Australia’s richest billionaires: Where they built property empires

Australia’s biggest billionaires aren’t rich because they leave their money sitting in a bank. See how they’ve built their empires.

Australia’s biggest billionaires are shaking up the property market with some eye-popping purchases.

Mining queen Gina Rinehart topped The List: Australia’s Richest 250 in 2024 thanks to her relentless quest for high-value acquisitions, and she’s not alone.

Nicola Forrest is emerging from the shadows of her failed marriage to Andrew ‘Twiggy’ Forrest, making a name for herself with lavish luxury ventures.

Check out how much Australia’s biggest billionaires are worth and where they are spending their money to build property empires.

RELATED: Versace Castle: medieval Victorian home has its own armoury

How you could own a home on The Block for just $350k

Award-winning TV chef offloads ‘Middle East Feast’ house

1. Gina Rinehart – total worth $50.48bn

Australia’s wealthiest woman, mining magnate Gina Rinehart, is also raking in the cash courtesy of a mind-blowing property empire.

From cattle stations larger than Japan to lavish luxury homes and lucrative mining sites, she’s bringing in the big bucks.

One of her massive 918,000ha cattle stations in Queensland’s remote outback has shot up in value from $14m to a staggering $54m.

With more than a dozen cattle stations to her name and a fortune exceeding $34bn, Rinehart’s property portfolio is a money-spinner.

A significant strategic purchase for Reinhert was the acquisition of S Kidman & Co, a company historically linked to her maternal grandfather.

Rinehart, in a partnership with Shanghai CRED, invested $386.5m to double her cattle stations to 21 and added nearly 4 million hectares, all part of a flourishing $200m deal reflected in the Weekly Times farm ownership report.

Even with some land sold off, including a 550,000ha Northern Territory station, Rinehart maintains major agricultural holdings, such as a 400,000ha farm in Fitzroy Crossing, Western Australia, and 384,451ha in the Pilbara – a prime mining location.

Additionally, she controls almost 1.5 million hectares in Queensland, larger than the size of Australia’s capital cities, under the S Kidman & Co banner, with plans for potential expansion to enhance proximity to key ports and markets.

In Victoria, she recently purchased Chrome Park, a 51ha farm for $8.6m, known for prestigious livestock and horse breeding for more than 60 years. Furthermore, towards the pandemic’s end in 2022, Rinehart invested upwards of $76m in four properties within a single Queensland suburb. This includes acquiring a $9.75m beach house from fellow entrepreneur Therese Rein, who had only purchased it for $6.75m six months prior.

The Sunshine Beach property, built in 1980, boasts breathtaking ocean views and development approval.

Located a few doors away from another Rinehart property purchased at $11.2m, she continues to acquire high-value properties, including a record-setting $21.5m home there.

Moreover, a Hancock Prospecting-affiliated company disbursed $34m for one of Queensland’s priciest homes, underpinning Rinehart’s ongoing interest in this prestigious area.

2. Nicola Forrest (with Andrew Forrest) – $37.17bn (combined)

Nicola Forrest (joint with her ex-husband Andrew ‘Twiggy’ Forrest) comes in second on the list – and she isn’t your typical rich lister.

Following her separation from Twiggy, the founder of Fortescue Metals Group, she’s become notable in her own right.

Usually based in Australia, Ms Forrest’s influence spans extensive business interests, such as the private Tattarang empire, jointly held with her former husband.

In the glittering world of acquisitions, Ms Forrest is no stranger.

In 2021 she, alongside Twiggy, secured a luxury Queensland island resort, Lizard Island, for a hefty $42m.

Their ventures included acquiring the Gaia Retreat & Spa near Byron Bay, a collaboration with the late Olivia Newton-John.

This $30m deal brought them into the limelight outside the mining sector, capturing wide interest.

Ms Forrest’s ventures also extend beyond Fortescue to include luxury properties and business acquisitions.

Earlier shared with Twiggy, these assets highlight her independent stature.

Recently, her separate holding in Fortescue has elevated her presence on The List, distinguishing her wealth from the combined family fortune.

