Australian house prices record highest increase in 18 years, particularly in Adelaide and Hobart

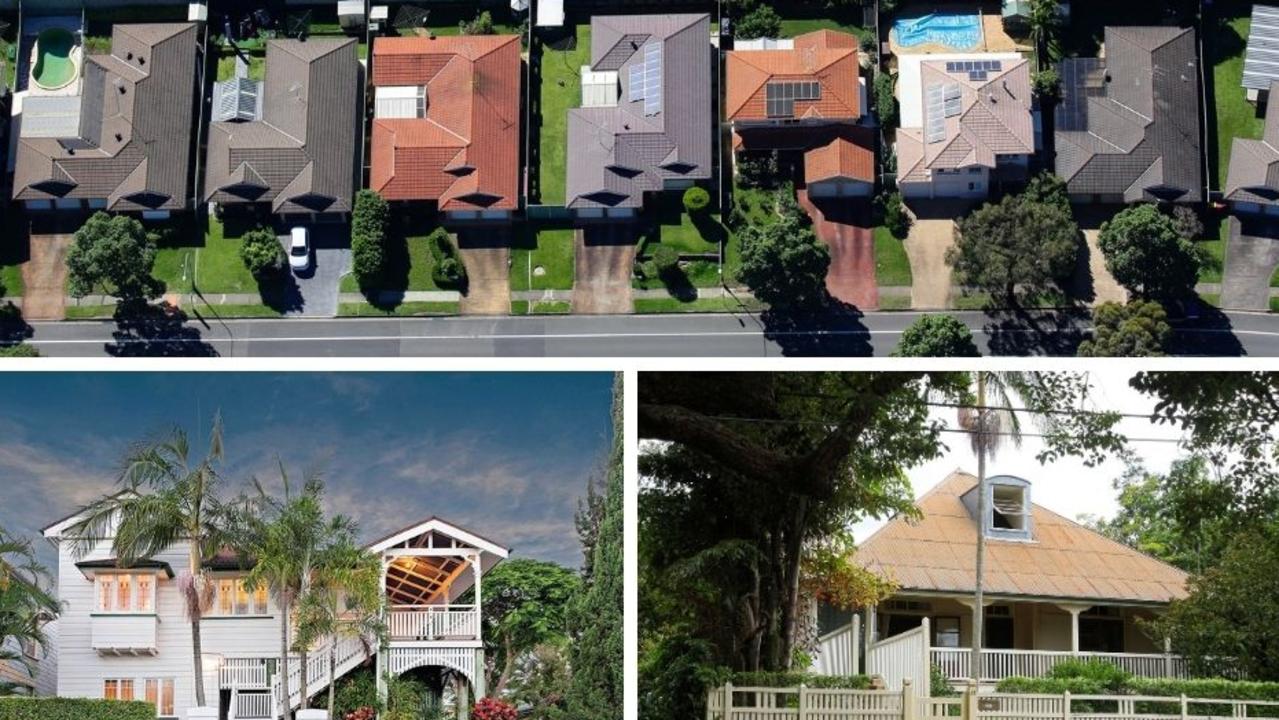

Sydney house prices hit a new record and other capital cities became less affordable, as some first homebuyers are paying more than $1 million to snag a property.

In grim news for house hunters, Australian house prices have skyrocketed to record highs, with the steepest increase in 18 years, and Sydney and Canberra recording the fastest quarterly increases in nearly three decades.

Sydney house prices jumped by $103,000 over the March quarter to hit a new record median of $1,309,195, while in Melbourne house prices are expected to crash through the $1 million mark in the next quarter.

The Domain House Price Report for the March quarter revealed that the Aussie dream of owning a home could be moving even further out of reach as traditionally affordable cities like Adelaide and Hobart set record highs.

Adelaide saw its highest annual gain since 2010, with house prices growing by 3.7 per cent to $599,706. For Hobart, house prices broke the $600,000 barrier for the first time, which means it’s now more expensive than Perth and Darwin to buy a property.

In Sydney, houses at the upper end are leading the price charge, with the strongest quarterly gains recorded in the eastern suburbs, northern beaches, Baulkham Hills and Hawkesbury. Sydney unit prices increased by 2.2 per cent in the March quarter to $751,038.

RELATED: ‘Why show up?’ Buyers’ frustration grows

Across Australia, the average house price is now just under $900,000, while units come in just below $585,000, Domain senior research analyst Dr Nicola Powell said.

“Nationally, house prices reached a record high over the March quarter of $899,509,” she said.

“The 5.7 per cent quarterly gain is the steepest rise in almost 18 years, with all capital cities posting growth. This is the first time house prices have risen simultaneously for two consecutive quarters since 2009 post-GFC.”

Record price gains are being set due to low interest rates, improved household savings, low availability of stock, lifestyle changes made after lockdowns, consumer sentiment sitting at an 11-year high and government incentives, according to Dr Powell.

