‘Just so expensive’: Data shows the Aussie dream is dead

Alarming new statistics have revealed it has taken just 25 years for the lives of young Australians to take a dramatic turn for the worse.

Over the 25 years since the last millennium closed out, the fortunes of the nation’s first homebuyers have been on quite the rollercoaster ride.

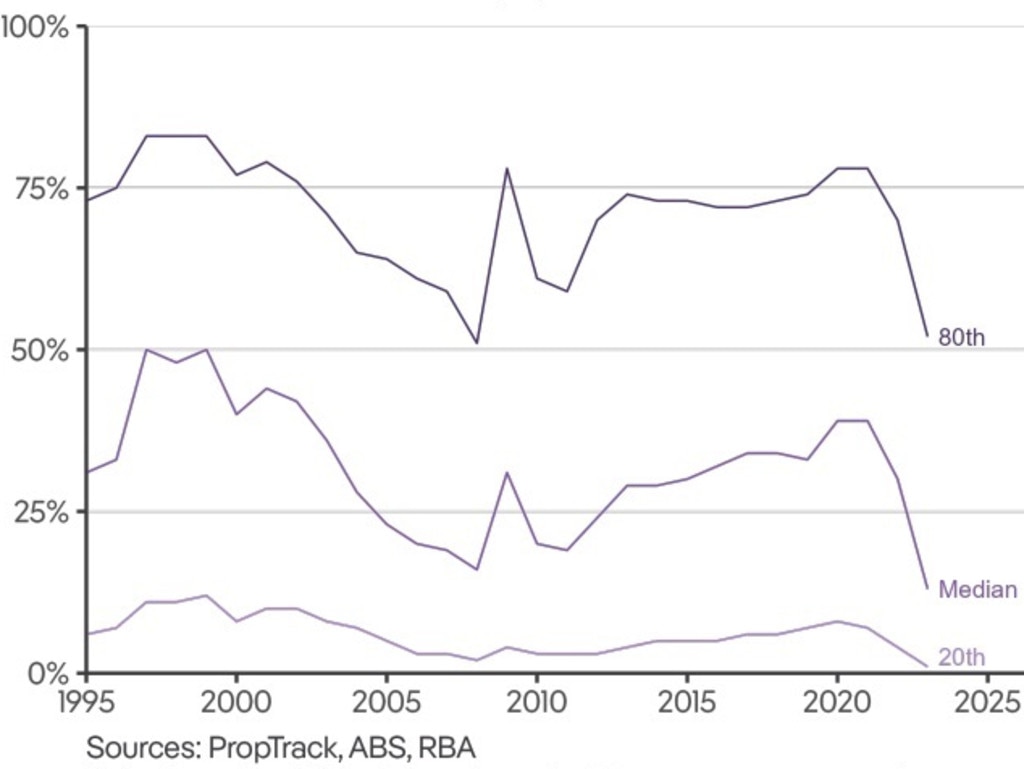

According to an analysis from property data firm PropTrack, in the year 2000, the median household could afford the median house at a national level, based on that household having the required 20 per cent deposit and transaction costs, with the mortgage consuming 25 per cent of the household’s gross income.

In short, buying a property was then more achievable for a first homebuyer than it has been at any time since, with the time to save a deposit around six years at a national level, compared with well over a decade today.

Meanwhile, as of 2023, PropTrack found that just 13 per cent of homes sold were affordable for a household on a median income, compared with roughly half back in 2000.

PropTrack’s data also concluded that at a national level, a household with an income in the 80th percentile (higher than 80 per cent of households) was competing with the median.

While there are a multitude of reasons why housing prices have continued to rise out of reach, one of the largely overlooked factors is the size of the first homebuyer age cohort and the number of properties that are being sold each year.

