Sign rate hikes will see Aussie house prices tank

Property prices are already falling at their fastest quarterly pace since the early-1980s – and there’s a worrying sign this is just the start.

ANALYSIS

On Tuesday, the Reserve Bank of Australia (RBA) stung mortgage holders with another 0.5 per cent interest rate hike – the fifth consecutive monthly increase.

The decision sent the official cash rate (OCR) to 2.35 per cent, up sharply from April’s all-time low 0.1 per cent.

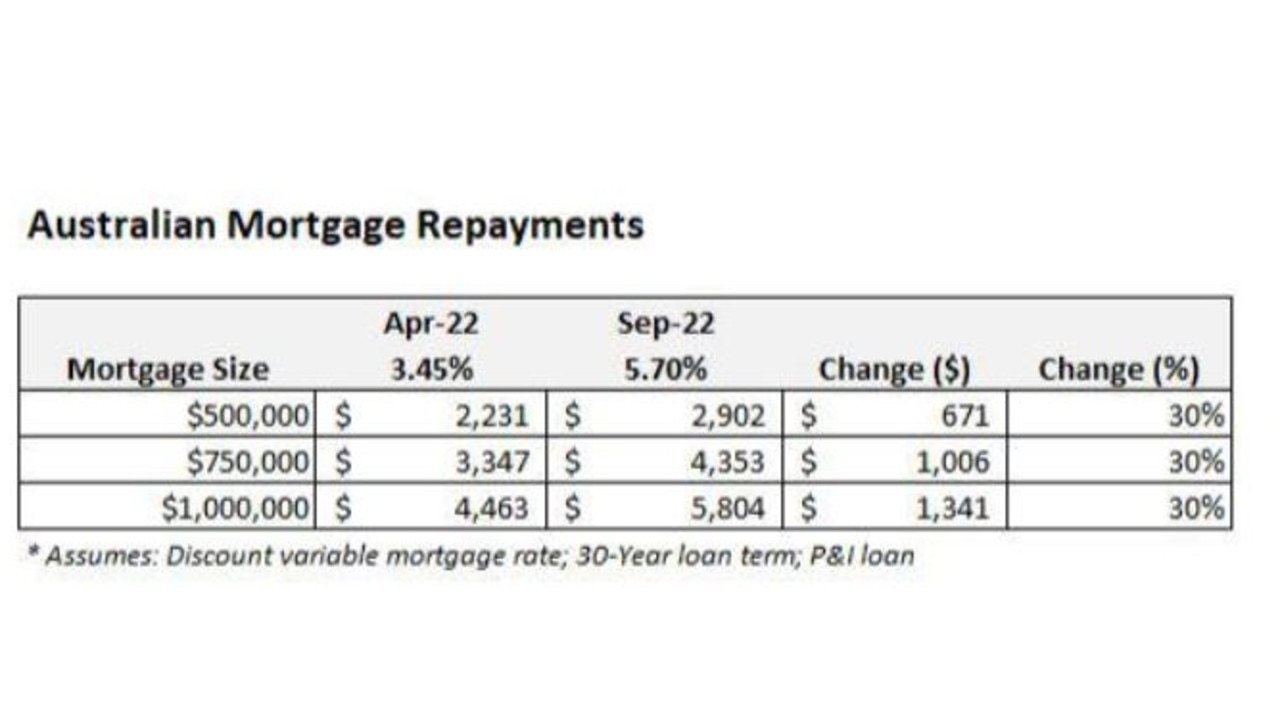

Once the rate hike is passed onto mortgage holders, the average discount variable mortgage rate will rise to 5.70 per cent, up from 3.45 per cent in April.

In turn, average monthly mortgage repayments will soar by 30 per cent from their April pre-tightening level:

For a household with a $500,000 mortgage, this represents a monthly increase in repayments of $671, whereas a household with a $1,000,000 mortgage will pay an extra $1341 a month.

RBA flagged further rate rises

In the RBA’s monetary policy statement accompanying Tuesday’s rate hike, governor Phil Lowe noted that “inflation in Australia is the highest it has been since the early 1990s and is expected to increase further over the months ahead”. Therefore, “the Board expects to increase interest rates further over the months ahead, but it is not on a pre-set path”.

Accordingly, the OCR will rise further over coming months, but how far will depend upon the incoming data, including Wednesday’s Australian Bureau of Statistics national accounts release for the June quarter.

Current forecasts for the OCR vary among economists and the bond market.

CBA, AMP and NAB had forecast the OCR to peak at 2.6 per cent, whereas ANZ and Westpac forecast a 3.25 per cent peak in early 2023.

The bond market is even more hawkish, pricing a peak OCR of 3.85 per cent by mid-2023.