With an influx of people fleeing the more expensive capital cities, Brisbane house prices soared to a median value of $632,999, with Aussies relocating to the Sunshine State at the highest level since 2006.

“COVID-19 has been the driver of change, accelerating an exodus from the larger cities of Sydney and Melbourne, and shifting residents across state borders – Queensland has been the population winner,” noted Dr Powell.

“Changed lifestyle preferences post-lockdown and the option of remote working has driven demand to Southeast Queensland as buyers are drawn by affordability, liveability, climate and greater value for money.

RELATED: Aussie houses selling at record speeds

After a five-year downturn, Perth prices have seen a steady increase with house prices now at $578,612 for the March quarter.

“Setting Perth apart is the affordability factor, with homeowners aware prices are below peak but rising, creating pressure to purchase before they accelerate too far,” Dr Powell said.

Canberra saw an almost 10 per cent increase with house prices surging to $927,577.

“Canberra is a breakaway performer compared to the other capital cities, recording the strongest annual and quarterly house price growth,” Dr Powell said. “Another quarter at the same percentage growth rate would push house prices above $1 million.”

Up in the Top End, house prices in Darwin jumped by 9.1 per cent to $554,295 – the steepest rise in over 10 years.

First homebuyers willing to hand over $1 million in NSW

With house prices skyrocketing, first homebuyers in Australia are willing to splash out eye-watering sums on a home, according to new research from comparison website Finder.

It found more than a third of first homebuyers from NSW are willing to pay over $1 million for a home.

But in Victoria, just 17 per cent of first homebuyers and 16 per cent of those in Queensland were willing to shell out seven figures on a property.

The survey found that the median budget for first homebuyers is between $500,000 and $750,000.

Graham Cooke, head of consumer research at Finder, said that despite price inflation, first-time buyers haven’t given up on their dream of home ownership.

“The combination of rising land values, low interest rates and easy access to finance has caused an explosion in property prices, particularly in Sydney,” he said.

“This means it could take years for some buyers to scrape a deposit together, making it even harder to get their foot on the property ladder.”

Although more first homebuyers from NSW are prepared to pay over $1 million compared to their Victorian and Queensland counterparts, their salaries are only marginally higher.

ABS wage data from February 2021 shows that on average, NSW workers are the nation’s third-highest earners after those living in the ACT and Western Australia.

Annually, NSW workers earn around $91,099, which is $7098 more than QLD employees, and $1737 more than Victorian workers.

When it comes to cracking the million-dollar mark, men are nearly twice as likely as women to have a budget of more than $1 million.

Mr Cooke said that saving for a deposit isn’t easy, but it can be done.

“There are plenty of online tools and calculators that can help you work out how much you need to buy a home, along with your borrowing power,” he said.

“From here, you can work out how much you need to save to be able to afford a deposit.

“Remember that the cost of borrowing may rise in the future, even if rates are low now.

“Banks can increase rates independent of the RBA – so make sure you can afford to pay a one to two per cent higher interest rate if required.”

Buying still cheaper then renting

Purchasing your own home though is still set to save people money compared to renting, although getting a deposit together is the biggest barrier to making it happen.

More than half of homes across Australia will be cheaper to buy than rent over the next 10 years at current prices, according to a report from the REA Group.

Buying conditions are particularly favourable outside of NSW and Victoria, with

more than 80 per cent of houses and almost all units, estimated to be cheaper to buy than rent.

Suburbs that offered the largest monthly savings for buying compared to renting include Tacoma in Sydney with a difference of $578 and Waterford Park in Melbourne with savings of $472.

Zuccoli, a suburb of Palmerston, near Darwin, was the best bargain buy, as opposed to renting, with a difference of $1449, while Kilcoy, 100km northwest of Brisbane, offered $1014 in savings for being a property owner and Coombs in ACT would net someone $1001.

Buying a property in the Perth suburb of Hilbert would put $811 more in someone’s pocket a month compared to renting, while Adelaide’s Elizabeth South had a price difference of $772 and Clarendon Vale in Hobart came in at $993 a month.

Paul Ryan, REA group economist said the report findings pointed to continued strong housing price growth, particularly outside Sydney and Melbourne.

“Many regions have hit all-time price records so it’s understandable that many people would be surprised to hear that it’s still more affordable to buy in more places than it is to rent,” he said.

“This research shows that much of the increase in demand we have seen in late 2020 and early 2021 has been driven by exceptionally low borrowing costs. The result is that the majority of properties in Australia are cheaper to buy than rent at current prices.

“Investors are driven by the same comparison between prices and rents, so the finding that so many units in particular are cheaper to buy suggests there may be profitable investments currently available. On this basis, we expect investor activity in the housing market to increase through 2021.”