Grim map plotting the least affordable housing markets in the world includes three Aussie cities

A grim illustration exposing our national shame has gone viral online, with three Australian cities here ranked among the worst in the world.

A depressing map revealing the least affordable housing markets in the world includes three Australian entries, with one city ranked second-worst globally.

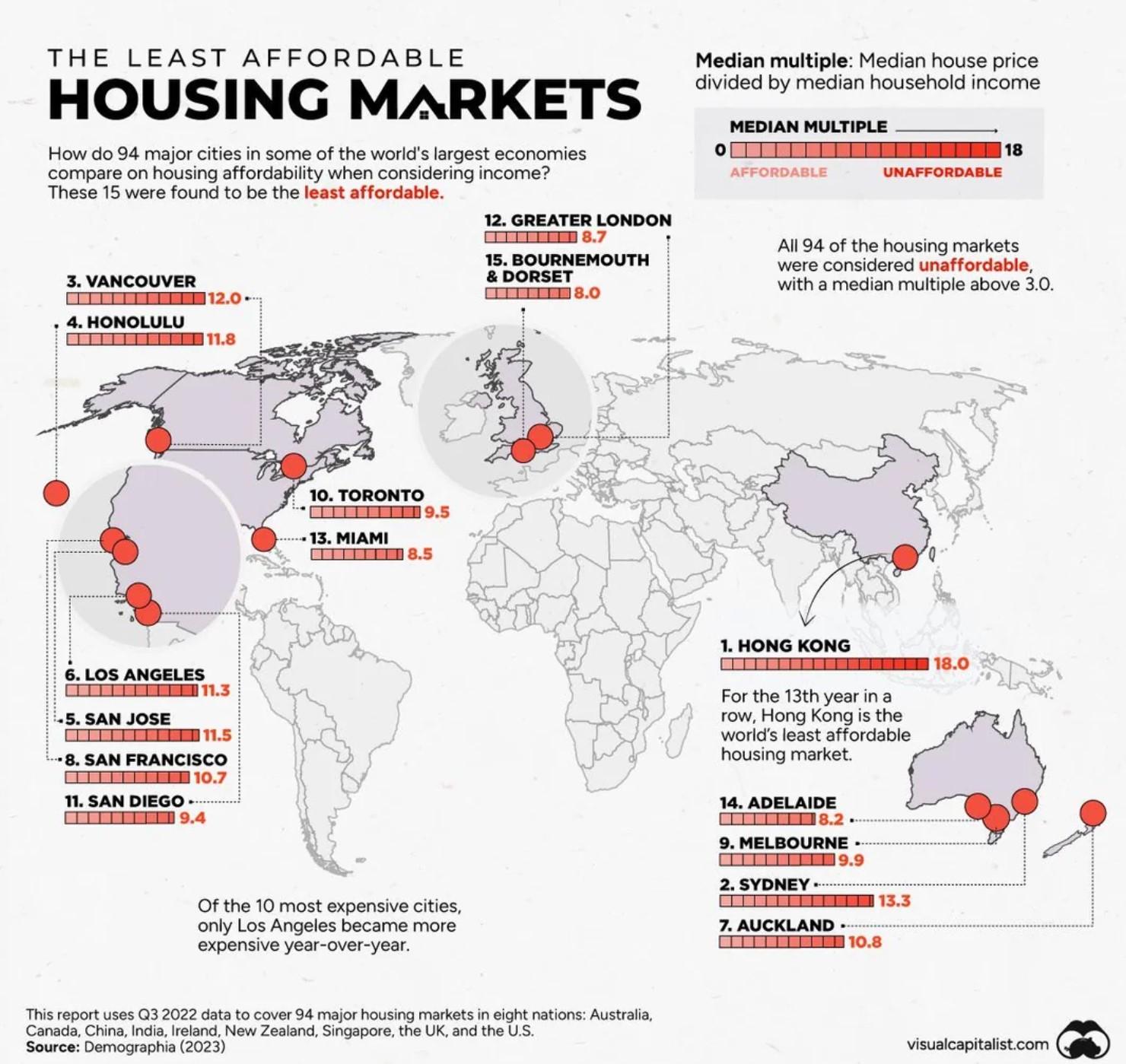

The illustration uses the latest data from Demographia examining 94 major housing markets across eight countries to compare affordability in some of the world’s biggest economies.

