Australians don’t trust the RBA to ease the cost of living in 2023, report finds

Burnt by a perceived promise by the RBA, Aussies are losing trust in the institution and are now forecasting their own trends for the property market.

Burnt by a perceived promise by the Reserve Bank of Australia that it would hold off increasing the official cash rate, Australians are losing trust in the institution and are now forecasting their own trends for the property market, a new study reveals.

During the worst of the pandemic in 2020 and 2021, RBA governor Philip Lowe strongly suggested Australia’s official cash rate would not be lifted until late 2023 or early 2024.

RELATED: Top 100 suburbs tipped to survive property downturn

Victoria’s best home and top 50 ranked

Hamish McLachlan making ‘phenomenal’ $13m South Yarra property play

But from May this year an eight-month campaign of hefty rate hikes moved the figure from a record low of 0.10 per cent up to 3.10 per cent.

As a result, borrowing power plummeted and housing prices started dropping.

Consumer sentiment bucks RBA prediction

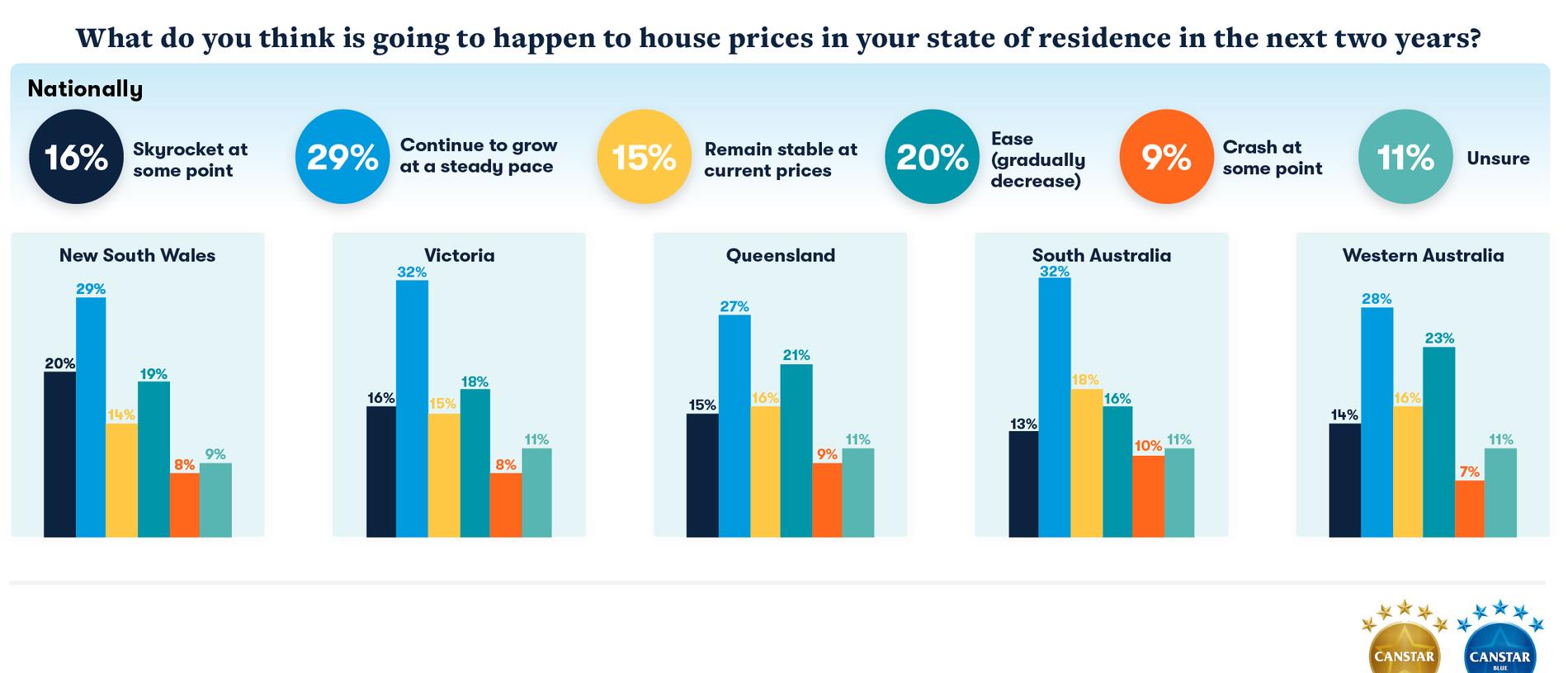

Despite RBA modelling suggesting house prices could fall by as much as 20 per cent nationally by the end of 2024, many Aussies still expect the direction of dwelling values to either stay put or head north, according to new research by Canstar.

In its Consumer Pulse Report, 60 per cent of respondents said they expected house prices to remain stable, grow or possibly even skyrocket at some point before the end of 2024.

