Aussie Home Loans Suburb Spotter Map shows truth of housing affordability in Australia

A new tool reveals how much money you need saved to buy in suburbs around Australia and the picture isn’t pretty.

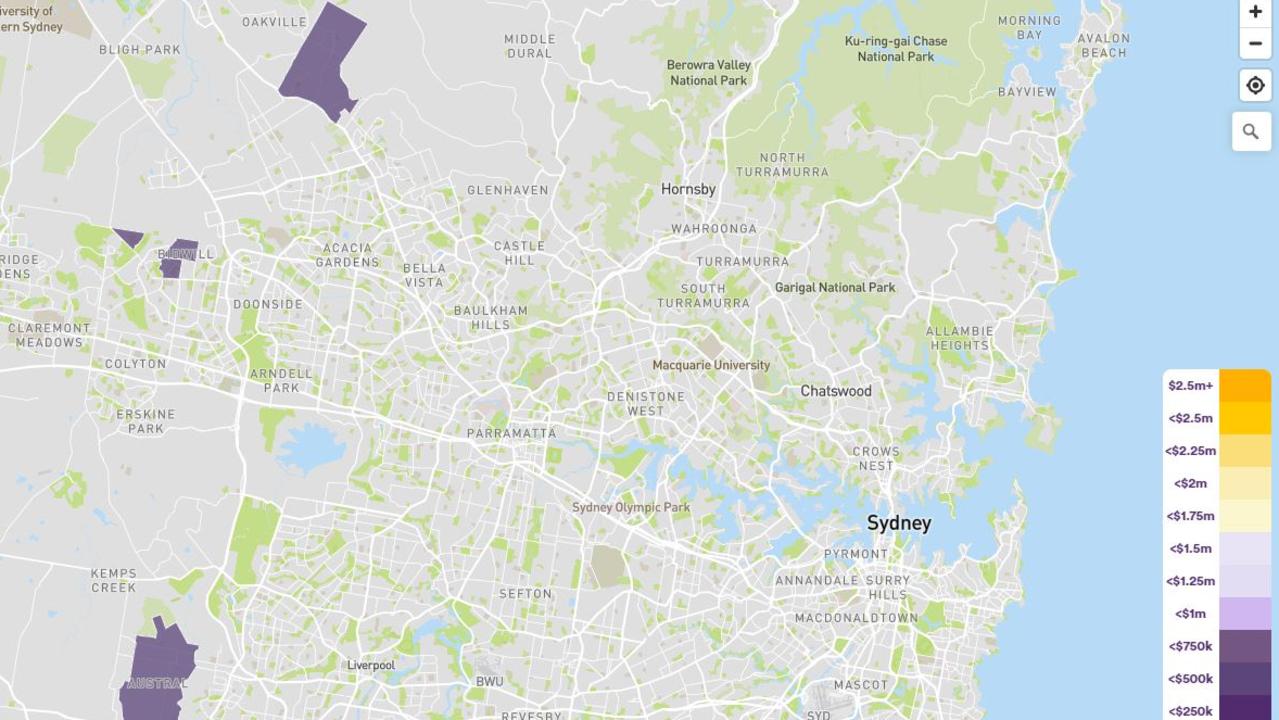

A map that shows what suburbs Aussies can afford to buy a house in based on their deposit shows the brutal reality of trying to break into the property market.

In Sydney, for people with savings of up to $100,000 who are looking to put down a deposit of 20 per cent, there are just six suburbs where they could afford to buy.

All are located in the outer city and are more than 40km away from Sydney central, including Austral, Airds, Blackett, Bidwill, Box Hill and Willmont.

Things are even worse in the nation’s capital with no houses available in Canberra with the same deposit.

Melbourne offers slightly more options for the $100,000 worth of savings with more than 10 suburbs affordable to buy including Wyndham Vale, Rockbank, Dallas Meadow Heights and Coolaroo.

Created by Aussie Home Loans the suburb spotter map draws on CoreLogic data to help prospective buyers spot suburbs across Australia that they could buy in based on median property prices and deposit amounts.

RELATED: Sign that housing market is overheated

Research from the mortgage broker found that more one in two Australian property buyers feel unsure about how to take the first or next step to achieve their property goal and over half identify market pressure as making them feel stuck.

Surprisingly, given house prices are skyrocketing across Australia, 80 per cent of those surveyed believe 2021 will be a good year for their property plans, with property buyers feeling more optimistic compared to June 2020.

