Flush with cash: Surprise Qld suburbs where residents could buy a home right now

Households in these Sunshine State postcodes have enough spare cash to put down a home deposit — and it is not just the richlister suburbs that made the list. SEE WHERE

Households in 20 Queensland postcodes have enough spare cash to put down a deposit for a city unit. And it is not just richlister suburbs that made the list, with surprising new data revealing under-the-radar pockets of wealth across Greater Brisbane and the regions.

The exclusive Digital Finance Analytics (DFA) data, commissioned by Betashares, shows areas with the highest disposable income where residents have enough in the kitty after rent or mortgage payments to fund a home or investment purchase.

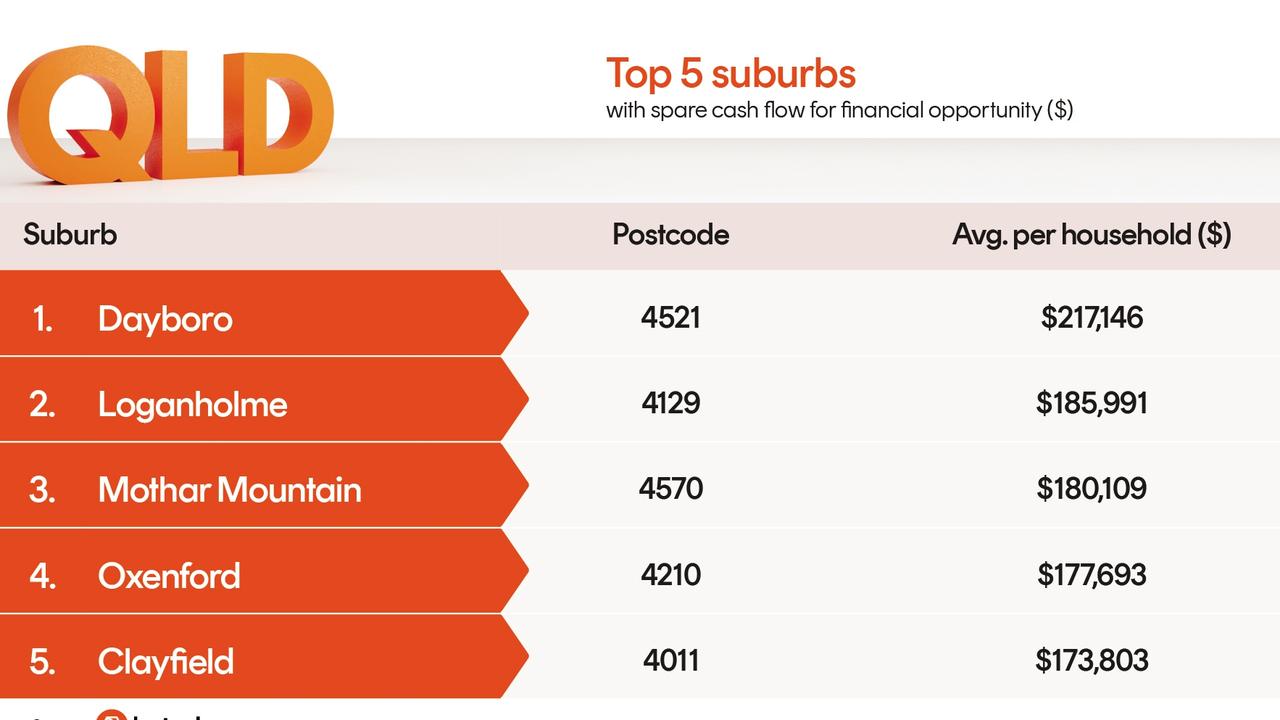

The top 20 suburbs each have at least $134,000 in average spare cash flow — sufficient to afford a 20 per cent deposit on a typical Brisbane apartment priced at $670,000.