Want tips to help manage the rising cost of living? Read Compare Money's guide >

When asked if they were concerned about property prices falling in the next two years, 49 per cent said “no” while 36 per cent said they had “some worry” and would reconsider decisions relating to accessing their equity, buying an investment property, planning for retirement or their investment strategy.

“Given the contrary view of many property market experts, the confidence Australians have in stable or growing property prices is surprising.

Perhaps the opinion reflects a long-term rosy view of property, which is held by the almost 70 per cent of homeowners not planning to sell in the next few years,” Canstar’s finance expert Steve Mickenbecker said.

Unfazed by price drop predictions, 31 per cent of property owners surveyed said they were considering selling their home or investment property in the next few years with upsizers leading the charge.

Borrowing concerns outweigh price falls

Buyer’s advocate Cate Bakos said she wasn’t surprised by the respondents’ contrary stance on a 20 per cent price crash as she believed savvy purchasers are less likely to buy into the hype.

“I think in those figures we’re seeing are a bit doom and gloom. I don’t believe those predictions and the reason I say that is they consistently get it wrong,” she said.

“We saw predictions about an impending crash after Covid, and we had the opposite.

“We also saw predictions about a crash during the GFC which wasn’t anywhere as significant. I’ve seen so many cycles now and those dramatic predictions grab headlines but there’s not always a lot of substance behind them.”

She said the disproportionate supply of housing stock, compared with continued demand, has so far saved Australia from considerable price falls this year.

“If we’d had a flood of listing activity, we might have seen sharp price falls but vendors have been sitting tight because they don’t choose to sell in a down market.

“That’s given us a bit of a floor under price falls which has been a positive,” Ms Bakos said.

However, the conversations around uncertainty have spooked one sector of the buying public.

“All this talk of downturns has impacted first-home buyer nerves. They’ve become really jittery and they’re not doing anything. It’s created a multi-speed property market; first-home buyer stock which is typically sub-$1m units and townhouses have come off because first-home buyers are just completely freaked,” she said, adding that the middle market is soldiering on.

“The general feeling out there is more of a frustration at the cuts to the borrowing capacity, rather than anger towards the RBA.

“There’s a bit of a frenzy of people trying to get in before a subsequent increase further erodes their borrowing capacity. It’s a bit of ‘family home FOMO’ right now.”

MORE: ‘Worrying’ rental crisis only going to get worse

Shock as fraudsters mimic rental listings

Doubts around debt

Although surveyed consumers seem to be confident property prices will remain stable, they are less confident about their ability to comfortably service a mortgage into 2023.

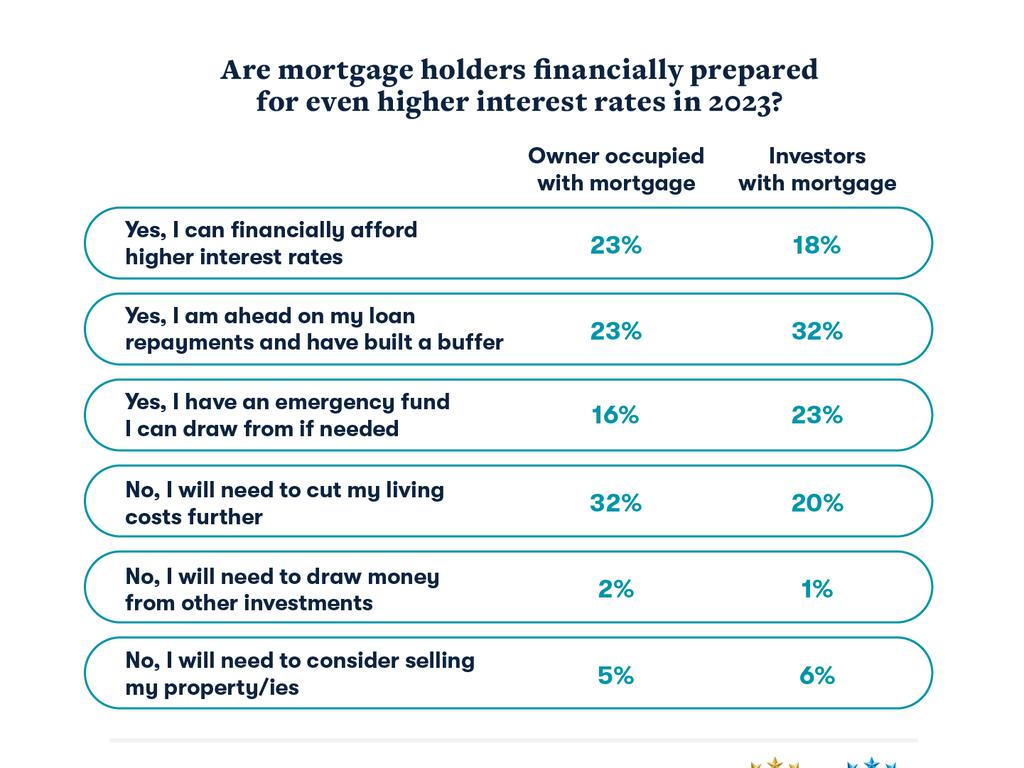

“The cash rate could reach as high as 3.85 percent next year, pushing the average variable rate for existing borrowers up to 6.73 percent and adding since April more than $1130 to monthly repayments on a $500,000 loan over 30 years,” Mr Mickenbecker said.

