Australian real estate: How Bruce Guan built his eight-property portfolio at just 39

Sydneysider Bruce Guan has a property portfolio worth millions, yet when he sold his very first house he made a $50,000 loss on it.

Sydneysider Bruce Guan has a property portfolio worth millions, yet when he sold his very first house he made a $50,000 loss on it.

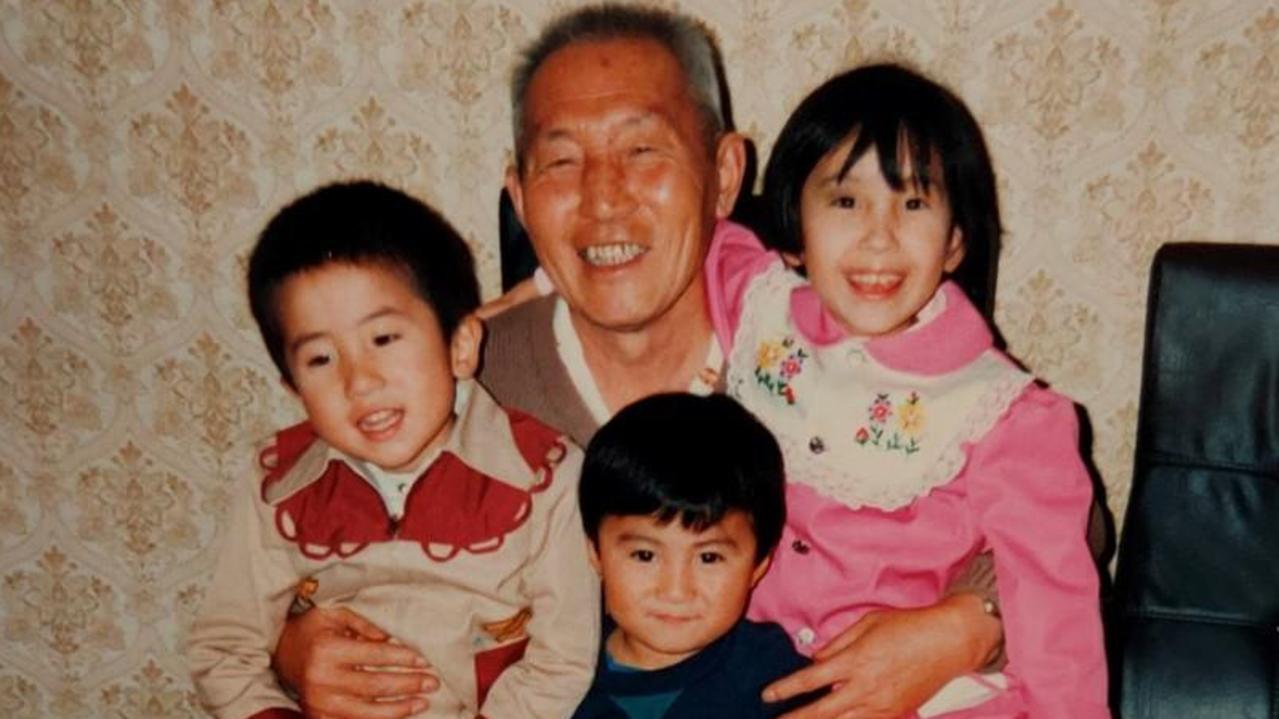

The 39-year-old arrived in Australia when he was just three after his parents fled China as refugees. They were placed in Cabramatta in government housing and back in the 1980s it was a rough area.

“There were literally heroin needles in the sandpits in the parks I used to play in,” he told news.com.au.

“One time in high schools gangs of people came into school that were looking for someone and they brought guns and knives, and nothing happened fortunately, but these are the kind of things I witnessed.”

There was another time he was walking down the street with his friend, who was held up by a man placing a needle against his neck and demanding money.

Mr Guan admits he isn’t an academic, scraping through his final year at high school and achieving a score of 56, which wasn’t good enough to get into university.