Based on the RBA’s statement that it “expects to increase interest rates further over the months ahead”, we should expect the lower-end economists’ forecasts to shift higher.

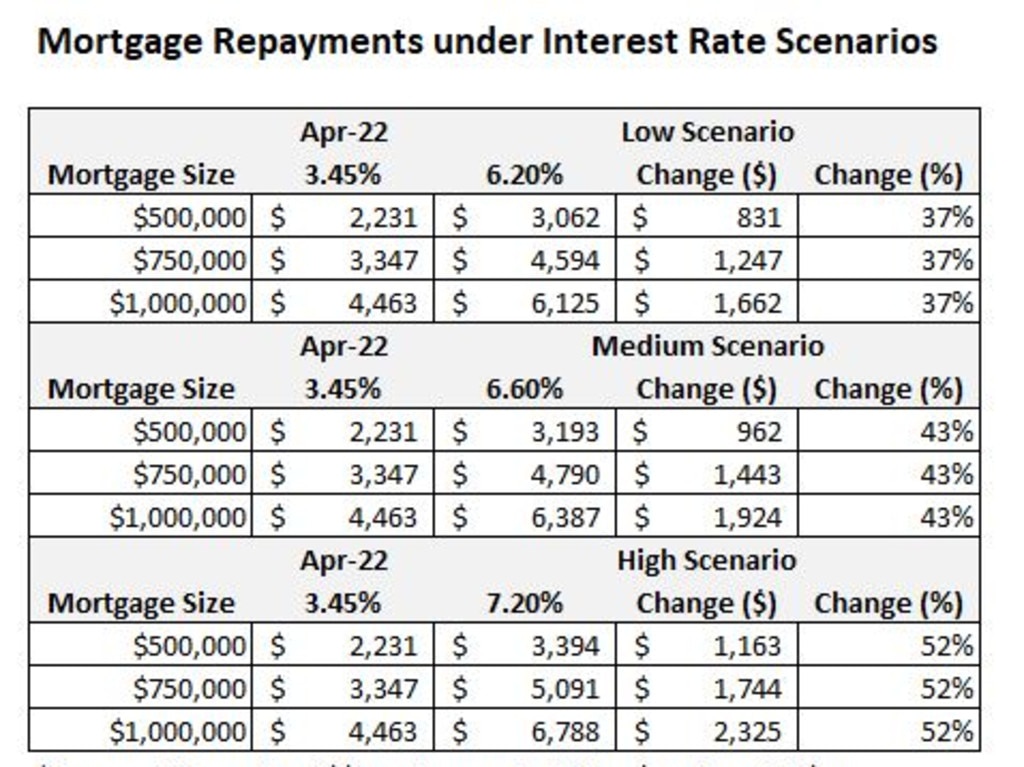

The above table illustrates the impact on Australian mortgage holders under three rate rise scenarios:

– Low Scenario: Assumes two more OCR hikes of 0.25 per cent.

– Medium Scenario: Assumes the ANZ/Westpac 3.25 per cent OCR forecast comes to fruition.

– High Scenario: Assumes the bond market’s 3.85 per cent OCR forecast comes to fruition.

Under the Low Scenario, Australia’s average discount variable mortgage rate would rise to 6.20 per cent.

In turn, average monthly mortgage repayments would rise by 37 per cent versus their level in April before the RBA commenced its rate tightening cycle.

The Medium Scenario of ANZ/Westpac would send the average discount variable mortgage rate to 6.60 per cent, in turn lifting average mortgage repayments by 43 per cent compared to their level in April 2022.

Finally, the High Scenario of the bond market would send the average discount variable mortgage rate to 7.20 per cent, thereby lifting average mortgage repayments by 52 per cent versus their pre-tightening level.

It is also worth pointing out that there is a large proportion of fixed rate home loans that will expire over the next eighteen months. The average loan rate for these borrowers is ~2.25 per cent, which is significantly lower than the discount variable rates illustrated above.

Thus, the fixed rate mortgage reset creates further natural tightening, even in the absence of additional OCR hikes from the RBA.

The key takeaway is that Australian mortgage holders are facing a painful lift in repayments. It is only a question of how much?

