$110,000 HECS debt highlights brutal reality facing young Aussies

A young Aussie’s candid confession about her HECS debt has exposed the brutal reality being faced by millions of people across the country.

In less than two months, millions of people across the country are going to be hit with another brutal increase to their student debt.

While HECS-HELP debt does not accrue interest, it is indexed for inflation every year.

This means, from June 1, anyone who hasn’t paid off their loan will see their debt rise in line with inflation, which last year was a whopping 7.1 per cent – the biggest increase in 30 years.

This year, it is looking like indexation will be about 4 per cent, which will still have a significant impact on people’s debts.

The brutal impact of HECS indexation was laid out in a social media post by journalist, Caitlin Cassidy.

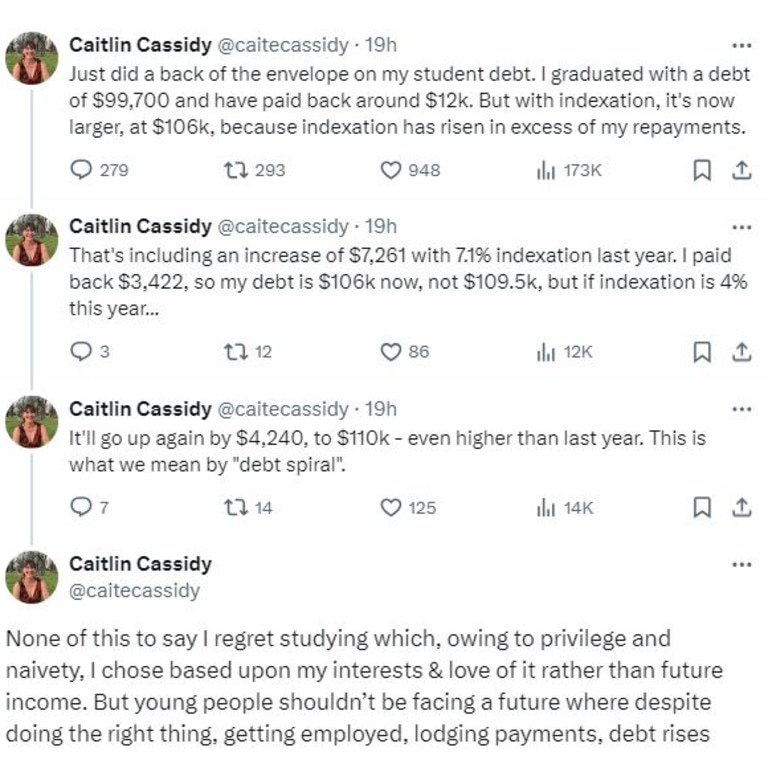

“Just did a back of the envelope on my student debt. I graduated with a debt of $99,700 and have paid back around $12k,” she wrote on X.

However, with indexation, her debt is now even bigger, sitting at $106,000. The Guardian education reporter said this was including an increase of more than $7200 as a result of last year’s record indexation.

“I paid back $3,422, so my debt is $106k now, not $109.5k, but if indexation is 4% this year … It’ll go up again by $4,240, to $110k – even higher than last year. This is what we mean by ‘debt spiral’,” she said.

Cassidy said, despite her HECS situation, she doesn’t regret studying, which she chose “based on her interests and love of it”.

She has a Bachelor of Arts in Politics & Creative Writing, a Masters in Global Media Communication at Melbourne University, and a Graduate Diploma in Journalism at RMIT.

Cassidy said young Aussies shouldn’t be facing a future where they are seeing their debt continue to rise despite doing all the things they are told to do, like going to university in order to gain a career.

She is far from the only young Australian who is unimpressed with the way our HECS and indexation system is set up.

While payments towards your HECS debt are taken out of your pay in real time, that money is not coming off your debt at the same rate.

Instead, the Australian Taxation Office (ATO) holds these funds as a credit until you file your tax return on or after July 1.