3. Anthony Pratt & Family - $27.66bn

Melbourne’s cardboard king, Anthony Pratt, presides over a real estate dynasty crowned by Raheen, his palatial Italianate manor in Melbourne’s inner eastern suburb of Kew.

Valued at a staggering $100m, this architectural jewel is destined to remain in the Pratt family’s exclusive grasp, tantalising admirers but never gracing the real estate market.

Built by renowned architect William Salway for brewery mogul Edward Latham, the mansion boasts a legacy of elegance and grandeur.

Sir Henry Wrixon, a pillar of Melbourne’s legal history, later called it home.

Since Anthony’s late fatther Richard Pratt’s acquisition in 1981, the family has restored and expanded this heritage-listed wonder with a striking Glen Murcutt designed extension.

While its gates occasionally open for charity events, Raheen remains a private oasis for guests of extraordinary fortune.

Pratt, a titan in both business and property, followed in his father’s footsteps – his ambitious property portfolio extends far beyond Melbourne’s suburbs.

In 2021, Pratt captured headlines with a record-setting $22m purchase in Sydney’s picturesque North Bondi.

Adding an international feather to his cap, Pratt procured a New York property for AU$21.3m in 2019.

Parallel to his property conquests, 2023 saw him open a colossal $US700m paper mill in Kentucky, epitomising his commitment to U.S. industry — a venture that began three decades ago in a single factory

Visa’s co-owner, alongside sisters Heloise Pratt and Fiona Geminder, Anthony Pratt’s empire contributes 60 per cent to a jaw-dropping $10bn in annual family revenue.

4. Harry Triguboff – $26.01bn

In the dynamic world of Australian real estate, few names resonate with as much authority and success as Harry Triguboff, the chief executive of Meriton.

Almost two decades ago, Triguboff made a strategic move that continues to bear fruit: he chose to retain and rent out a portion of the massive number of apartments Meriton constructs annually.

In 2023, while Meriton’s annual profit experienced a slight dip to approximately $290m, the company’s rental income soared by an impressive 36 per cent, reaching $660m from the nearly 15,000 units.

Triguboff has actively acquired several development sites across Sydney, southeast Queensland, and has made a noteworthy entry into Melbourne’s market with a serviced apartment building in the CBD.

He also took a dip into the Gold Coast’s booming market in 2021, with his purchase of a second prime site in Surfers Paradise.

In Sydney, the company also constructed a 270-unit block in Zetland.

In a testament to Meriton’s enduring legacy, units at 96 Burns Bay Lane Cove were taken to market this year with an estimated value of around $10.5m – with the result surpassing expectations.

The site, a 1970 block reputed to be an early example of Triguboff’s work, underscores the lasting appeal of Triguboff’s footprint on Australian real estate.

5. Mike Cannon-Brookes – $22.92bn

Mike Cannon-Brookes, the co-founder of Atlassian, sees his fortune skyrocket with the robust performance of his software giant’s NASDAQ-listed shares.

The tech mogul founded Atlassian with Scott Farquhar back in 2002 after meeting at the University of NSW.

However, recent headlines have been dominated by Cannon-Brookes’ personal life, particularly the highly publicised separation from his wife, Annie.

Amid the glitter of their sprawling real estate portfolio — worth more than $500m in Sydney and southern NSW — the financial details of their split remains tightly under wraps.

Steering his focus back to property, Cannon-Brookes continued an extravagant buying spree in the idyllic Southern Highlands, marking three notable additions in Mittagong.

Cannon-Brooke’s latest snag was a $12.25m estate sprawling over 4.3ha on Reservoir Street.

The Mittagong property adds to the already impressive 9.8ha Greyladyes Farm, purchased for $13m from developer Andrew Richardson in 2022.

His Point Piper home, a 1.1-ha property acquired by Cannon-Brookes in 2018 was purchased for $100m from the estate of the late Lady Mary Fairfax.

This estate held the title of Australia’s most expensive house until Farquhar broke the record.

6. Scott Farquhar – $22.65bn

Scott Farquhar’s substantial wealth is largely attributed to his significant shareholding in Atlassian, the software company he co-founded in Sydney with fellow co-founder and rich lister Mike Cannon-Brookes.