Australian house prices will tank

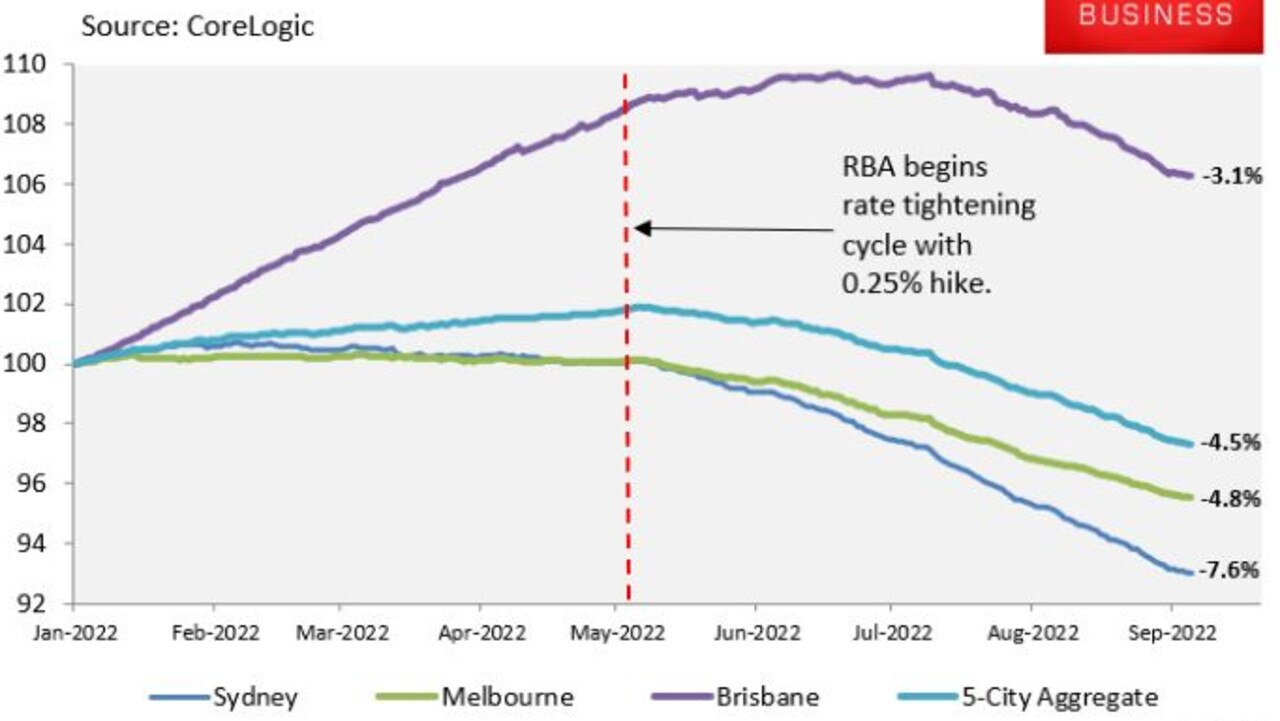

Australian house prices have already fallen sharply in response to the RBA’s rate hikes.

As illustrated in the next chart plotting CoreLogic’s daily dwelling values index, home values at the five-city aggregate level have fallen 4.5 per cent from their peak, driven by sharp 7.6 per cent and 4.8 per cent declines across Sydney and Melbourne:

Dwelling values are already falling at their fastest quarterly pace since the early-1980s across Sydney and at the five-city aggregate level.

Tuesday’s 0.5 per cent rate hike, alongside further increases flagged by the RBA, will drive home values down further, likely resulting in the biggest house price correction in living memory.

This is not hyperbole. The RBA’s latest Financial Stability Review estimated “that a 200-basis-point increase in interest rates from current levels would lower real housing prices by around 15 per cent over a two-year period”.

Based on this modelling, Australia faces a peak-to-trough decline in real house prices of somewhere between 20 per cent and 30 per cent, based on the above OCR scenarios, or between 12 per cent to 20 per cent in nominal terms assuming inflation remains high.

The RBA is ‘flying blind’ on interest rates

This week, the CBA’s head of Australian economics, Gareth Aird, released research showing that it takes an average of two-to-three months for an increase in the OCR to be felt by mortgage holders.

This suggests that most of the RBA’s rapid monetary tightening has yet to be felt by Australians with mortgages, meaning “there’s a degree to which the RBA Board is flying blind. It has simply been too early for the spending data to pick up the impact of the already delivered rate hikes”.

Separately, Aird cautioned that the RBA’s aggressive tightening is “like having five shots of vodka in an hour and saying, everything is OK. But you know that it will soon have a big effect”.

I firmly believe the RBA has lifted rates too far, too quickly, and should pause to see what the effect is. Otherwise, it risks driving household consumption off a cliff, crashing house prices, and driving Australia into an unnecessary recession.

I also believe the RBA will be forced to cut rates mid next year. By then, the delayed impact of rate hikes will have arrived with house prices having fallen sharply, the economy stalling, and inflation declining.

After seeing the RBA go too hard on tightening, expect to see it backtrack and slash rates next year to stave off recession.

Leith van Onselen is Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.