It divides the median house price in each city by the median household income as of mid-2022 to give an overall score.

The 15 worst-performing locations were plotted by Visual Capitalist and the stark map has gone viral on social media locally, with Aussies disturbed to find three of our cities on the list.

Sydney ranked second in the world with an index rating of 13.3 out of 18, behind Hong Kong in top spot with a maximum score of 18, and just ahead of Vancouver with a rank of 12.

Melbourne came in at ninth spot with a score of 9.9 while Adelaide was 14th with a ranking of 8.2.

Buying a house in Sydney is less affordable than in the notoriously expensive markets of London, Los Angeles and Miami.

It’s worth noting that the limited dataset only taking in eight countries excludes entries one might expect to see, such as Paris and Singapore, among others.

Meanwhile, the exclusion of famously costly cities like New York and the appearance of unexpected areas like Adelaide is down to higher incomes offsetting high home prices in the Big Apple, and vice versa in the South Australian capital.

But the illustration demonstrates how stark the housing crisis in Australia is – and affordability has only gotten worse here since the data for the map was compiled.

Majority of suburbs get more expensive

Last week, research house CoreLogic said its Home Value Index had seen an 8.9 per cent increase over the past 12 months, adding the equivalent of about $63,000 to the national median dwelling price.

CoreLogic’s monthly index hit an all-time high in February, economist Kaytlin Ezzy said.