RELATED: Map reveals brutal house price reality

But he had seen his parents work hard, starting off as kitchen hands, moving into labouring work and now his dad runs a chain of five restaurants around Sydney. While his parents split up when they moved to Australia, Mr Guan’s mum purchased her own home with his stepdad in 1996.

A love of video games and movies saw Mr Guan study a diploma of graphic design, and he found a job in the field after graduation.

Later on he moved into account management, but he knew he needed to do more than climb the career ladder to grow his wealth and “get out of the rat race”.

So in 2004 he purchased his first property in western Sydney from savings he made while working, but he admits he didn’t do his research.

“I basically just listened to what other people told me and I bought the property for $280,000 and today it’s now worth almost $1 million. The sad thing is I only held the property for three years so I bought it in 2004 and I sold it in 2007 and three years later the market hadn’t moved, so it actually went down and I sold it at a loss for $260,000,” he explained.

“I lost in total $50,000 as it wasn’t just the loss in capital growth, but I lost money on rent and maintenance costs. I had tenants living in the property at the time and they were drug dealers and they were cooking up heroin in the kitchen of my property and it was really difficult to get them evicted as well.

“These tenants that were living in my property were tenants from hell … their children were writing on walls and putting holes into walls. I was racking up all the maintenance costs and loss of rent, so it eventually became a financial and mental burden and I sold the property for a loss.”

RELATED: Biggest house price increases in 18 years

Being such a “newbie” to the property market, he said he just felt relief when he sold – not realising the huge growth to come.

But three years later he realised he had made a huge mistake and “that’s when it hurt”, he admitted.

“It wasn’t the property that was the issue. I made the wrong decision as I didn’t research properly and it wasn’t the right property for me,” he admitted.

“I sold it on emotional and personal reasons, rather than selling it based on research. I would have found a way to get rid of the tenants and recoup my losses and the research would have told me to hold on.”

In 2010 he decided to dip his toe back into the property market, but beforehand he read a lot of books, watched a lot of movies and worked alongside a family friend who had 10 homes in his portfolio.

“I told myself if this was guy able to do this, I wanted to achieve what he has achieved. He was working for my dad as a contractor and he grew his business hiring contractors so he saved up all his money and started to invest,” he said.

“It took about seven to eight years to be able to buy all those investment properties, but he used all the equity generated off them and quit as a labourer and started working in the property industry as an agent. So I got a taste of property and how powerful it can be.”

He started from square one in terms of savings after the loss made on his first property and earning around $75,000 a year, he managed to save between $30,000 and $40,000 for the deposit.

RELATED: ‘Why show up?’ Buyers’ frustration grows

Looking for something he could hold for the long term, he purchased a one-bedroom apartment in Stanmore for $365,000, which today is now worth about $800,000.

“When I bought the second property, I made sure I could hold on to it for the next 10 years regardless if the market moved and actually it was all predetermined, so when I bought the first property knew I was going to buy a second property within about two years,” he said.

But when 2012 rolled around he actually purchased two properties, a one bedroom and two bedroom apartment in Parramatta, as it was an up-and-coming area at the time.

“The market did really well between 2010 to 2013 – the Sydney market was crazy and my Stanmore one went from $360,000 up to $500,000 to $550,000 in market value so what I was able to do was … go to the bank and renegotiate the loans and refinance and take out extra equity – about $110,000 off the first property, which was more than expected, so I was able to have the option to buy two properties instead of one,” he said.

He sold the one bedroom in 2018 for around $630,000 making a tidy profit of $260,000, while the two bedroom sold last year for around $810,000 after he purchased it for just $515,000 in 2010.

Mr Guan said being aggressive in his career also helped him build his property portfolio as he made a jump to account director, increasing his salary to $110,000.

He then went on a spending spree. His portfolio now includes a Melbourne CBD apartment which he purchased in 2014 for $240,000, which is now worth about $500,000.

