenants, who have the option to move to cheaper housing if caught in a pinch.

The areas also tended to have a higher concentration of newly built units.

PropTrack senior analyst Karen Dellow said in a recent column that there were signs “things are improving in the rental market” and more “relief may be on the horizon”.

“More investors have entered the market, increasing the number of properties listed for sale,” Ms Dellow said.

“Additionally, in the recent Realestate.com.au Property Seeker Survey, most first-home buyers claimed that they were buying a house in order to stop renting … these factors collectively boost property stock while reducing demand.”

It’s worth noting that any relief may not come immediately as February and March are usually the hardest time of the year to find rentals because of a surge in demand from students.

Areas in Sydney where annual rises in vacancies were most significant were the inner southwest, including the St George and Canterbury-Bankstown areas, the CBD and inner south and the outer southwest.

Vacancies in each of these areas were up more than 65 per cent annually, according to PropTrack.

“Improving vacancy rates and slowing rent increases suggest that the Sydney rental crisis is indeed easing, offering a glimmer of hope for renters in the city,” Ms Dellow said.

Economist Kaytlin Ezzy said rent increases were slowing because of affordability challenges: many tenants cannot afford further rent increases on top of those endured over recent years.

Prospective renters were also adapting to steep rents by staying in their parents’ homes for longer or by forming larger share houses, Ms Ezzy said.

MORE: Shock rates warning for all homeowners

The popularity of living alone has also been waning after hitting a high during the early onset of the Covid pandemic, which has helped ease rental demand.

Ms Ezzy said other changes in supply and demand helped ease rental conditions, including a drop in overseas migration over recent months, along with higher investor activity.