Australia’s ‘crane index’ hints at a recovery in the embattled building sector, offering a glimmer of hope amid the housing crisis

Cast your eyes upward in most Australian cities at the moment and you’ll notice a trend that offers a glimmer of hope amid the nation’s severe housing crisis.

The latest numbers from an economic measure known as the ‘crane index’ show positive momentum in the residential construction sector, which offers a glimmer of hope for Australians being hammered by the housing crisis.

Right now, the number of cranes in the sky on building sites across the country has hit the second-highest level on record.

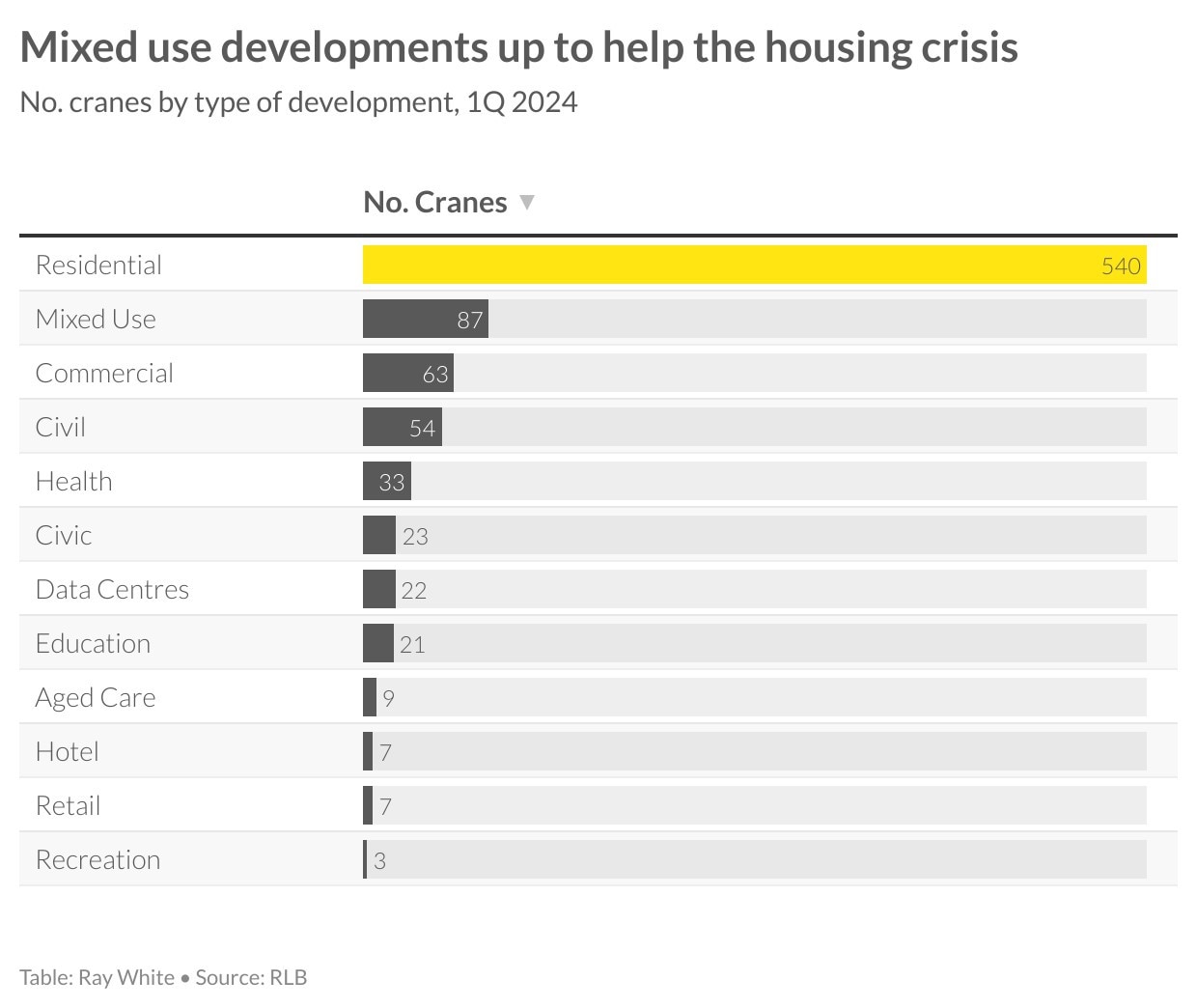

Of the 869 cranes currently active, 540 are working on residential projects, signalling a rebound in confidence in an industry that’s been in the doldrums for the past few years.