“The most startling find when it came to mortgage holders coping with higher interest rates is worryingly almost one in two – 48 per cent – of homeowners with a mortgage and 37 percent of investors with a loan are unsure how much their mortgage interest rate has risen since the Reserve Bank started aggressively lifting interest rates in 2022,” Mickenbecker says.

When asked how prepared they were for even higher interest rates, 39 per cent of homeowners and 27 per cent of investors were not prepared and indicated they would need to cut their living costs further to make ends meet.

The bank of mum and dad still in play

Cost of living pressures combined with sky high property prices in many markets (despite falling prices) more Australians are conceding that getting on the property ladder is a multigenerational feat.

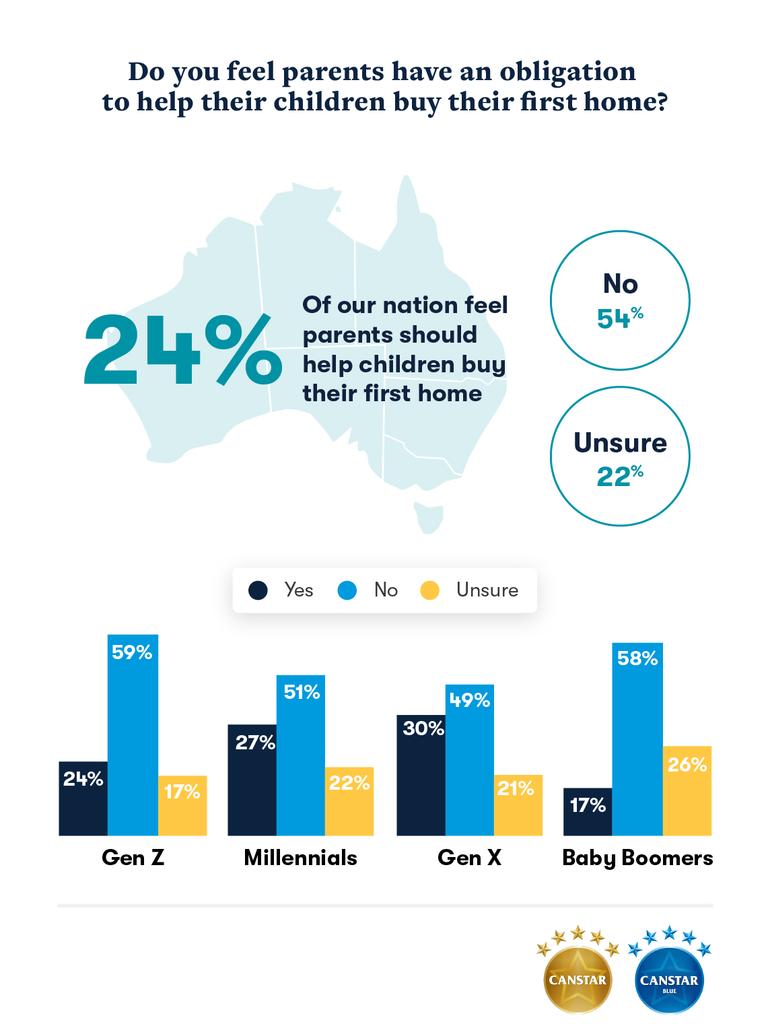

Canstar’s data showed a growing number of Australians feel parents have an obligation to help their children buy their first home, up from 21 per cent last year to 24 per cent.

“Intergenerational equity is concerning Australians of all ages, with parents worrying that their children will not be able to afford the same access to home ownership they enjoyed. The good news is that there are many ways that parents can help even if they don’t have a mountain of savings,” comments Mickenbecker.

“For a lot of families that might include helping to boost potential first-home buyers’ savings by offering rent-free or reduced rent for adult children residing at the family home for longer.”

The research showed that Australians believe the best way for parents to support their children to buy is; financial education (22 per cent of respondents), contributing financially to the deposit (19 per cent), offering rent-free accommodation (16 per cent), going guarantor on the loan (13 per cent), contributing to living costs (8 per cent) and buying with them (6 per cent).

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Hamish McLachlan making ‘phenomenal’ $13m South Yarra property play

Chinese buyers remain the dominant force in Australian real estate market: new report