Hot competition gets hotter

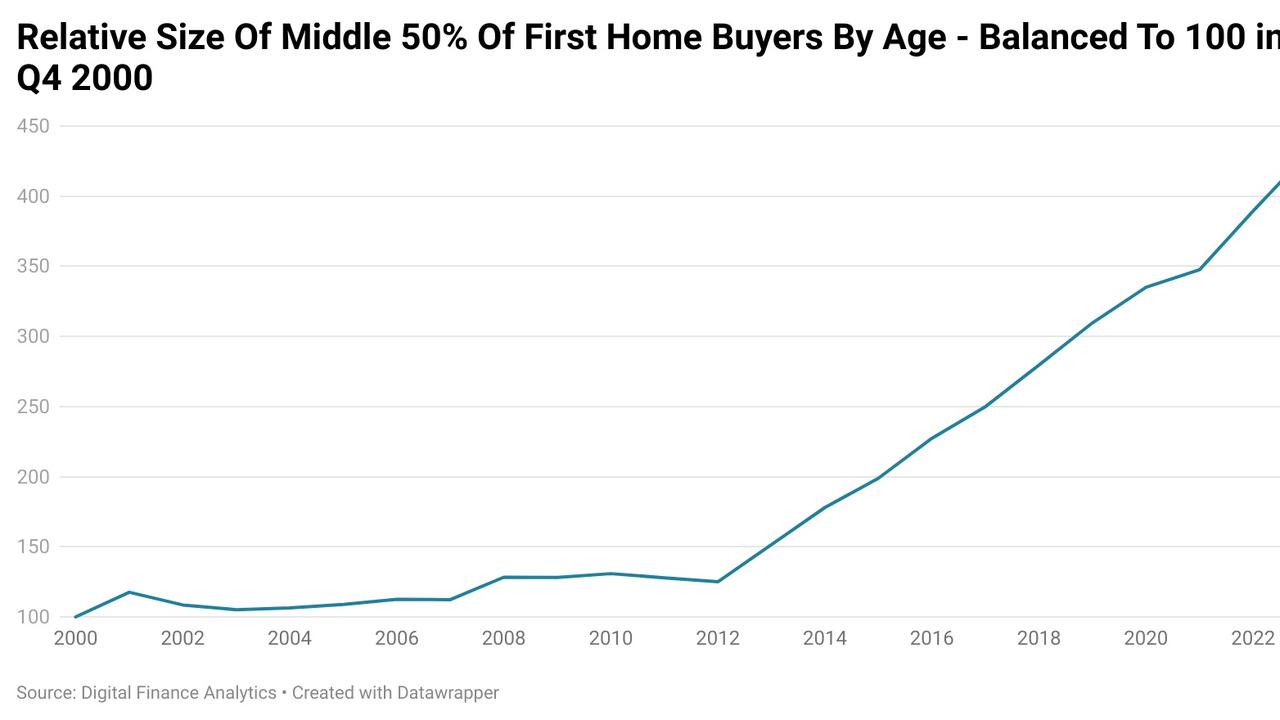

When research firm Digital Finance Analytics began collecting data on the age of first homebuyers in 2000, 50 per cent purchasing in that year fell between the ages of 24.1 and 26.3.

This metric that encompasses the middle 50 per cent of first home buyers is intended to provide a degree of clarity on what age range of prospective first homebuyers were actually buying homes in any given year and also provide a base from which the size of this cohort could be calculated from for a particular year.

For example, in 2000, 578,800 people fell within the age range of 24.1 to 26.3 years of age, giving a rough idea of the size of the demographic where first homes were being most hotly contested.

In the latest data, the middle 50 per cent of first home buyers is aged between 31.1 and 37.7. If we extrapolate that on to the most recent demographic breakdown of the population which covers up to the end of 2023, the size of the age demographic encompassed by that middle 50 per cent of first home buyers now numbers 2.49 million people.

