RBA February 2025 rate cut: Banks yet to pass on cuts

Virgin Money is no longer alone, with another subsidiary of a defiant lender refusing to pass on the RBA rate cut to customers.

EXCLUSIVE | Tim McIntyre and John Rolfe

A second bank has emerged as refusing to pass on the RBA’s historic February rate cut; and it’s part of the same big bank group as Virgin Money.

BOQ Specialist, another subsidiary of the nation’s eighth-largest lender, Bank of Queensland, lends to doctors, dentists, veterinarians and accountants. It broke the bad news to customers on its online interest rate hub.

“BOQ Specialist variable home loan interest rates for new and existing loans will remain unchanged following the RBA’s February 2025 cash rate change,” the site reads. “BOQ Specialist regularly reviews savings and home loans rates to ensure they balance the needs of savers and borrowers and are competitive in the market.”

One unhappy BOQ Specialist customer contacted this masthead, claiming the lender had them “over a barrel” until construction of their home was complete.

“Having finally got a reprieve from this never ending high interest cycle it was soul destroying to find out a couple of weeks later that my bank BOQS was not intending to pass any of it on,” the customer, who did not wish to be named, said. “I’ll be refinancing at the next available opportunity.”

MORE: Winners and surprise losers of rate cut

A BOQ Specialist media spokesperson pointed out that while BOQ Specialist and Virgin money had not passed on rate cuts, BOQ itself had, along with its other lending channel ME Bank.

“BOQ Group has given careful consideration to balancing customer interests, market rates, and funding costs. As challenger brands, VMA and BOQS have historically offered lower than market rates to stand out against larger competitors,” the spokesperson said. “The highly competitive home lending market has improved rates for customers, whilst recent industry-wide margin compression has required smaller banks to consider the sustainability of returns to ensure customers have continued access to lending.

MORE: Call your bank: Rate cut trap revealed

“The decision to realign rates with those of our competitors ensures that we can continue to support VMA and BOQS customers effectively. We understand that this impacts some customers, especially given the current high cost of living pressures.

“We are providing rates that align with our competitors while ensuring we can generate sustainable returns and continue to serve customers into the future.

We remain committed to supporting customers in need and encourage those experiencing hardship to reach out to us.”

Customers of BOQS have taken to the lender’s social media pages to vent their frustration.

“Here to help but you are pocketing the savings from the cash rate drop, what a joke. I don’t understand how BOQ does drop its rates but BOQ Specialists does not...I guess it’s time to refinance...” Peter Stone posted.

“Why don’t you help people by passing on interest rate cuts,” Adrian Beau added.

It comes after Treasurer Jim Chalmers lambasted Bank of Queensland CEO Patrick Allaway for failing to pass on any of the recent official interest rate cut to tens of thousands of Virgin Money home-loan customers.

Virgin publicly stated its rates “will remain unchanged” despite the Reserve Bank of Australia’s 0.25 percentage point reduction last month.

Virgin’s decision to hold out drew the ire of many customers – and the Treasurer, who made his displeasure known to Allaway.

MORE: Home loan trap taking years to escape

“It’s very disappointing and I’ve passed that on to the CEO,” Dr Chalmers told this masthead.

“Banks and other lenders shouldn’t treat their customers like mugs.

“The best thing you can do if your lender refuses to pass on this rate cut is to shop around for a better deal,” the Treasurer said.

And that is exactly what many Virgin Money customers are doing, according to the lender’s social media pages.

“Currently negotiating a new deal with another bank. You’ll have lost home loan and credit cards with us because of the greed,” posted Kelly Schuppe.

“You applied every increase the RBA put on us but now there is a cut and you won’t pass it on? Absolutely grubby pieces of junk you are. Good luck with an empty bank with no customers we will all be looking to move on if there isn’t immediate change,” said Matt O’Neill.

“The biggest scam is Virgin Money profiting from the RBA cut and refusing to pass it onto loyal customers,” said Kin Mrap.

BoQ has been contacted for a response to Dr Chalmers comments.

More than 100 lenders have passed on rate cuts since the RBA finally pulled the trigger at its February meeting and customers at the vast majority of banks are already being charged a new, lower rate of interest, with new rates to kick in soon for the rest.

MORE: ZERO return: Warning for savers after rate cut

An interesting stance considering that the lender passed on the most recent RBA cash rate increase, back in 2023. Even more interesting considering Virgin Money promptly slashed 0.35 per cent from the interest it gives savers using its Boost Saver Account; a 10 basis point greater drop than the RBA’s.

When this was pointed out to Virgin Money, a spokesperson doubled down.

“Our rate decisions are well considered ensuring that we provide our customers with a competitive proposition aligned with our funding costs and the needs of all our stakeholders,” the spokesperson said. “Virgin Money home loans are competitive and remain aligned with market. For any customers concerned about their current financial situation, we encourage you to reach out to our dedicated teams who are here to listen and provide support. Having these conversations early can help us explore support options best suited to your needs.”