But, because indexation occurs before this on June 1, your past contributions are actually applying to the higher indexed rate, despite coming out of your pay much earlier.

This is why so many people are – despite making thousands in repayments – finding themselves in the same position or even worse off than they were the previous year.

Ahead of last year’s 7.1 per cent indexation, 25-year-old Betty Zhang told news.com.au she was bracing for her debt to jump by an extra $8300.

Having studied a Bachelor in Exercise and Sport Science and then completing a Masters of Physiotherapy, Betty was looking down the barrel of a $127,000 HECS debt.

“I have a huge debt that I don’t think I’ll ever pay off in my lifetime,” she said. “My debt will only keep growing and whatever I’ve paid off won’t matter anymore.”

Anthony Albanese hints at looming HECS changes

Prime Minister Anthony Albanese has hinted that an announcement regarding changes to Australia’s HECS system could be imminent.

He was questioned about the impending indexation while speaking to radio station Hit Central Queensland on Thursday.

“There’s a range of areas where we need to do much better with the younger generation basically, and HECS is one of them,” he said.

“What we’ve done is we’re developing a universities accord, essentially with all of the universities across the board, and what that has said is that the system can be made simpler and be made fairer.”

The review from the Universities Accord, released in February, recommended a series of changes to Australia’s student debt system.

While the review didn’t call for indexation to be scrapped completely, it did say it needed to be “modernised” and recommended it be kept in line with whichever is lower out of inflation and the wage price index.

“The idea of HECS is a good one, it’s one that has led to a massive expansion, the number of people being able to do university degrees,” Mr Albanese said.

“But we’re examining the recommendations and we’ll be making announcements pretty soon on that. We, of course, have a budget coming up.”

According to the ATO, 14 per cent of Australians – equivalent to more than 2.9 million people – are riddled with student debt. This is down from just over 3 million in 2021–2022.

A recent Finder survey of people with student debt found 63 per cent were concerned about not being able to pay their HECS, up from 54 per cent last year.

Worryingly, 12 per cent of respondents said they didn’t think they would ever be able to repay their student debt.

“While inflation is easing, indexation will still lead to increased student loan balances, emphasising the need for proactive budgeting and repayment strategies,” Graham Cooke, head of consumer research at Finder, said.

“Remember, student debt is inherently different from other loans, so prioritise loans which have the highest interest rate.”

The wider conversation that needs to be had

Harrison Astbury, editor and research analyst at financial comparison website InfoChoice, believes the issues around HECS and indexation form part of a wider conversation around Australia’s attitude to university.

He noted there is so much pressure on school students to go to university so they can have a career and many teenagers are often unaware there are other options out there.

“The reality is at 17-18 these kids’ brains are not fully formed to be processing such decisions,” he told news.com.au.

“Back in the day, there was a greater breadth of pathways to gainful employment, such as technical colleges that could serve as a more practical way for vocational courses such as teaching, nursing, and some applied science.”

Mr Astbury also claimed there needs to be a review of the university fee structure, saying there is no reason an arts degree, for example, should be costing more than $20,000-$30,000.

“The government, extending what’s essentially a good loan to young adults, in turn guarantees unfettered ability to justify fee increases without an increase in service or product quality,” he said.

“Yes the federal government has oversight and reviews in place to ensure what unis charge does not get out of hand, but in my opinion the scrutiny needs to be higher.”

On indexation, Mr Astbury said it did seem like “quite a perverse outcome” where a young adult is saddled with a loan and then sees it increased despite being diligent in paying part of it down.

However, at the end of the day, he still believes HECS is a “pretty good debt to have” if people understand what they are getting into and see out their degree.

More Coverage

“Inflation will moderate over the next couple years, and the storm will pass,” he said.

“In previous years this wasn’t even a conversation – it was basically always better to let your debt sit and only repay the minimum.

“Now there’s a strong case for if you can pay it off, you should. This decision is entirely personal. The benefits are you won’t get indexed again (if you pay it off before June 1), and your take-home income will be higher.”