Confused and unprepared home buyers

David Smith, CEO Lending at Aussie Home Loans, said buying a property is a big deal for most people but many buyers are confused and overwhelmed.

“In today’s property market, it’s easy to be intimidated by the big numbers you see on property listings – so we wanted to show Australians the tangible numbers of what it takes to get you to your goal. We think it’s important to show buyers what a deposit of five, 10, 15, or 20 per cent could get you on the map,” he told news.com.au.

“With two in three aspiring buyers missing out on properties because the market was too competitive, the over half not knowing what suburbs they can afford to buy in, and two in five confused about the current house prices in their desired suburb, the current housing boom is creating a form of ‘progress paralysis’ amongst many Australians.”

News.com.au has previously revealed the heartbreaking reality for many Aussie families, who have been struggling to get on the property ladder despite savings of between $100,000 and $135,000.

Yet Mr Smith believes there is still significant opportunities out there although he acknowledged “the competitive market conditions may be disheartening”.

“According to our research, two in three property buyers are missing out on properties because they were not ready with a pre-approval. When you do find a home, having finance pre-approved leaves you free to focus on price negotiations — rather than juggling the stress of finding a suitable home loan at the same time,” he said.

“You’re also generally in a good position to snap up a bargain quickly, proceed to full approval for your loan and exchange contracts before others in the market are able to.”

RELATED: Hardest place to buy a home in Australia

For a beginner, it can be particularly hard to take the first step with no prior experience in the property market, he added.

“So for anyone stuck on where to start or look, the suburb spotter map can help you spot suburbs across Australia that you could buy in, based on the average deposit amount you’ll need,” he said.

“It is also a great way to explore and expand your property search; because the neighbouring suburbs might still offer the lifestyle you’re looking for – without the higher price tag.”

Sparks of hopes in some cities

But it’s not all bad news for home buyers around Australia.

The map shows Adelaide, Brisbane and Perth have substantially more suburbs that are achievable to buy with $100,000 or less in the bank.

Single mum Leila Cienciala, who works in real estate administration, thought she would never be able to buy a house like the clients coming through the doors.

But she was able to secure her first home in March. She spent two years working towards the goal, with savings of $8500 that she had accumulated over 10 years which she then managed top up to $40,000 by reigning in her spending.

She followed a scheme similar to that recommended by the Barefoot Investor, with four different accounts separated for daily expenses, savings, school and sports, as well as bills.

With two teenage daughters, she also looked at savvy spending like buying second hand clothes.

Two months ago she snapped up a three bedroom property in Adelaide’s northern suburbs.

The 40-year-old said it was “empowering” to own her home as well as offering her family a sense of security.

“Over COVID, we saw a massive spike in rental demand and not enough properties and single parents were competing with high income earners. Now I’m out of that I think I’m so glad I’ve got my own house and I don’t have to worry about having to move every three years as the owners are selling up their investment properties or renovating,” she told news.com.au.

“I have had to move every three years for last 15 years. It’s demoralising for a start to have people come in to inspect the property every three months for routine inspection and we don’t have to deal with it anymore. The children can put pictures on the wall and I can drill a hole in the wall to put a mirror or clock up, so its empowering, fun and secure.”

Aussie Home Loan’s research also found people are confused about understanding home loan language and how to secure the required finance or a home loan and the pre-approval process.

Top 10 least affordable Aussie suburbs on the map ranked by median dwelling values:

Longueville, Lane Cove — $3,641,690

Dover Heights, Waverley — $3,242,502

Clontarf, Northern Beaches — $3,164,193

Palm Beach, Northern Beaches — $3,055,580

Bringelly, Liverpool — $3,034,600

Balgowlah Heights, Northern Beaches — $3,009,225

Castlecrag, Willoughby — $3,008,90

Northbridge, Willougby — $2,933,663

Vaucluse, Waverley — $2,786,127

Hunters Hill - $2,748,552

Top 10 most affordable Aussie suburbs on the map ranked by median dwelling values:

Noresman, WA, — $58,286

Cunnamulla, QLD — $70,428

Coober Pedy, SA — $76,346

Coonamble, NSW — $81,747

Bourke, NSW — $84,494

Blackall, QLD — $84,588

Charleville, QLD — $84,826

Peterborough, SA — $87,530

Wee Waa, NSW — $87,596

Coolgardie, WA — $90,287