Vanessa Rader, head of research at Ray White Group, said residential projects “absolutely dominate” in the crane index, with particularly strong conditions across the east coast.

“But importantly, the fact these are cranes also suggests rather high-density properties. You’re not usually putting a big crane up for a small townhouse development or something like that,” Ms Rader said.

“So, it’s a super positive sign when it comes to housing supply. The fact it’s maintained a high rate definitely indicates we’re heading towards more supply in the pipeline.”

Beginning of a boom?

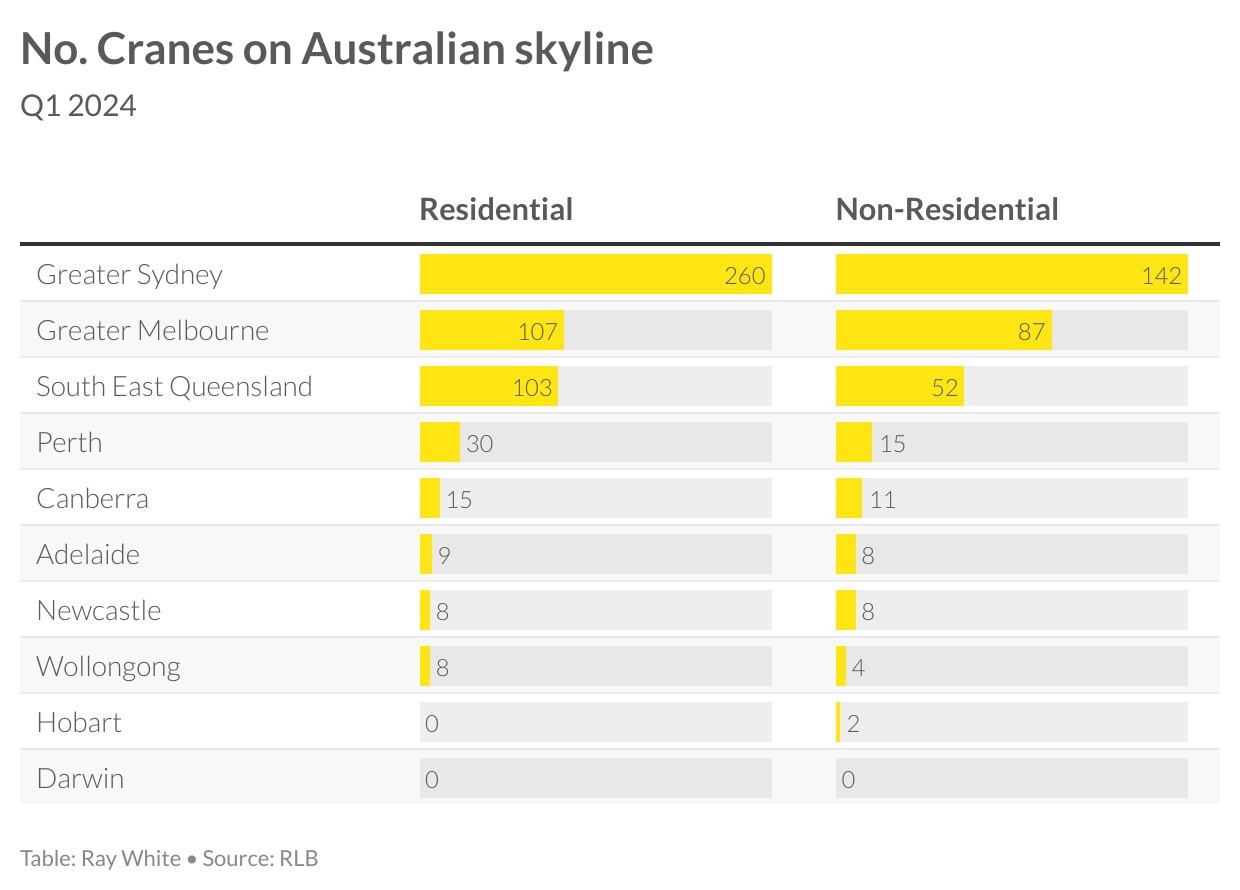

Great Sydney, including the New South Wales Central Coast, has the highest level of activity with 402 cranes across the skyline, accounting for almost half of all activity nationally.

