Shocking number of years it will take first homebuyers to save a deposit

Both sides of the property market, including buyers and homeowners, are being battered by rising interest rates. And the outlook isn’t pretty.

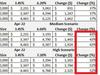

The grim reality of trying to get into the property market has been laid bare with new research showing it would take a first homebuyer a whopping 17.5 years to save a 20 per cent deposit to purchase a home in Sydney with rising interest rates.

Across Australia, the shocking research revealed that with the eight cities combined it would take 14 years to save for a deposit.

Surprisingly, the city that took the second-longest time to save for a 20 per cent deposit was Hobart with buyers facing a lengthy 13.7-year wait to accumulate the money, investment bank Barrenjoey found.

Brisbane is not far behind with the time needed to put together a deposit sitting at 13.2 years, while in Melbourne it is 12.8 years.

Saving for your first home deposit? Compare Money's ultimate guide for first home buyers could help >

In Adelaide, buyers had to spend just over a decade saving for a home deposit, while it was 9.2 years in Perth.

The most affordable capital was Darwin with homeowners expected to spend 6.8 years saving.

However, super-sized interest rates also mean buyers’ borrowing capacities are taking a battering with predictions the amount of money that people can borrow will plummet by around 25 per cent by mid-2023.

And if interest rates rose to 3.8 per cent, overall borrowing capacity would fall 30 per cent.

This would be the largest decline in borrowing capacity in modern history and would also hit house prices, the research found.

“Worryingly, there is clear downside risk to this outlook. Indeed, if interest rates rise to current market pricing, and inflation is strictly applied to borrower’s expenses, borrowing capacity could decline by more than 35 per cent,” the Barrenjoey report said.

“We would expect this to trigger an even more severe correction in the housing market and credit growth, having implications for the economy and banking sector.”

But higher interest rates and inflation then predicted could spell an even bigger disaster, the bank warned.

“The combination of these factors could see borrowing capacity fall as much as 37 per cent lower from the peak by mid-2023,” the report said.

“Such an outcome would undoubtedly see house prices fall further than our base case, impacting the broader economy. We would expect the RBA to be quickly easing monetary policy in this scenario.”

The bank’s modelling has predicted an extraordinary fall of 25 per cent for Sydney house prices due to rising interest rates but predicted it could go as high as 30 per cent, a bigger drop than most experts have forecast.

Reserve Bank governor Philip Lowe recently predicted that house prices could fall by 10 per cent across the nation.

But with housing affordability at a record low, there’s also bad news for people who already own a home.

The Barrenjoey analysis found mortgage repayments in Sydney were already taking up more than 61 per cent of disposable household income but rising interest rates were expected to push up this figure even higher.

“In the next three to six months we expect the rise in interest rates to outweigh falling house prices, driving the cost of servicing a new mortgage to new highs,” the report said.

Across Australia, monthly home loan repayments have risen to 49.4 per cent of income on average across Australia’s capital cities from a low of 34 per cent during the pandemic, but it’s expected to get even worse.

“In the very near term, the rapid rise in interest rates (both fixed and floating) is expected to outweigh falling house prices with the cost of servicing a new mortgage on the median dwelling expected to increase to a peak of 56 per cent of median income – a record high for the indicator on a national level,” the report said.