Topping the list, households in Dayboro in the City of Moreton Bay had an average of $217,146 available to spend or invest. A typical house in the rural town north of Brisbane costs $915,000, up 4 per cent over the past year.

The entry-level urban market of Loganholme came in behind with disposable income of $185,991 per household.

It is one of five suburbs among the top ten where house prices are below the median of $862,000 in Brisbane, or $703,000 for the rest of Queensland (PropTrack, all dwellings), along with Mothar Mountain (cashflow $180,109), Maryborough ($164,182), Annandale ($162,958), and Strathpine ($150,224).

Prices in Loganholme have soared 20 per cent since 2023 to $754,000 for houses and $630,000 for units, boosted by strong demand from investors and first-home buyers priced out of city markets.

But the area also hosts a sizeable older community and acreage pockets with surprising wealth.

Other top-ranked suburbs were Oxenford on the Gold Coast, and Clayfield, Seventeen Mile Rocks and Manly in Brisbane.

Betashares CEO Alex Vynokur said the Spare Cash Flow and Financial Opportunity Index gives an unexpected insight into how Aussies are managing their finances amid the rising cost of living.

The report, based on data from 52,000 Australian households in September 2024, highlights strong financial resilience among middle-income and rural areas and challenges the idea that traditionally affluent suburbs hold the majority of cash flow.

“Often people who earn a lot, spend a lot,” Mr Vynokur said.

“The lifestyle of wealthy Aussies is not always the lifestyle that necessarily lends itself to a decent savings balance.”

Ray White AKG Group CEO Avi Khan was surprised to learn Loganholme, south of Brisbane, ranked so highly.

“I wouldn’t have picked that,” Mr Khan said.

He said the area’s relatively older population of homeowners who may have already paid off their mortgage could be a contributing factor to cashflow.

“Normally we find the higher the disposable income is in an area, the longer people will hold onto their properties.

“Loganholme has more retirees and people aged over 50 who love the area for its convenience and don’t want to leave.

“It has the Hyperdome shopping centre and it is the perfect spot to access both Brisbane and the Gold Coast, so it is actually a very closed market,” he said.

Digital Finance Analytics director Martin North said younger generations had missed the opportunity of older homeowners to build cash reserves, as soaring house prices had outpaced wage growth. Housing costs were about three times typical incomes in the 1990s, but that’s grown to eight times income in much of the country, he said.

“Younger generations are more likely to be renting, living further out, and or have a lot less paid down on their mortgages,” Mr North said.

“There would be fewer younger people saving up significant amounts and often, when they are, it’s for the purposes of getting together a deposit on a home.”

MORE NEWS

First look inside Australia’s first Mondrian Hotel

‘Reset’: Major bank flags big change ahead for homebuyers

New listings surge to stunning decade-high

Mr North said the varying amount of cash held by households reflected growing inequality, which was part of the reason behind the Reserve Bank’s (RBA) interest rate hikes’ mixed impact on taming inflation.

“At an aggregate level, there’s still a lot of people able to consume. The RBA is hitting a portion of people really hard, but there is another cohort saying, ‘what’s all the fuss about?’.”

Higher household savings rates in certain postcodes bode well for housing prices in those areas, Mr North said.

“These households are less likely to need to sell their homes, so the supply and demand equation will keep prices higher.

“There are also smaller impacts like households being able to better maintain their properties.”

Mr Vynokur said the amount of cash households had at their disposable was influenced not simply by how much they earned, but how much they kept.

“People tend to spend more on rent and mortgages in fancy areas and they send their kids to private schools. What we know for sure is that the net balance of how much you have (in cash) is a function of income and expenditure,” Mr Vynokur said.

He added that many of the areas where households had greater savings balances were family oriented.

“You’d think it’s families that would spend more but they’re often the ones that tend to think most about the next generation.

“Inflation is ripping through the economy and the cost of living is high but most (families) are generally sensible with their money,” he said.

Originally published as Flush with cash: Surprise Qld suburbs where residents could buy a home right now