Less on offer

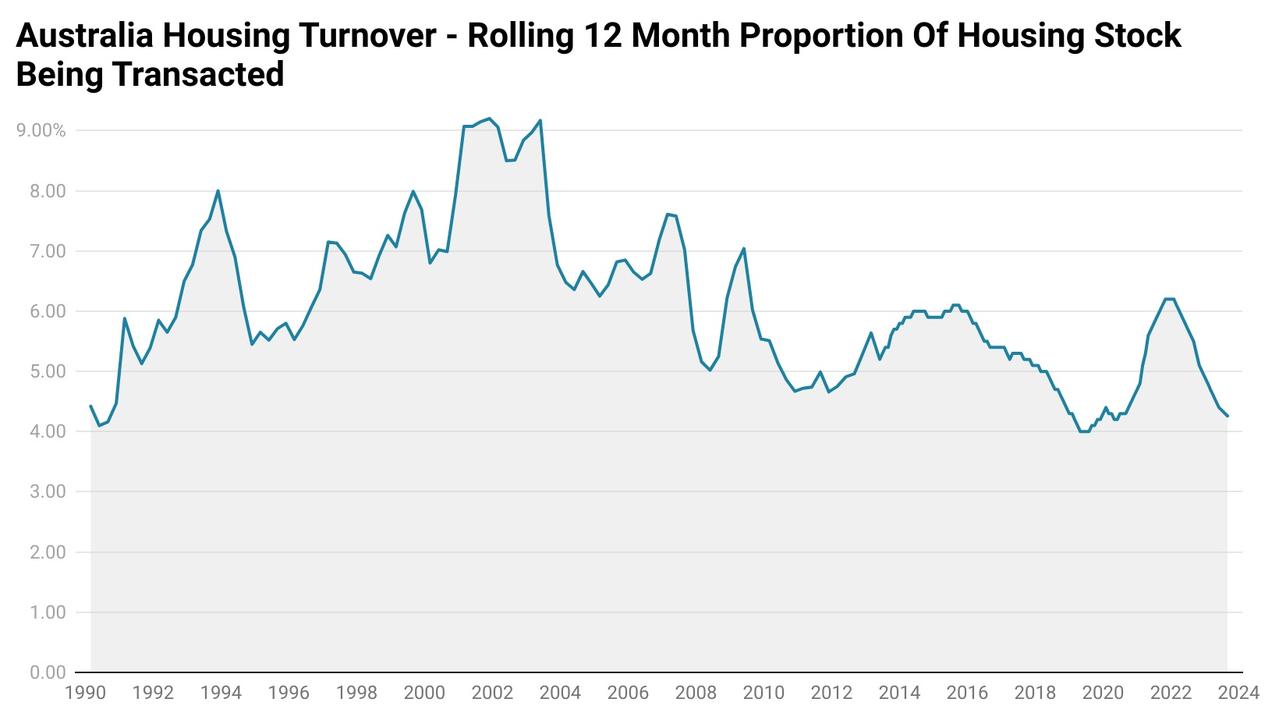

At the 2001 census, there were 7.8 million private dwellings in Australia. According to an analysis from the RBA, the annual rate of housing turnover at that time was 9.1 per cent. This comes to roughly 706,000 homes being transacted upon during that time.

Despite the nation’s population growing by 8.7 million people or 46.2 per cent since 2001, in the last 12 months only 513,000 homes changed hands. This equates to a turnover rate of 4.57 per cent or almost half what it was in 2001.

Life postponed

Amid an environment with significantly less housing turnover and far more prospective first homebuyers, even purely in a vacuum, these two issues have made it significantly more challenging to get into the housing market.