There’s also three Brisbane units that he purchased between 2015 and 2018; a one bedroom that he snapped up for $400,000 that’s now worth about $500,000, a two bedder that’s valued at $720,000 and has grown $110,000 in worth and another two bedder for $500,000 that has increased to $680,000.

“The Brisbane and Melbourne ones are more cash flow type properties, some are OK on capital growth, but the main reason I bought them was for cash flow reasons,” he revealed.

“The Melbourne one I bought for $390,000, but in terms of rental income it was getting $510 rent a week, so it was making me $1000 a month, however, that was prior to covid. After that it’s dropped down to about $400 per week now, so it’s come down but it’s still completely paying itself off.”

The Brisbane properties are also paying themselves off with the rent, he added.

Across the country, he has also bagged a number of other properties including a luxury apartment in Adelaide, with two bedrooms on the “top floor of a pretty well known building” that faces the CBD. He picked that up in 2017 for $570,000 and it’s now valued at around $750,000, and he scores $610 in rent a week.

Back in Sydney he also has a three bedroom townhouse in Marsden Park, which he bought in 2017 for $660,000 and is now worth $770,000.

“The majority of capital growth came in the last six months,” he said. “From 2017 to 2020, the market didn’t really grow, it just held the same price but it’s gone up another $100,000 in the past six months.”

But it’s the eighth property in his portfolio that has a sentimental touch to it — he bought his mum’s property in western Sydney.

“Basically what happened is my parents never ended up paying off that loan as they kept on taking money out of it to do things. My stepdad is a bit of business person, so they took equity out of their home but not everything succeeded, so at one point the loan did get paid down but then they took money out to do business ventures and it pushed them back up again,” he said.

“So he’s now at a point where he’s not working anymore and mum is not working either. That happened about five years ago, so I decided to take over their whole mortgage as well.”

At 30, Mr Guan decided to make a move into property as a career, because he had achieved everything he wanted in design, but he also recognised that his earning capacity in that career would tap out at $150,000.

The move felt natural with his family and friends coming to him for property advice, but he said it was a huge step to quit an industry he had spent 13 years in, and he started off in a consulting role where he wasn’t even being paid a salary.

For Mr Guan, amassing the huge property portfolio doesn’t feel like “anything special” but he said he sacrificed a lot to make it happen.

“A lot of people wouldn’t do the things that I did and make decisions I did. Who wants to put themselves into millions and millions of debt? Who wants to quit their job and move into a new industry and be paid commission only?” he said.

“When I was first working in property I wasn’t even getting paid a salary – that was a pretty scary thing to do. I was very determined that I wanted to see a higher level of success than I could possibly achieve in the design industry. I was hungry for that and the decision doesn’t come lightly.”

Just last year in the middle of the pandemic, he founded his own company called Investmentor to help people build a property portfolio, including advice on where to buy based on capital growth, and with the aim to make “wealth accessible to everyone”, he said.

Mr Guan is confident someone could replicate his property success, despite the current situation with skyrocketing prices across the market.

“It’s absolutely possible to do that, because when we look at someone’s investment strategy it’s not about what is happening today, it’s about what’s going to happen over the next 10 to 15 years,” he said.

“If you look at my example, if someone is only investing in the short term based on what happens in the last 12 months and they become disheartened and sell, like I did when property was down and then in the next five years it doubled in value, then that isn’t successful.

“There are peaks and troughs in the market and you want to ride the peaks … and prepare the capital during the troughs.”

He adds that just because cities like Sydney and Melbourne have gone crazy, doesn’t mean opportunities don’t exist in other places around Australia. He recommends putting money into the Perth, Adelaide or Brisbane markets.

“There’s much more lenient markets for first time people to enter but there is never a point in time that there isn’t an opportunity, you just have to be willing to put the right time and resources into it to find it,” he advised.

Mr Guan isn’t planning to stop at eight properties either and has a goal to get to 13 in his portfolio, although he admits he is also juggling investing funds into his business.

“I now have enough properties that even if stopped right now, the wealth that accumulates will set me up for the rest of my life,” he said.