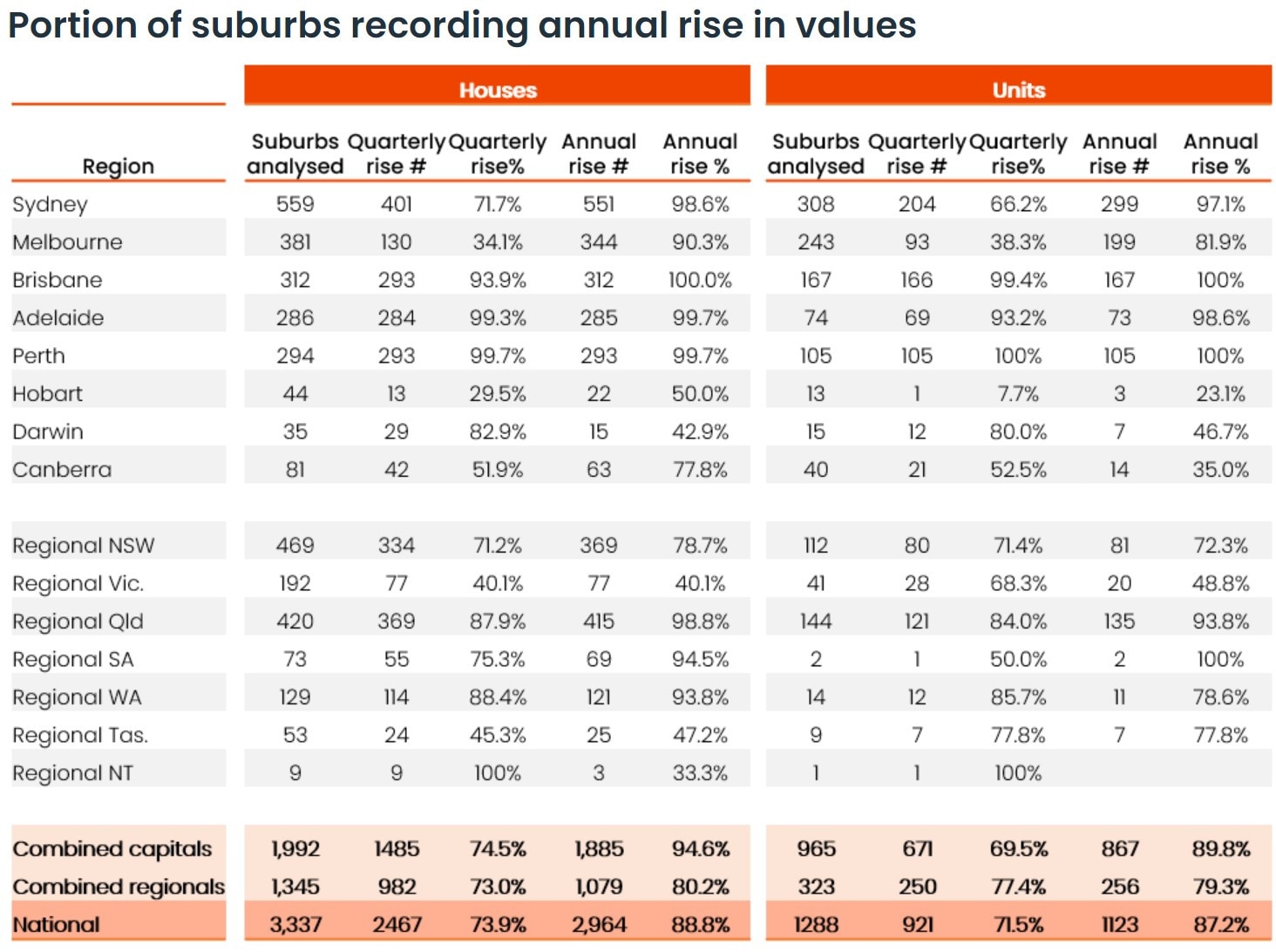

Ms Ezzy conducted suburb-level analysis of movements in house and unit prices and found 88.4 per cent of Australia’s 4625 suburbs saw values rise across the past year.

That’s up sharply from just 52.9 per cent of markets recording positive annual growth in July 2023 and up from the 39.1 per cent of suburbs increasing in price in February 2023.

“Despite three rate hikes, worsening affordability, and the rising cost of living, the increasingly entrenched undersupply in housing stock, and above average demand thanks to strong net migration, has helped push values higher,” Ms Ezzy said.

Most renters getting stung

It’s not just purchase prices that continue to soar, but the cost of renting is also through the roof.