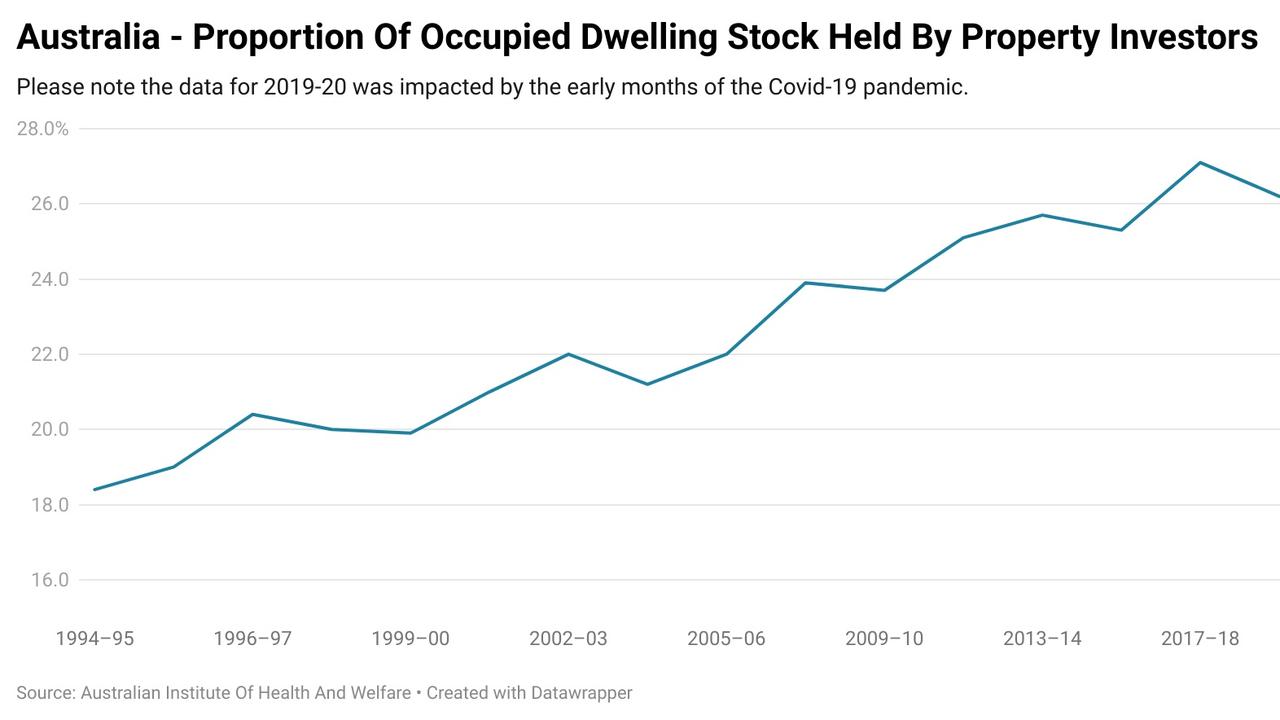

When combined with the proportion of housing stock owned by property investors growing by almost 50 per cent since the mid-1990s and a long list of other factors, prospective first homebuyers have seen buying a home go from something done in one’s mid-20s to one’s mid-30s.

Finder financial expert Richard Whitten recently noted that young people just aren’t hitting milestones at the same rate as previous generations.

“When it comes to hitting major life milestones in Australia, 30 is the new 20, 40 is the new 30,” Mr Whitten told news.com.au.

“It’s just so expensive to move out of home, buy a house, have a child, and do all the things we consider major life events. So Australians do them later,” he said.

Mr Whitten said young people are slower to forge their own way because of the cost of living crisis.

“The soaring cost of housing, particularly in cities, has made it difficult for young adults to afford their own place. This has led many to delay or give up homeownership, opting to stay with their parents as a more affordable alternative,” he said.

A challenging reality

When looking at the underlying figures that define the task ahead for prospective first homebuyers, it’s immediately clear how much things have changed.

The size of the first home buying demographic has surged dramatically as higher prices relative to incomes forced purchases to be pushed back later and later in life.

Meanwhile, a combination of higher prices and less properties on offer has left the first homebuyer demographic competing for a much smaller slice of the property market compared with their forebears.

Ultimately, it is a highly competitive environment in which to buy a first home, where one is not only competing with an ever-increasing number of fellow first homebuyers, but also those with the assistance of family, as well as state and federal governments.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator