How falling house prices could end up making us rich

WE’RE all so distracted by growing house prices that we’ve forgotten about the other way to get rich. So maybe a drop will do us all good.

MY MATE is a brilliant engineer. He’s got a good job but he wants to get rich. The other night as we stood round at a barbecue, he was telling me about his plan to buy another house — or maybe a flat — in the suburb he lives in.

I smiled and said ‘awesome!’ But later I kept wondering about his choice. It makes me worry about this country.

In another kind of Australia, an engineer wouldn’t aim to get rich by owning property. He’d be investing in an engineering business.

The lesson of the last 30 years is that the best, safest, smartest way to get rich is to buy a property. A whole generation has grown old with rising property prices elevating them into the wealthy classes. Now, they are passing that lesson on to their children. Get a foothold, they implore. Get a loan. Their kids are buying investment properties even while they are still renting.

We all like to talk about grand business ideas after a few drinks. But too many great Australian business ideas are never even tried. They remain just a dimly remembered conversation or — at best — a business plan saved in a .doc file that hasn’t been opened in years.

Some of them would have been world-beaters. The next Uber, the next Nike, maybe the next Tesla. But they never had a chance.

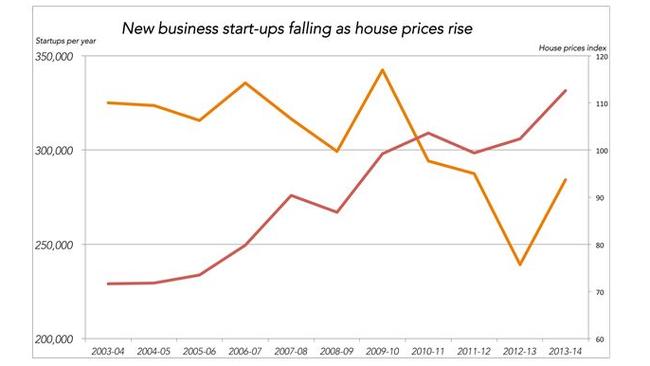

To see the trade-off between house prices and entrepreneurialism, check out the last 10 years.

In 2003-04 brave Aussies opened well over 300,000 business. Fast-forward a decade and we’re frightened. Even though the population was bigger and interest rates were lower, we opened well under 300,000 businesses (The orange line in the graph below).

Why are we slowly turning fearful? The red line helps explain it. Why invest in a risky business when you can get huge returns by just owning a flat? As far as entrepreneurialism goes, land-lording is the number one kind.

There are even investors whose confidence in getting a capital gain is so great they don’t bother renting their property out. They just leave it vacant.

And there are the inevitable stories of the young go-getters who own dozens of properties and seem utterly oblivious to the fact that owning something that already got built actually adds nothing real to the economy.

The top brains at the RBA reckon the rise in house prices is just a big money-go-round. “Much of what is gained on the one hand is lost on the other,” the Deputy Governor said recently. “The main impact of higher land prices is not really to increase our national wealth, but to change the distribution of that wealth.”

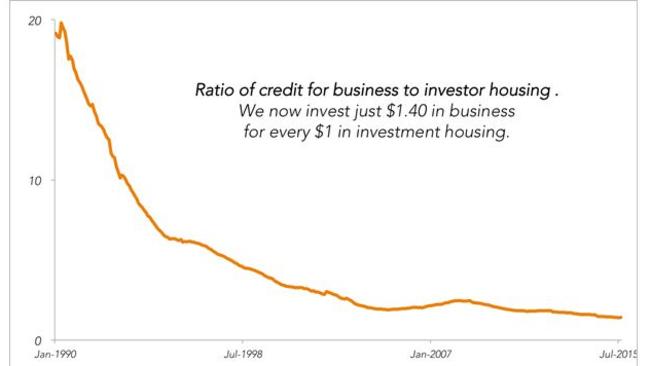

The trend for investment housing has been huge in Australia. In 1990, we invested around $10 billion each year. About 25 years later we are ploughing in $500 billion a year.

This graph shows the ratio of business investment to housing investment lines over the last 25 years.

Australia used to invest $20 in businesses for every $1 that went to being a landlord. Now it’s $1.40. No wonder our economy is all about housing and I can barely think of an Aussie start-up that has come good recently.

The relative collapse in business investment is a sad indictment on a nation that was once all about the pioneer spirit. We are a nation where property owning and profitmaking is now so mainstream we make TV out of it. Could The Block have been invented in any other country?

The tax system is definitely part of the reason here. Negative gearing makes housing investment more attractive. You can negatively gear a business too, of course. But nobody expects a business that makes a loss to appreciate in value. Why do they expect a loss-making patch of land to appreciate? Only because they always have.

Until now.

The end of an era of ever-rising house prices is probably upon us. It will be uncomfortable and a lot of people — including those smiling young ingenues whose property portfolios are as vast as their debt — will lose money.

But the lack of a safe path to riches should pose no problem for the current crop of Aussies. We are brave. We are smart. If we put our money where our mouths are and actually invest in opening businesses we could discover something — Australia’s economic potential is far more than owning a few flats.

Jason Murphy is an economist. He publishes the blog Thomas The Think Engine. Follow him on Twitter @jasemurphy.