Millions of Aussies hit by brutal HECS rise today

From today, millions of Aussies are at risk of a “debt avalanche” - and there is one group that is copping the brunt of the brutal change.

Millions of people across the country, many of them young Australians, have now been smashed with a brutal increase to their student debt.

From today, June 1, anyone who has a HECS-HELP loan and hasn’t paid it off will see their debt rise by a whopping 7.1 per cent – the biggest increase seen 30 years.

HECS-HELP debt does not accrue interest, however, it is indexed for inflation every year.

Last year, the indexation rate hit a high of 3.9 per cent, but with inflation skyrocketing, that number has now almost doubled.

The looming indexation has had many people concerned, with Betty Zhang, 25, telling news.com.au the change means an extra $8300 will be added to her debt.

Having studied a Bachelor in Exercise and Sport Science and then completing a Masters of Physiotherapy, Betty is now looking down the barrel of a $127,000 HECS debt.

“I have a huge debt that I don’t think I’ll ever pay off in my lifetime,” she said. “My debt will only keep growing and whatever I’ve paid off won’t matter anymore.”

Ms Zhang lives in the outer Northern Sydney suburb of Berowra but is preparing to move out to a rental in the lower north shore.

“I’m just about to move out of home for the first time so will also be paying rent/bills etc, which will add to my costs,” she explained.

Ms Zhang said it just wasn’t feasible for her to pay off her HECS debt in full before June 1 in order to avoid copping the new indexation rate, saying: “I don’t have that kind of money saved”.

“I’m mostly worried about how it will affect me when I decide to buy a property and have to ask for a loan,” she said.

“My biggest goal is to save as much money as possible so I have a reasonable amount to put on a deposit and hope for the best.”

Ms Zhang isn’t the only person who is worried about how her HECS debt will impact her chances of buying a home.

This was also a major concern for Melbourne woman Vi Dang, who made the decision to pay off the final $20,000 of her HECS debt to avoid being slugged with the 7.1 per cent increase.

The 28-year-old racked up the debt during her four years of study, including completing an honours degree.

Vi has been working full-time since 2017, slowly chipping away at the debt, but was faced with the grim reality of just how much the leftover $20,000 would impact her chances of owning a home.

“I’m looking to purchase my first house this year and since I [had] a $20,000 HECS debt this greatly impacted my borrowing power from the bank,” she said.

The Melbourne woman spoke with a broker who advised her to pay off her debt in order to increase how much the bank was willing to lend her.

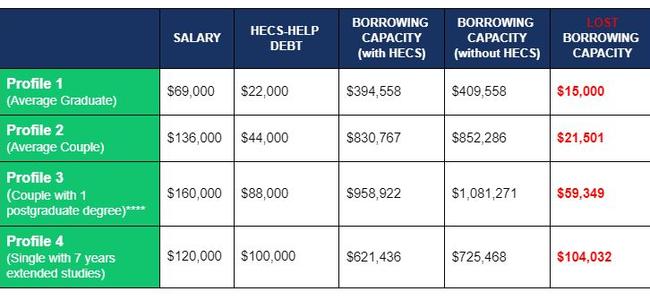

Analysis from personal finance marketplace and advice company Compare Club found a HECS debt will cut, on average, $15,000 from a graduates borrowing power.

This increases to $100,000 for a higher earner with more debt.

A single person on a $120,000 salary and no HECS debt is looking at a borrowing capacity of about $725,468.

However, a HECS debt of $100,000 reduces borrowing capacity significantly to $621,436.

Compare Club co-CEO Lance Goodman said not only does HECS debt limit borrowing power, it also “severely limits” a person’s lending options.

“When our brokers looked at our average graduate, the number of options dropped from 15 lenders to one lender once HECS debt was added into the equation,” he said.

“In this scenario, this meant our average graduate could only get a loan at 5.89 per cent but without HECS, they would have been able to shave 0.45 per cent off this rate and get a 5.44 per cent loan.

“So HECS is now not only restricting borrowing power, it restricts your options and increases your repayments. This means graduates face a triple whammy of restrictions when they look to get a mortgage.”

3m Aussies ‘swept away by a debt avalanche’

According to the Australian Taxation Office, 15 per cent of Australians are saddled with student debt, meaning more than three million people are going to be impacted by this increase.

A recent Finder survey of more than 300 Australians with current student debt found over half were concerned about their ability to repay it.

Worryingly, 14 per cent of respondents said they didn’t think they would ever be able to repay their student debt.

Graham Cooke, head of consumer research at Finder, warned that increasing student debt could impact the ability of young Aussies to break into the property market.

“Inflation is causing headaches for almost all Australians, and former students are no exception,” he said.

“Our high inflation rate means more interest will be charged against student debt than we have seen in decades. No doubt the effects will be significant.

“Many Australians with plans to get on the property ladder or take out any sort of loan in the future will find it extremely difficult as lingering student debt is a massive liability.”

There have been calls for the Government to help ease the cost of living for young Aussies by pausing indexation this year.

Eight crossbench MPs and senators recently called for urgent intervention to stop millions of Aussies being “swept away by a debt avalanche”.

In their letter to Prime Minister Anthony Albanese and Education Minister Jason Clare, they warned indexation was causing student debts to increase faster than they were being paid off.

“Larger debts take much longer to pay off, with student debt becoming a lifelong burden for too many,” they wrote.

“The growth of student debt disproportionately impacts young people and women, entrenching inequality.”