State breakdown: Horror impact of banks’ rates buffer

Millions of Aussies will have to work longer hours to earn a significant amount more a month if they want a new loan or plan to refinance.

Millions of Aussies will have to work longer hours to earn a shocking amount more a month if they want a new loan or plan to refinance.

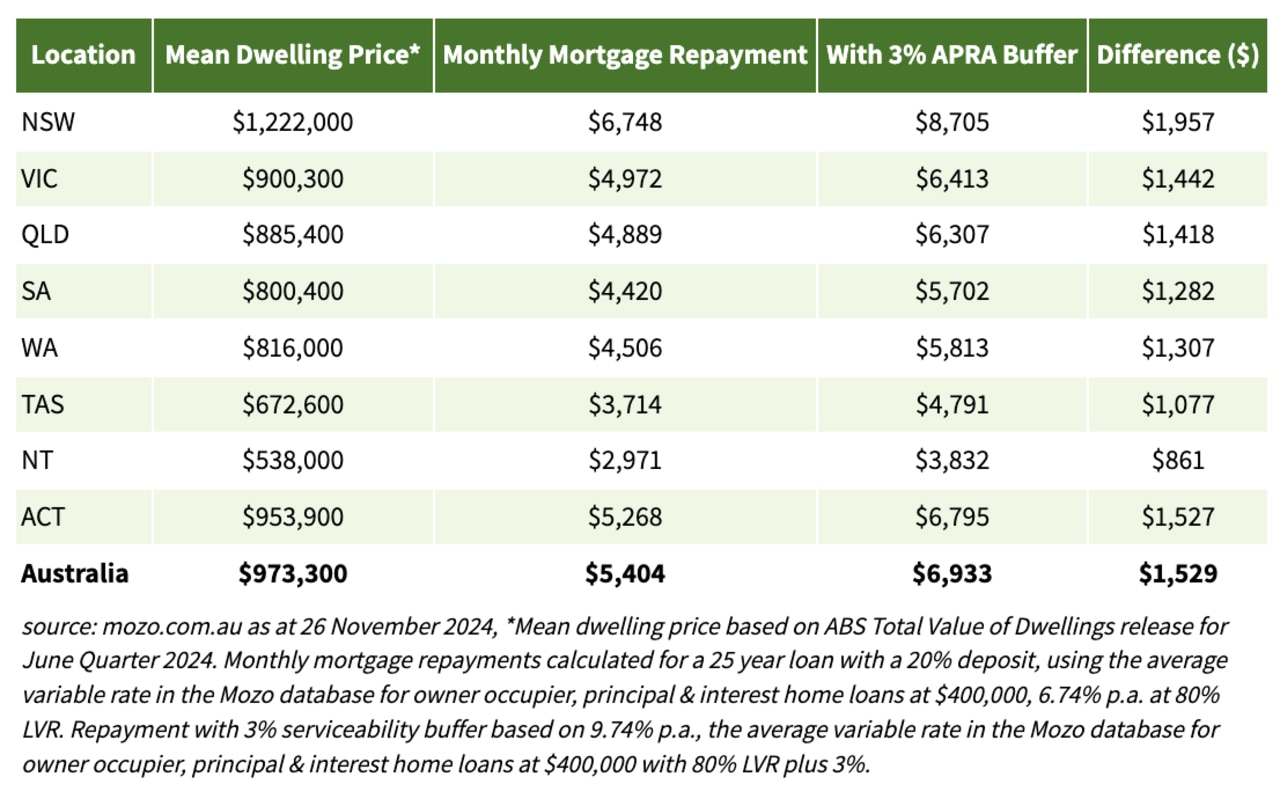

New analysis by Mozo, breaking down state by state the impact of the federal banking regulator APRA’s strict 3 per cent mortgage serviceability buffer has found borrowers would need between $861 to as much as $2,000 more a month in disposable income if they want to qualify for average home loans in their state.

Rachel Wastell, Mozo finance expert/Mozo spokeswoman said “it’s like being told to set aside enough money for a big house renovation, even though your place only needs a fresh coat of paint”.

RELATED: Bad news for homebuyers before Christmas

Sizzling forecast for Brisbane home prices in 2025

Another big bank slashes interest rates

Those in New South Wales are hardest hit – needing to show $1,957 more disposable income than their actual mortgage repayment in order to qualify for a loan or refinance an old one – but most other states and territories were not far behind with all but one requiring a buffer over $1,000.

“The APRA buffer adds an extra hurdle for borrowers, in an already challenging market, as they scramble to find upwards of $1,000 more every month to put aside – just in case,” Ms Wastell said.

“The last time the cash rate reached 7.35 per cent — the rate APRA would like borrowers to prepare for — was back in 1996”.

The Australian average for a mortgage of around $973,300, requiring repayments of $5,404 a month was a buffer of $1,529 in income, the Mozo analysis found.

The Australian Capital Territory had the second highest dollar value buffer requirement at $1,527, followed by Victoria’s $1,442, Queensland on $1,418, Western Australia $1,307, South Australia $1,282 and Tasmania $1,077.

Only Northern Territory was below $1,000, with the buffer required for the average mortgage there sitting at $861.

Retired at 30: How Aussie crypto queen made millions

Olympic champ Emma McKeon’s $2.4m exit plan

Ms Wastell said the APRA decision meant average borrowers were required to have as much as $2,000 extra a month available to cover mortgage repayments “just in case rates increase by another 3 per cent”.

“However, given we’re at the peak of the most aggressive rate-hiking cycle since the 1990s, it’s highly unlikely we’ll see another 3 per cent increase.”

“While rates may increase that much at some point in the future, by that time borrowers taking out home loans now will have reduced their outstanding balance.”

The official interest rate has jumped 13 times in the current cycle, from a record low 0.10 per cent to 4.35 per cent in two years.

Ms Wastell warned APRA was not likely to be moved on the issue, so borrowers should shop around for a lower home loan rate if possible.

“If you’re looking to refinance or purchase a new home, now’s the time to be vigilant about rates. The difference between a low and high rate can make or break your ability to comfortably meet your repayment obligations and will determine how much extra you need stashed away to prove you can meet that extra 3 per cent buffer.”

The calculation was taken off mean dwelling prices in Australian Bureau of Statistics data as at the end of the June quarter on a 25 year loan with a 20 per cent deposit.

The repayment with 3 per cent serviceability buffer was based on 9.74 per cent per annum – which is the average variable rate in the Mozo database for owner occupier, principal and interest home loans at $400,000 with 80 per cent LVR plus 3 per cent.”

Originally published as State breakdown: Horror impact of banks’ rates buffer