Similar to Cannon-Brookes, Farquhar annually sells a relatively small yet highly profitable portion of his stake to enhance Atlassian’s stock market liquidity.

This strategy generates hundreds of millions of dollars in cash for the duo each year, enabling Farquhar to make high-profile purchases such as the $71m cash acquisition of a mansion in Sydney’s Point Piper when he broke national house price record for the crumbling home for $71m.

He recently sold the property, which neighbours Cannon-Brookes’ own home, for a record $130m and is a serial renovator in his own right.

Farquhar and Cannon-Brookes first crossed paths at the University of New South Wales, later founding Atlassian in 2002 and listing it on the NASDAQ in 2015.

Farquhar, alongside his wife Kim Jackson, also established the venture fund Skip Capital, which has invested in numerous infrastructure projects and start-ups, including Canva.

7. Clive Palmer – $21.92bn

Clive Palmer, a prominent and often controversial figure in Australian politics, continues to diversify his investments by leveraging the substantial mining royalties he receives annually.

Palmer is a notable collector of Queensland properties and vintage cars.

Palmer has acquire numerous high-value estates across Brisbane and the Gold Coast.

He has developed a private compound in the affluent suburb of Fig Tree Pocket, Brisbane, amassing an estimated over 40,400sq m with nearly half a kilometre of river frontage.

The home which could be valued at over $60m, grew with the purchase of multiple neighbouring properties since 2018.

Palmer has expanded his holdings with recent acquisitions, including a $28m luxury home on Hedges Ave and another valued at $16.95m on Albatross Ave on the Gold Coast.

In addition to his real estate ventures, Palmer is highly active in the political arena, famously spending $2m to support the ‘No’ campaign during last year’s Voice to Parliament referendum.

The ex-real estate agent is also known for his extensive legal battles, displayed in his $300bn damages claim against the Australian government concerning the stalled Balmoral South iron ore project in Western Australia.

Palmer made headlines with the purchase of the Hyatt Regency Coolum site, famously featured in the Australian cult TV series Kath & Kim.

While retaining the golf course, he left the hotel portion in disrepair, despite prior plans for development.

However, redevelopment efforts for the resort commenced in late 2023, signalling a new phase in its transformation – he has revealed plans to establish a car museum at the golf resort.

8. Kerry Stokes – $11.01bn

Kerry Stokes, the chairman of Seven Group Holdings, has witnessed a significant increase in the conglomerate’s share price – amid an ongoing media circus at Seven West Media.

Seven Group Holdings owns several key ventures, including Caterpillar mining truck dealerships across Western Australia, New South Wales, and the Australian Capital Territory, along with Coates, an equipment hire business, and holds a majority stake in the building supplies company Boral, alongside various oil and gas-related investments.

On the real estate front, Glanworth House, located at 5 Lindsay Ave in Darling Point, stands out as one of Stokes’ prominent acquisitions and is often hailed as one of the finest residences in Sydney. Stokes acquired this prestigious property back in 1998 for $9.5m.

Stokes, is widely recognised as the executive chairman of Seven West Media, which owns the Seven Network,

However, Stokes’ involvement in the media sector has been fraught with challenges.

He is reported to have invested approximately $30m to support Ben Robert-Smith’s defamation lawsuit against Nine, Seven’s competitor, and agreed to cover Nine’s legal expenses to prevent the disclosure of emails involving Seven, his private firm, and the ex-soldier’s legal team.

9. Cliff Obrecht and Melanie Perkins – $10.92bn

Husband and wife Cliff Obrecht and Melanie Perkins have built themselves an empire from online graphics company Canva.

On the property front, its chief executive Perkins and chief operating officer Obrecht making the call to offload their Surry Hills warehouse investment apartment in 2021.

The one-bedroom, one-bathroom apartment at 109/26-44 Kippax Street, Surry Hills sold for $870,000 in 2021.

The swanky warehouse conversion boasted huge arched windows and soaring 3.6m ceilings the feeling of a classic New York brownstone.

