Woman who bought house at 23 reveals reality of living the ‘Great Aussie Dream’

A young Aussie has revealed the brutal reality of buying a house in your early 20s, while also hitting back at a property claim Boomers keep spouting.

Maddie Walton was just 23 when she bought her first home.

The young Aussie has been working since she was 12 years old, with the dream of buying a house always at the forefront of everything she did.

She worked full time throughout university, then, once she finished her degree, she got a full-time job in the medical research field while also continuing to work her retail job at an Apple store as well.

Finally, in August 2021 she was able to achieve her dream, buying a three bedroom, two bathroom house on the Gold Coast for $691,000.

While Ms Walton is proud of her achievement, she recently opened up about the “constant struggle” she has experienced since the purchase.

The now 26-year-old, who made the big decision to switch careers to become a mortgage broker just a few months after buying her home, opened up to her 24,000 followers about the not-so-glamorous side of home ownership.

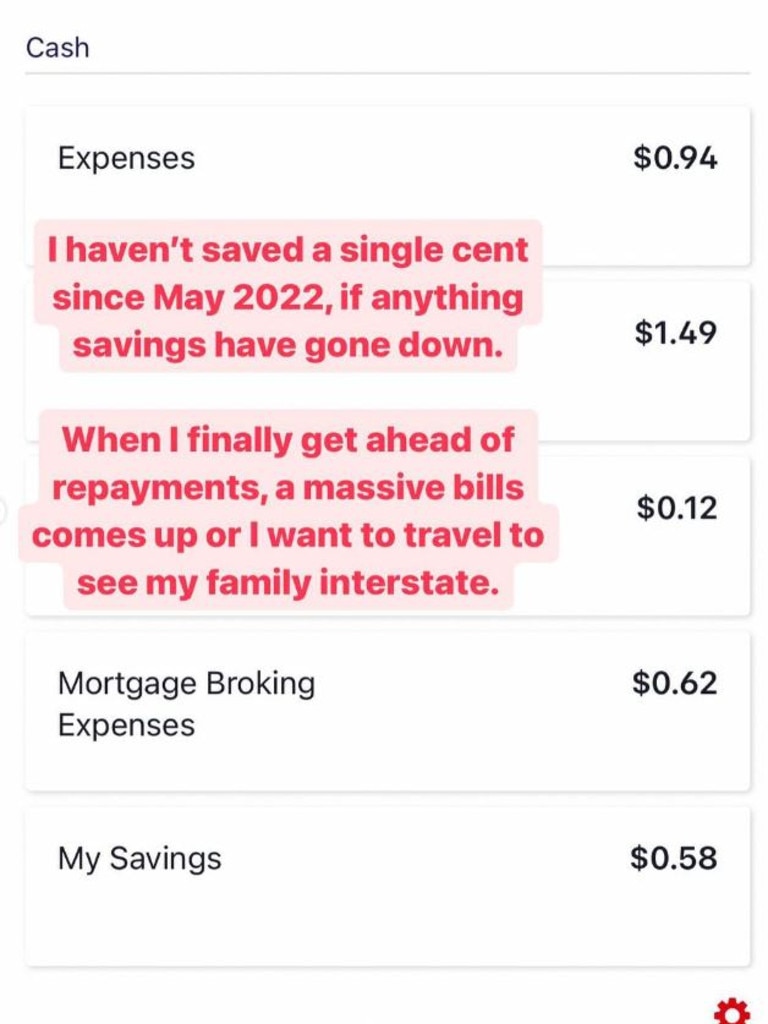

“I have been struggling with my finances since I bought my first home,” Ms Walton recently revealed on social media.

Rapidly rising interest rates meant her repayments have nearly doubled since she bought the property, going from $550 a week to $1000.

Speaking to news.com.au, Ms Walton said that in December 2021, just four months after buying her home, she decided she wanted to switch careers after having a “really bad experience” with mortgage brokers throughout the buying process.

“I bought and purchased for a lot higher than I believe I should have. And my mortgage broker, I feel like, just wanted the commission so pushed up my mortgage higher,” she said.

Ms Walton bought at a time when rates were historically low and was never given any indication from her broker that they could be about to rise.

“I don’t think anyone expected them to rise so rapidly, but they were going to rise, they were never going to stay at two per cent,” she said.

“I thought that I had a little bit more time to prepare, but I think it really comes down to my broker didn’t advise me and what my repayments would look like when the rates started to rise and so I didn’t see or didn’t anticipate that.

“And that comes down to being young but also trusting in professionals. I think that they were just chasing the commission and it left a really sour taste in my mouth on what brokers did.”

It was this experience that inspired Ms Walton to switch careers so she could be in a position to provide people with the help and information that she wished she had when buying her home.

She quit her retail job and started a job in loan processing for a broker, while still working full time in medical research.

In May 2022 she transitioned full time into loan processing before becoming a broker last year.

Ms Walton revealed the decision to change her career path saw her pay cut in half, going from earning about $120,000 between two jobs to bringing in about $60,000 a year.

With rates continuing to rise, the young Aussie started to rent out the spare rooms in her house in order to keep up with her repayments.

“Then the rates started rising extremely rapidly. I don’t think anyone anticipated how fast they went up. So I thought I’d have a bit more time to buffer but I didn’t,” she said.

Now that she is a broker, she is able to earn a higher income than when she started out as a loan processor, so she is back into a more comfortable financial position – but it still isn’t easy.

“It’s not easy paying $1000 a week mortgage when you don’t have a partner, but you make do and you will do everything to keep a roof over your head,” she said.

“Housing is the last thing that humans naturally will give up. So it’s the same for me.”

Despite the challenges, Ms Walton knows her purchase is going to be something she is going to be very happy about in the long term, noting the home has already increased $300,000 in value.

However, knowing what she knows now, there are some things she may have done differently given the chance.

“I would have bought maybe a cheaper house or something a little bit smaller realistically, but I also would have looked at fixing or like half-half fixed and variable rates instead,” she said.

“Sometimes I do regret buying the house because it’s a bit stressful but overall I know in the future I will be happy about it and I know that it’s worth it.

“But I don’t recommend it to everyone because not everybody has the same financial mindset. I have very good financial literacy. I understand my money. I’m very good with budgeting. So I think that gives me a little bit of leverage.”

Ms Walton’s openness about the reality of homeownership struck a chord with many of her followers, with people praising her for being so candid.

However, she has noticed a difference in the responses from older Australians, compared to Millennials and Gen Zers.

“Boomers and retirees they are like ‘back in my day, interest rates were 17 per cent’ and basically kind of try and invalidate how you are feeling,” the 26-year-old said.

“I think that yes, they had it hard for their time, but we also have a hard time and I don’t really believe that just because one generation struggled, the newer generation should also struggle.”

Ms Walton gets a lot invalidating comments from people in the Baby Boomer demographic claiming she should have “bought for less” and should have “known better”.

However, she noted that knowledge comes with life experience. As one of the first people in her family to buy property, she didn’t have a lot of knowledge when she first started her property journey.

She also pointed out that, when a lot of Boomers were buying their first homes, the average house price was closer to four times the average wage, where as now it is more like ten times the average wage.

“So in my opinion, property is a lot harder to get into compared to back then,” she said.

“I think we all go through different things each generation, but I don’t think it’s fair to invalidate how someone’s feeling and what it’s like for our experiences as Gen Zers and Millennials.”