Five reasons the only smart reaction to a housing crash is fear

OUR property rollercoaster has been chugging uphill, but it might be time to throw your hands in the air and start screaming.

I REMEMBER the first time I went on a rollercoaster, at Dreamworld on the Gold Coast. Beforehand I was petrified, but the long, slow ride up the first steep hill was calming.

At the top, I admired the view. “You can see the ocean from here!” I said. I wasn’t paying attention to the huge drop that was about to happen.

Australia’s house price rollercoaster has chugged uphill for the last 20 years. But it might be time to throw your hands in the air and start screaming — a huge terrifying downhill could be about to arrive.

Some people are excited by a big housing crash. They think it would be justice for oldies who got so rich doing so little, and a good time to buy. Others are calm, thinking it won’t matter to them.

They’re all wrong. A sharp crash would hit Australia in so many ways we’ll all come out battered and bruised whether we own a house or not.

Here’s five reasons you should be clenching your buttocks in abject terror.

1. BANKAGEDDON

There are 216,000 people employed in the finance industry in Australia. They must think about a house price crash and tremble.

If houses fall in value, the profits of banks will start to look shaky. Banks will make smaller loans, fewer new loans and deal with a lot more mortgages that are in default.

Mortgage defaults are already higher in WA, where the mining boom is ending.

When profits come under threat, banks will cut costs. All those employees in the whole finance sector will be suddenly at higher risk of unemployment.

Australia’s banks won’t fail. They are safe. But there are little financial institutions — local brokers and lenders — that could go bust if house prices fall sharply.

Banks share prices would fall though. That matters to you because of …

2. SUPER

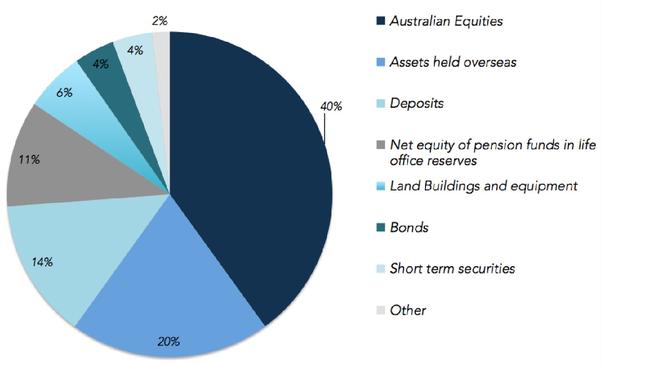

The banks are the four biggest companies in the ASX 200. Together they account for more than a quarter of it. Aussie super funds invest mostly in shares. That means your superannuation depends on the health of banks.

Australian banks are some of the most valuable in the world. Two of our banks make it into Forbes top 20 in the world. Does that make sense for a little country? Britain and Japan each have only one in the top 20.

If the banks fall in value — and who knows how far they could fall — the tumbling ASX will drag down your chances of a nice comfortable retirement.

Think you can rely on the pension instead? Cross your fingers, because that depends on the …

3. GOVERNMENT

When house prices fall, governments get less tax (capital gains tax on investment properties, stamp duty on house sales). When they get less tax, they have three options: raise taxes, cut government spending or watch the deficit get bigger and bigger and not do anything.

The last one is probably the best option for the economy. Because it would at least prop up one corner of the economy.

If the government cuts spending in a hurry, the result will be more unemployment. Public servants and other contractors will lose their jobs.

That slump in spending will flow out and ruin conditions in the rest of the economy, which will already be crappy because of …

4. CONSTRUCTION

If house prices are rising, you can make profit building new houses and selling them. Property developers get busy. If prices are falling, you’d be crazy to do that.

If a sharp crash comes, property developers will slow down the speed of business and a whole lot of architects, bricklayers and carpenters will suddenly find themselves at home on a Monday morning.

They’re not going to be spending up a storm which is bad for …

5. RETAIL

When people buy a new house, they have to fill it up with stuff. A decline in house prices will mean fewer houses being sold and will hurt retailers like Harvey Norman.

But that’s not all.

Some very cool research came out this year showing when people’s houses go up in value, they are more likely to buy a new car.

So you can imagine what will happen when people’s houses start going down in value. They’ll spend less and less.

One persons spending is another person’s earning, so the reality is a worse economy on all fronts. If this is happening at the same time as all the effects mentioned earlier — falling superannuation, worse unemployment, and government deficits — it could be the perfect storm for the Australian economy.

So there you have it. A housing crash is not just about housing. It affects the whole economy. From the Budget to Harvey Norman, from your superannuation to the pay packets of day labourers. That’s why we should be worried.

Now, I’m not saying a big housing crash will happen, nor am I saying it won’t. What I am saying is that a sharp crash will not be like a 30 per cent off sale at Target where you snag a bargain and then everything is normal again.

If there is a big housing crash, it could be a long time till we get to have another turn on the rollercoaster.

Jason Murphy is an economist. He publishes the blog Thomas The Think Engine. Follow him on Twitter @jasemurphy.