Housing: The one thing our politicians haven’t ruled out is the one thing they should do

AUSTRALIA is running out of ideas for dealing with the housing crisis. One thing could work - but the government is scared.

THE pre-Budget period is a fun time.

The government is busy trying to make sure it won’t be another stinker like the one that brought down Abbott and Hockey. So its ministers are testing out ideas. They leak them to the press and watch: Does the idea get a bollocking?

In the case of using your superannuation to buy a house, the bollocking was good and proper.

Most people noticed the idea would add money to the housing bidding war while simultaneously draining people’s super balances. In my opinion the idea was a dud — a great way to transfer young people’s super balances to old people’s bank accounts.

The government is now acting coy about the idea, so the chance of actually seeing it in the Budget papers on the second Tuesday in May must be skinnier than before.

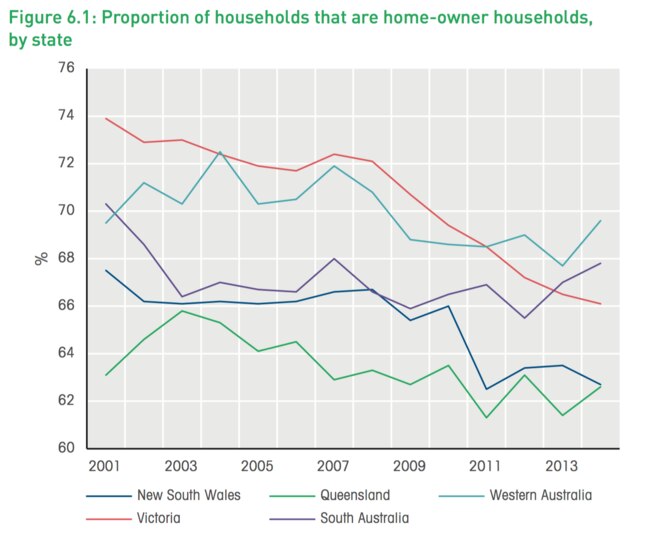

Nevertheless they’re still promising a housing package. Doing something to make housing more affordable. The Treasurer has been out there saying he’s worried about the falling rate of home ownership.

He is going to try a few things, and you can expect him to hit a soft target — vacant houses.

NO VACANCY

A tax on vacant houses is good in theory. There’s lots of stories in the press about vacant flats. But I have strong doubts about whether it will make a real difference.

The most widely-cited data are based on water use patterns, which suggest 4.8 per cent of all homes are vacant. That number depends on analysis that says if you use less than 50 litres of water a day, you count as vacant.

There’s plenty of reasons a house might use less than 50 litres a day and not be vacant in the classic sense, including weird people with a phobia of showers, or because of tank water, ill health, or frequent travel. If someone’s away for work every week and only home on weekends, is that house really vacant?

If you live alone in a flat, use a communal laundry, and sometimes shower at the gym, it’d be easy to come in under 50L a day. And it’s worth noting that most of the empty places they identify are right in the inner city. Most of those places are probably occupied, at least sometimes.

So a vacant property tax is likely, but it will mostly be for show. What we need is something effective. The Treasurer has ruled out negative gearing changes, and the super for housing idea is teetering on the edge of the bin, but there is one good idea he hasn’t ruled out.

A HARD TARGET

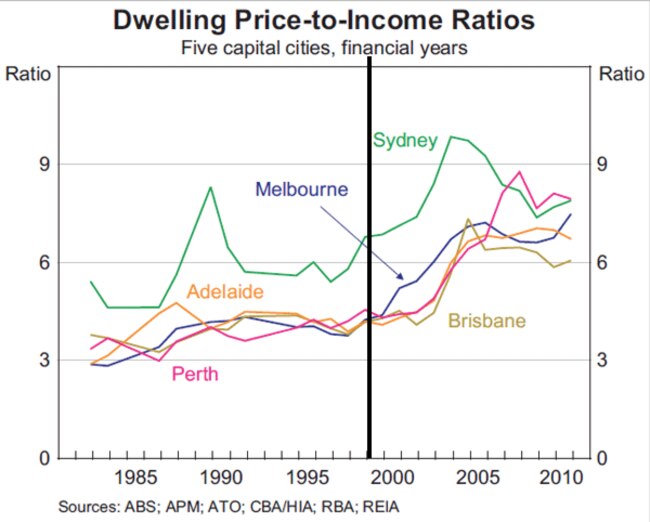

Changing capital gains tax. Negative gearing gets all the limelight, but this is actually the big one. The capital gains tax discount came in 1999 (marked by the vertical line in the graph below) and you can see that across Australia, houses started getting more expensive shortly afterwards.

That’s circumstantial evidence, to be sure, but there is no question that the CGT discount makes investing in housing more attractive, and Australians have invested so much in housing that we’ve pretty much stopped investing in anything else.

The CGT discount works like this: An investor buys the property for $400,000, sells it later for $500,000 and gets a $100,00 capital gain. Instead of paying tax on the $100,000, they effectively “discount” the gain by 50 per cent. So they only pay tax on $50,000. It’s a pretty nice way of making money without paying much tax, especially if you’re buying property and flipping it quickly.

The government has mentioned the idea of cutting the capital gains tax discount from 50 per cent to 25 per cent (i.e. the investor would pay tax on $75,000 in the above example).

That could be a good way of getting housing out of the hands of investors and into the hands of owner-occupiers. (You don’t pay any capital gains tax on the family home.) But it will only work if ScoMo gets a few things straight.

The Treasurer hasn’t ruled out this change, but he seems nervous about changing CGT. He says mum and dad investors are important for increasing supply of rental properties, and he says the reasons they own those houses is for capital gains. He’s worried that if he makes them pay tax on capital gains, they’ll stop providing rental properties.

But he may be getting a bit mixed up. Whether they are rented out or owner-occupied, those properties exist. If they’re not owned by investors, they’ll be owned by someone who lives there. Most investors already have a house. So a renter will probably move in and become an owner-occupier in the process.

Of course, some caution is required. I’ve written before about the economic consequences of a housing crash. ScoMo is probably worried about pushing house prices — which are frothier than a beer in a dirty glass — into a downward spiral and getting the blame.

One way to make the change would be to do it slowly, reducing the capital gains tax discount from 50 to 25 per cent over time. Whether even that is too courageous for ScoMo, we will find out on Budget night.

Jason Murphy is an economist. He publishes the blog Thomas The Thinkengine. Follow Jason on Twitter @Jasemurphy