MORE: Huge prediction for Aussie house prices

Virgin Money is now separate from Sir Richard Branson’s overall Virgin brand, having been bought by the Bank of Queensland in 2013. Interestingly, the Bank of Queensland passed on rate cuts to its customers and has had a best variable rate of 5.93 per cent since 7 March.

Virgin Money’s Variable Rate Home Loan currently offers a rate of 6.44 per cent, and only for customers with at least a 40 per cent deposit.

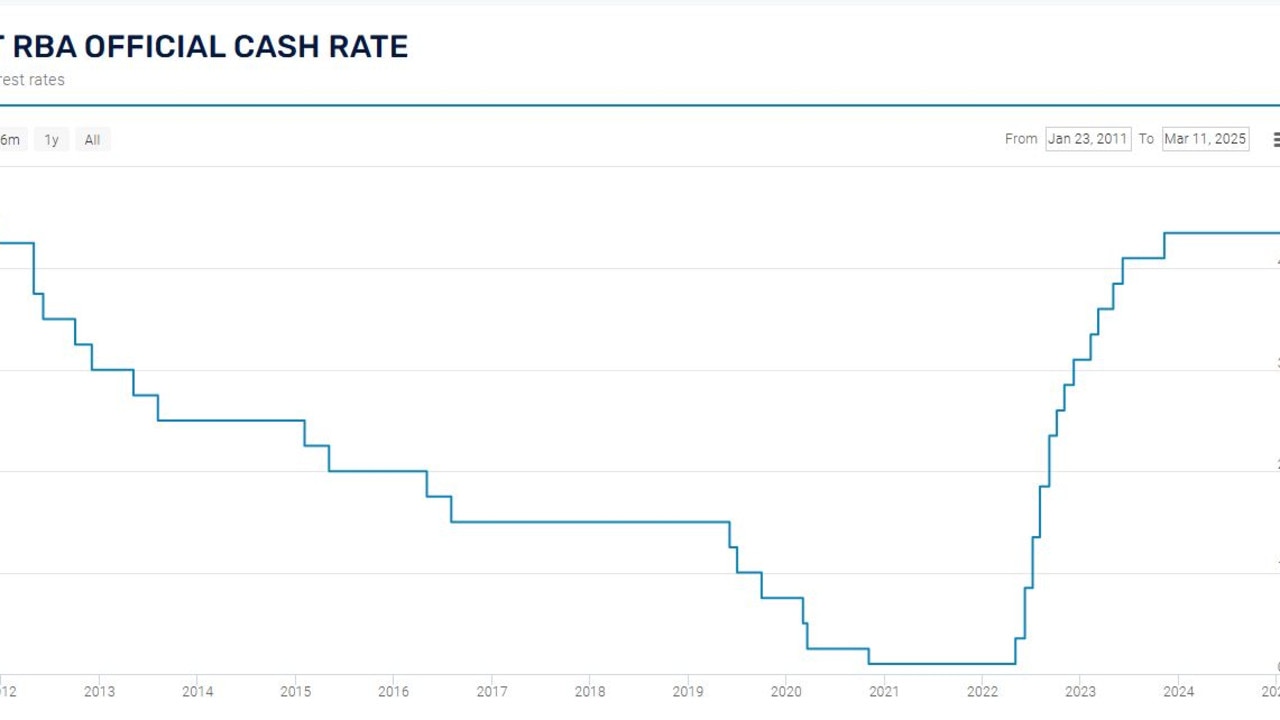

The RBA’s 25-basis-point reduction to the official cash rate announced on 18 February brought it down to 4.10 per cent from 4.35 per cent.

It was the first rate cut since 2020 and follows 13 consecutive hikes that pushed rates to their highest level since 2011.

Commonwealth Bank, ANZ, NAB and Westpac quickly announced they would implement the full 25-point reduction.

Graham Cooke, head of consumer research at Finder, said Aussie homeowners have a right to be upset if their lender isn’t announcing a cut.

“Every extra day without a cut leaves many Aussie homeowners with tighter budgets,” he said.

“If your bank isn’t looking out for you when all eyes are on an RBA cut, when will it?”

Cooke said refinancing is the best way to save on your mortgage costs.

“Social media was full of Aussies celebrating their bank announcing a 25-point cut on Tuesday – and it was refreshing to see some lenders announce they will be passing on the full rate cut,” he said.

MORE: Rate cut: Winners and surprise losers

“The reality is you can likely save more than a couple rate cuts by switching to a better deal.

“A reduction of even half a per cent can be the difference of thousands of dollars a year.

“Shop around to find a variable home loan that offers a lower interest rate than your current provider. The very lowest rates now have a ‘5’ in front of them.”

Banks who have passed on the cut so far

NAB- New lowest rate 6.19%- Effective 28 February

CommBank- 5.90%- 28 February

ANZ- 5.84%- 28 February

Westpac- 6.19%- 4 March

Adelaide Bank- 5.99%- 7 March

AMP- 5.89%- 28 February

Arab Bank Australia- 5.50%- 4 March

Athena-5.99%- 18 February

Aussie Home Loans- 5.88%- 7 March

Auswide Bank-5.74%- 28 February

Australian Military Bank- 6.18%- 4 March

Australian Mutual Bank- 5.44%- 1 March

Australian Unity- 5.69%- 6 March

Bank Australia- 5.13% (Clean Energy Home Loan only)- 4 March

Bank First- 5.84%- 27 February

Bank of China- 5.68%- 4 March

Bank of Melbourne- 6.04%- 4 March

Bank of Sydney-5.79%- 12 March

Bank of Queensland- 5.93%- 7 March

Bank of us- 5.89%- 12 March

Bank Orange- 5.69%- 6 March

BankSA- 6.04%- 4 March

BankVic- 5.74%- 4 March

BankWAW- 5.54%- TBC

Bankwest- 6.04%- 28 February

Bendigo Bank- 5.84%- 7 March

Beyond Bank- 5.89%- 4 March

BCU- 5.74%- 5 March

Bluestone- 6.79%- 5 March

Border Bank- 5.88%- 28 February

Broken Hill Bank- 6.64%- TBC

Cairns Bank- 5.99%- 8 March

Central Murray Credit Union- 5.99%- 28 February

Central West Credit Union- 6.04%- 25 February

Credit Union SA-5.79%- 5 March

Coastline Credit Union- 6.69%- 28 February

Community First Bank- 5.69%- 12 March

Defence Bank- 6.34%- 27 February

Easy Street- 5.79%- 12 March

Firefighters Mutual Bank- 5.74%- 28 February

Firstmac- 5.89%- 4 March

First Option Bank- 5.74%- 1 March

FreedomLend- 5.90%- 17 March

Gateway Bank- 5.60%- 25 February

Geelong Bank- 5.89%- 5 March

GMCU- 5.94%- 1 March

Great Southern Bank- 5.89%- 4 March

Greater Bank- 5.74%- 7 March

G&C Mutual Bank- 5.70%- 1 March

Gouldburn Murray Credit Union- 5.94%- 1 March

Heritage Bank- 5.74%- 4 March

Homeloans.com.au- 6.14%- 5 March

Homestar- 5.74%- 4 March

Horizon Bank- 5.64%- 28 February

HSBC- 5.74%- 10 March

Hume Bank- 5.74%- 3 March

Illawarra Credit Union- 5.69%- 5 March

IMB- 5.79%- 4 March

ING- 5.89%- 4 March

Laboratories Credit Union- 5.70%- 1 March

La Trobe- 6.54%- 17 March

Liberty Financial- 6.24%- 7 March

loans.com.au- 5.74%- 4 March

Macquarie Bank- 5.89%- 28 February

ME Bank- 5.88%- 8 March

Mortgage House- 5.64%- 7 March

MOVE Bank- 5.69%- 1 March

MyState Bank- 5.79%- 4 March

Newcastle Permanent- 5.74%- 7 March

NRMA- 5.78%- 7 March

Pacific Mortgage Group- 5.64%- TBC

People’s Choice- 5.64%- 4 March

Pepper Money- 6.59%- 5 March

P&N Bank- 5.88%- 5 March

Police Bank- 5.59%- 28 February

Police Credit Union- 5.74%- 1 April

Qantas Money- 5.88%- 7 March

QBank- 5.74%- 11 March

Qudos Bank- 5.64%- 27 February

Queensland Country Bank- 5.89%- 11 March

RACQ Bank- 5.64% – 4 March

Reduce- 5.74%- TBC

Regional Australia Bank- 5.69%- 4 March

Resi- 5.89%- 28 February

Resimac- 6.14%- 5 March

Southern Cross Credit Union- 6.23%- 3 March

Southwest Slopes Bank- 6.35%- 4 March

St. George- 6.04%- 4 March

Sucasa- 6.05%- 28 February

Summerland Bank- 5.49%- TBC

Suncorp- 5.88%- 28 February

Teachers Mutual Bank- 5.74%- 28 February

The Capricornian- 5.64%- 7 March

The Mac- 5.67%- TBC

The Mutual- 5.64%- 4 March

Tiimely- 5.74%- 7 March

Transport Mutual- 6.69%- 21 February

Ubank- 5.84%- 27 February

Unibank- 5.74%- 28 February

Unity Bank- 5.74%- 28 February

Unloan- 5.74%- 21 February

Up Bank- 5.75%- 1 March

Warwick Credit Union- 6.14%- 27 March

Well Money- 5.81%- 7 March

Yard Home Loans- 5.89%- 7 March

Yellow Brick Road- 6.64%- 28 February

Banks who have not yet passed on cuts

Virgin Money

The full, most up to date Finder list can be found here

Originally published as RBA February 2025 rate cut: Banks yet to pass on cuts