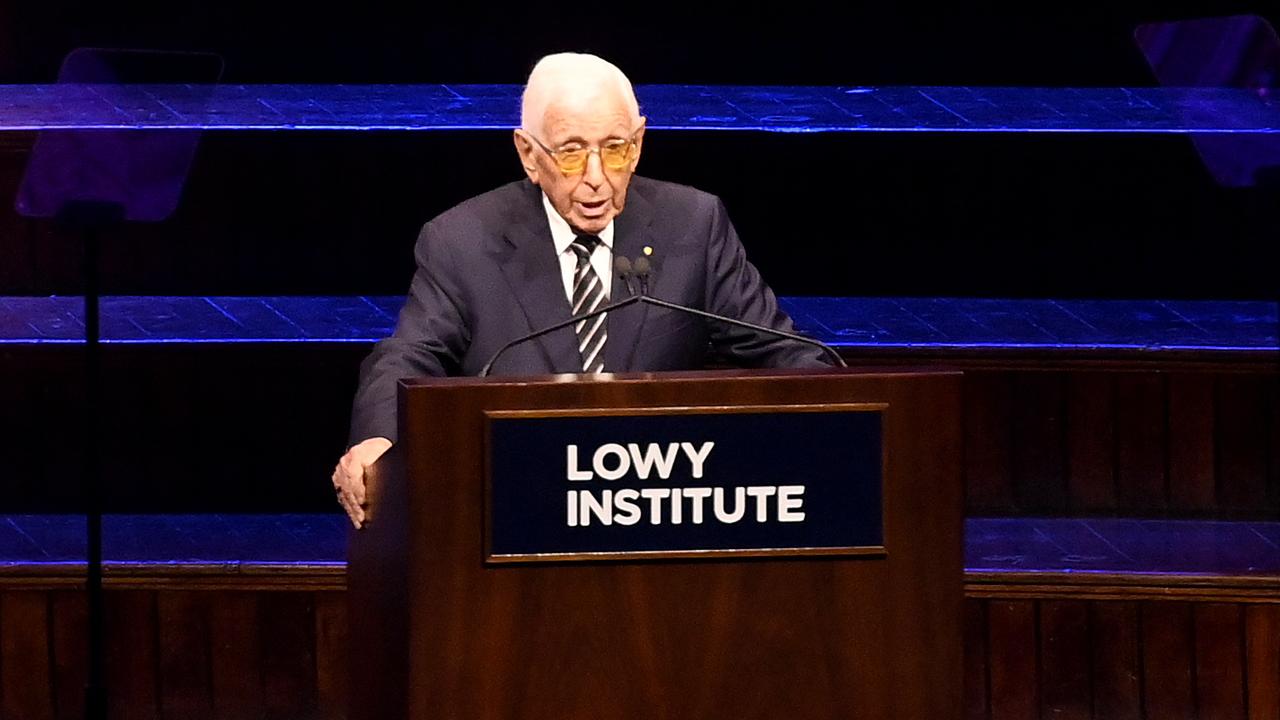

10. Sir Frank Lowy – $10.26bn

Sir Frank Lowy, renowned as a co-founder in the Westfield Group, continues to make headlines with his strategic property moves.

The Westfield empire, co-founded by Lowy and former business partner John Saunders in 1959 in Sydney’s Blacktown, blossomed into a global shopping centre powerhouse.

Recently, Lowy has been linked to a local consortium that acquired a commercial site in Eastwood for $29.8m at auction this month.

The purchase, conducted through CBRE Western Sydney agents Lord Darkoh and Ray Ahsan, was reported to be one of the most significant transactions in terms of price per square metre for a commercial property.

Attempts by a buyers agent reportedly representing Lowy with “Team Lowy” with a bold $1m knockout bid were unsuccessful.

The CBRE agents said they had no knowledge of Lowy being even interested in the property.

The auction is said to be the biggest auction of the year so far.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Once a star on The Block, now a steal: Port Melbourne luxury pad lists for $2.1m

Is this Australia’s cheapest metro home?

Bayside’s biggest beach box has TV, kitchen and Bain-Marie

david.bonaddio@news.com.au

Originally published as Australia’s richest billionaires: Where they built property empires