In the past six months, as 108 cranes were disassembled at completed projects, another 100 were erected at new sites.

“The greatest number is located in Sydney’s north, with an increase in mixed-use developments and strong residential activity in suburbs like Macquarie Park,” Ms Rader said.

“Sydney’s West is also busy with 31 new cranes erected for both residential and non-residential projects including Western Sydney Airport, Kemps Creek and Tallawong Village. Cranes are now seen in 35 suburbs across the western suburbs.”

The 194 active cranes across Greater Melbourne make up 22 per cent of all activity nationally, with a strong increase in the past quarter.

“The high population zone of southeast Queensland continues to be the third-greatest location for cranes, representing 17.8 per cent of activity,” Ms Rader added.

“However, this period we have seen a reduction in crane numbers across some regions, with Brisbane down seven cranes to 78, Sunshine Coast down six to 16 as projects come to an end, while the Gold Coast remained stable at 16 cranes.”

Again, the proportion of cranes working on residential projects dominates in the southeast Queensland region, she said.

Ms Rader said there was a clear “urgency” in moving ahead with residential and mixed-use developments.

“We’re building more,” she said. “Construction is starting to happen, which is good news because we were going through that period where the industry was really unsure.

“Developers were unsure what to do, materials prices were high, labour issues were very tight … the fact that people are starting to construct property, in particular residential, is only a good news story when it comes to the housing supply issue.”

Horror time for builders

In the wake of pandemic, the home-building sector faced extreme conditions that put unprecedented pressure on operators.

The cost of building materials soared post-Covid as supply chains were thrown into chaos and demand skyrocketed, pushing prices higher by about 18 per cent each year.

Cost increases have come down to about eight per cent per annum, but they remain historically high. As a result, large-scale projects are expensive to get out of the ground.

At the same time, a shortage of skilled labour is putting additional pressure on the industry.

Those forces combined have seen countless builders, both small and big, collapse in recent years. Corporate insolvencies continue to rise across the country.

More activity essential

Tom Devitt, senior economist at the Housing Industry Association, said the number of new home sales across the country increased by 4.9 per cent in March compared to the previous month.

While an increase is good news, results over the first quarter of the year are flat when compared to the same period in 2023.

“Concerningly, sales in the first three months of this year remain 41.3 per cent below the same quarter in 2021, 18.2 per cent below the same quarter in 2020, and 18.9 per cent below the same quarter in 2019,” Mr Devitt said.

“There is an increasing divergence at a state level, as those markets with higher land prices endure a larger downturn in home sales.”

Sales across New South Wales and Victoria are “down significant” compared to previous years, by 48.7 per cent and 32.7 per cent respectively, he said.

“Lowering the cost of delivering new homes to market is essential to achieving the Australian Government’s target of 1.2 million new homes over the next five years,” Mr Devitt said.

Building approval data also makes for unhappy reading, Ms Rader.

“If you look at the building approval statistics, we know across the country that we have a shortfall. And approvals don’t necessarily always translate to construction either.

“However, the encouraging thing is that the crane index has increased from that Covid period, from even prior to the Covid period. It’s higher today than it was back then.”

High demand and constrained supply continue to put upward pressure on home purchase prices in virtually all markets.

In the rental market, historically low vacancy rates and rising demand are seeing would-be tenants battle it out for a small pool of available homes.

As a result, prices have risen sharply in previous years and there are few signs of relief on the horizon.

“The housing market is in a really difficult situation,” Ms Rader said.

“If you look at the forecasts for population growth going forward, particularly across those east coast markets, we are in a situation where housing needs to increase quite a lot.

“And also, a lot of these big projects, from conception through to completion, can take anywhere up to six years.

“So, anything we can do to start moving the process along rapidly is going to be a good news story.”