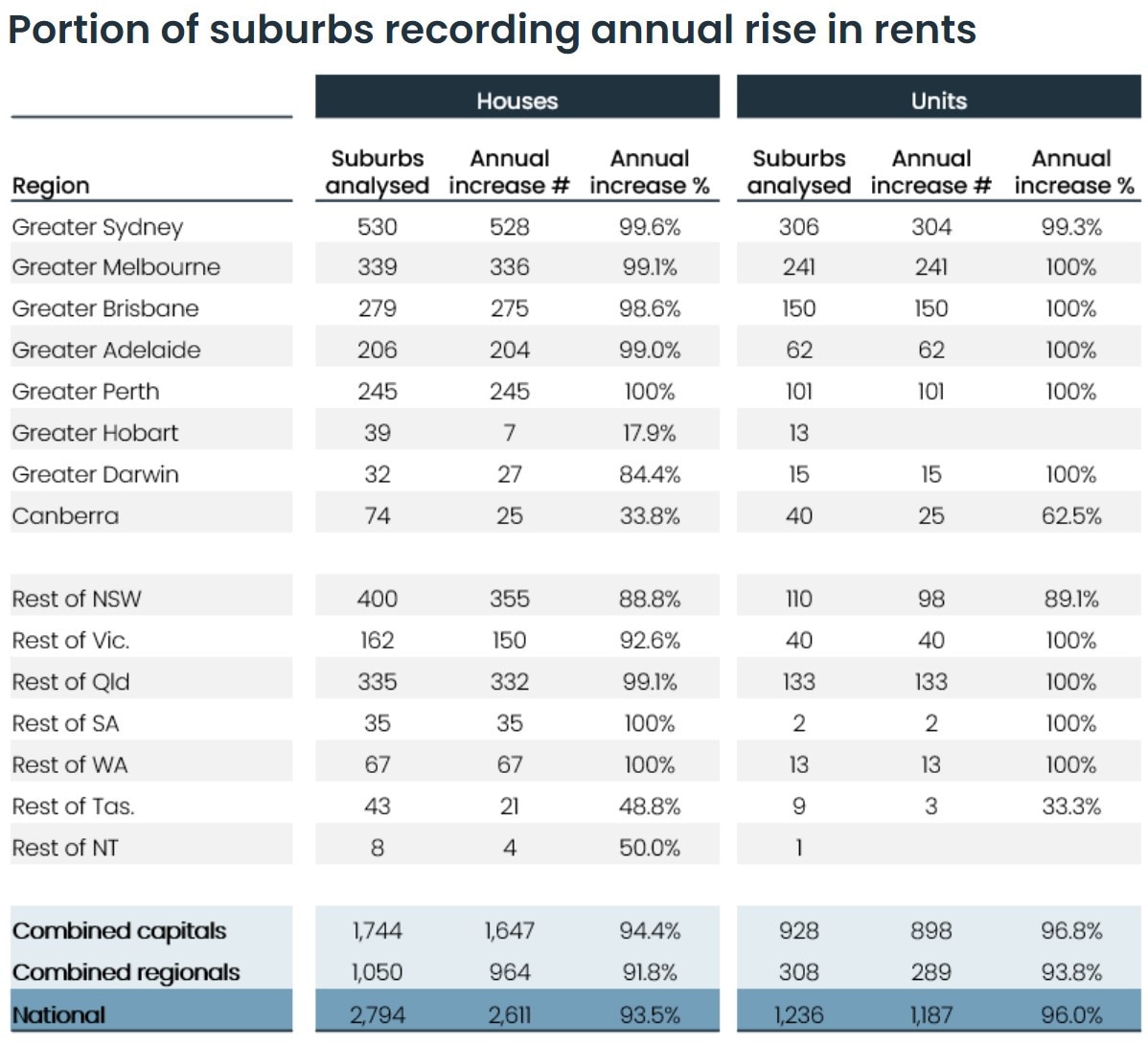

CoreLogic used the same suburb-level analysis to determine that 94.2 per cent of all Aussie suburbs saw an increase in rent prices nationally.

And almost 40 per cent experienced value increases of 10 per cent or more over just a year.

“Over the past few years, rental growth has been skewed to capital city units, but as unit rent affordability has been eroded, some prospective tenants may be shifting towards house rentals, likely reforming larger households as a way of sharing the rental burden or to more affordable markets further afield,” she said.

Earlier this month, PropTrack released its latest Rental Affordability Report, which painted a grim picture of the state of markets across the country.

“Rental affordability has hit its worst level in at least 17 years, when records begin,” PropTrack economist and report author Angus Moore said.

The index, which measures the share of advertised rentals that households of all incomes can afford to lease, shows renters in New South Wales, Tasmania and Queensland are having the toughest time.

But across the board, Mr Moore said affordability has deteriorated on the back of significant price increases and sluggish wages growth.

“Over the six months from July to December 2023, households across the income distribution could afford to rent the smallest share of advertised rentals since at least 2008,” he said.

“That is a substantial change from conditions before and during the pandemic.”

It’s not just Australians on low incomes who are struggling, with the report revealing median income households “have never been able to afford so few rentals”.

“Highlighting the alarming state of rental affordability at present, a household earning the median or typical income in Australia of $111,000 can now afford just 39 per cent of rentals advertised,” Mr Moore said.

“This is, by a reasonable margin, the lowest share since records began in 2008… [and] represents a substantial decline from historically favourable affordability conditions seen before and during the pandemic.”

Severe cost of affordability crisis

A summit held late last year by the Councils of Social Services, representing thousands of organisations from around the country, described the housing system as “utterly broken”.

The national body’s chief executive Cassandra Goldie said the soaring cost of putting a roof over one’s head had sparked a “tsunami of homelessness”.

More than 640,000 low-income households are in a state of housing insecurity, Dr Goldie revealed, meaning they’re either living in overcrowded dwellings, paying more than 30 per cent of their salaries on rent, or experiencing homelessness.

“As property investors enjoy surging house prices, people on low incomes are choosing between eating and keeping a roof over their heads in an unworkable private rental market squeezed by surging prices and record low vacancies,” Dr Goldie said.

“Frontline homelessness services are doing everything they can, but current funding is simply not adequate to keep up with surging demand for help.”

While ACOSS welcomed measures by governments to improve rights for renters and develop a 10-year national housing strategy, it said more needs to be done.

“The answers are right in front of us,” Dr Goldie said.

“Crackdown on unfair tax concessions enjoyed by investors, massively boost social and affordable housing supply, fund homelessness services adequately, raise the rate of income support, cap rental increases, and establish nationally consistent tenancy protections including from evictions into homelessness.”

The consequences of inaction could be painful – and broad – for communities.

A report by the Australian Institute of Health and Welfare released last September said access to affordable and quality housing “is fundamental to wellbeing”.

“It can help reduce poverty and enhance equality of opportunity, social inclusion and mobility,” the report said.