Australian housing: The true cost of upsizing your property revealed

The pandemic has seen a major shift in the way we live and work. But what will the cost be to make that change to your home? Well, it depends on where you live.

The desire to set up a home office could cost some Australians more than half a million dollars and add years to their house hunting plans as buyers seek to upsize.

Pre-COVID-19, a city-fringe address attracted a premium price tag as location trumped size. But now that so many Australians are working from home – either full time or part time – extra space is rising to the top of buyers’ wish lists.

RELATED: How COVID-19 is making people rethink where they want to live

Aussie property market turned from smashed avo to scrambled eggs

To get insight into how Australians’ property preferences have changed as a result of lockdowns, research agency and financial comparison site Canstar conducted a sentiment survey.

The study found that one in every two adults had reconsidered their list of “must haves”. When asked what the lockdown had taught them; 36 per cent wanted more natural light, 29 per cent desired a home office space, 28 per cent wanted to live in a neighbourhood with more local shops, parkland and outdoor activities, 28 per cent sought a view, 25 per cent were after some outdoor space, and 24 per cent wanted more outdoor space.

More spare change for a spare room

Considering the shift in property preferences, Canstar researchers analysed data from realestate.com.au to discover the ultimate cost of inner city upsizing.

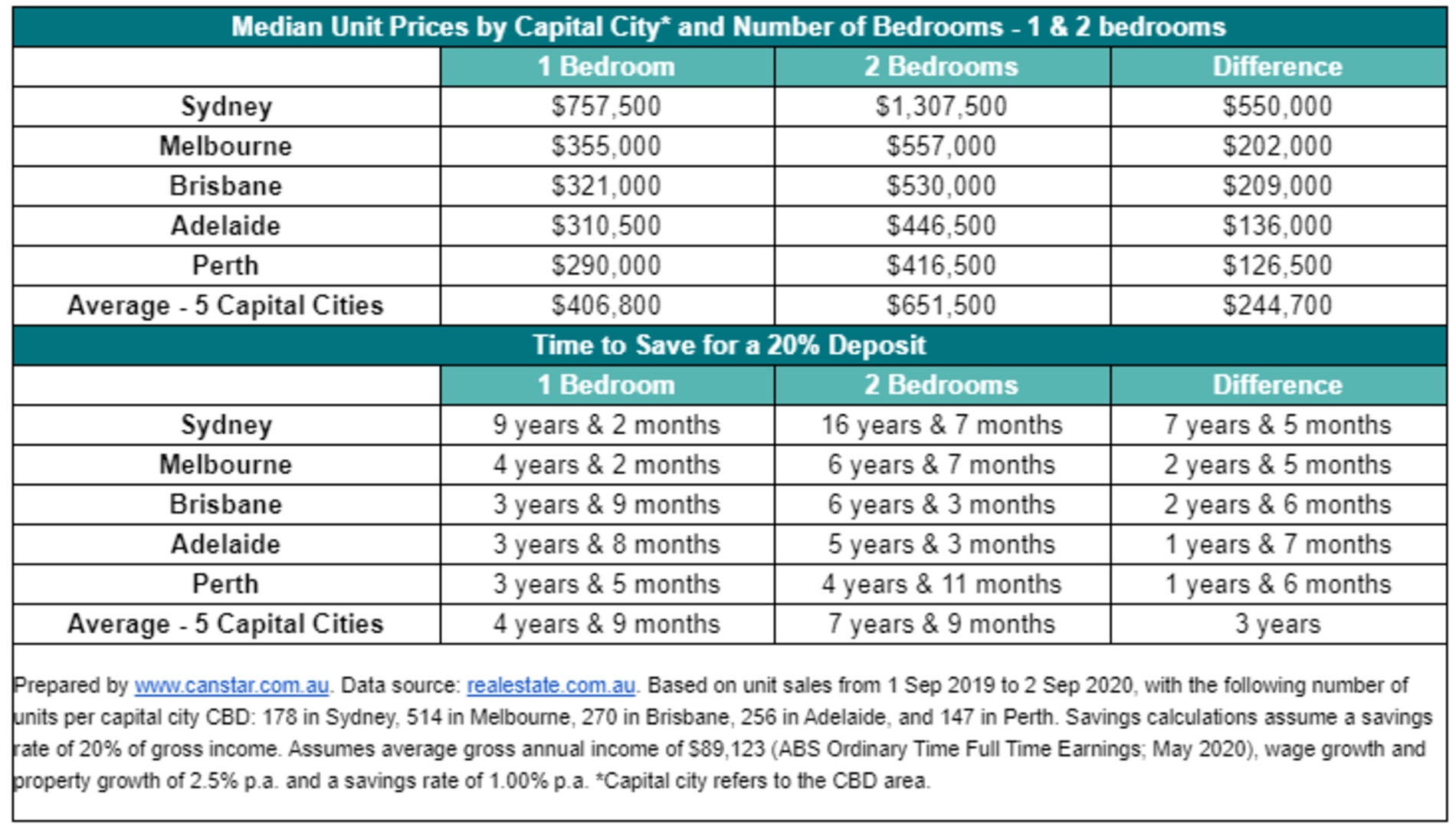

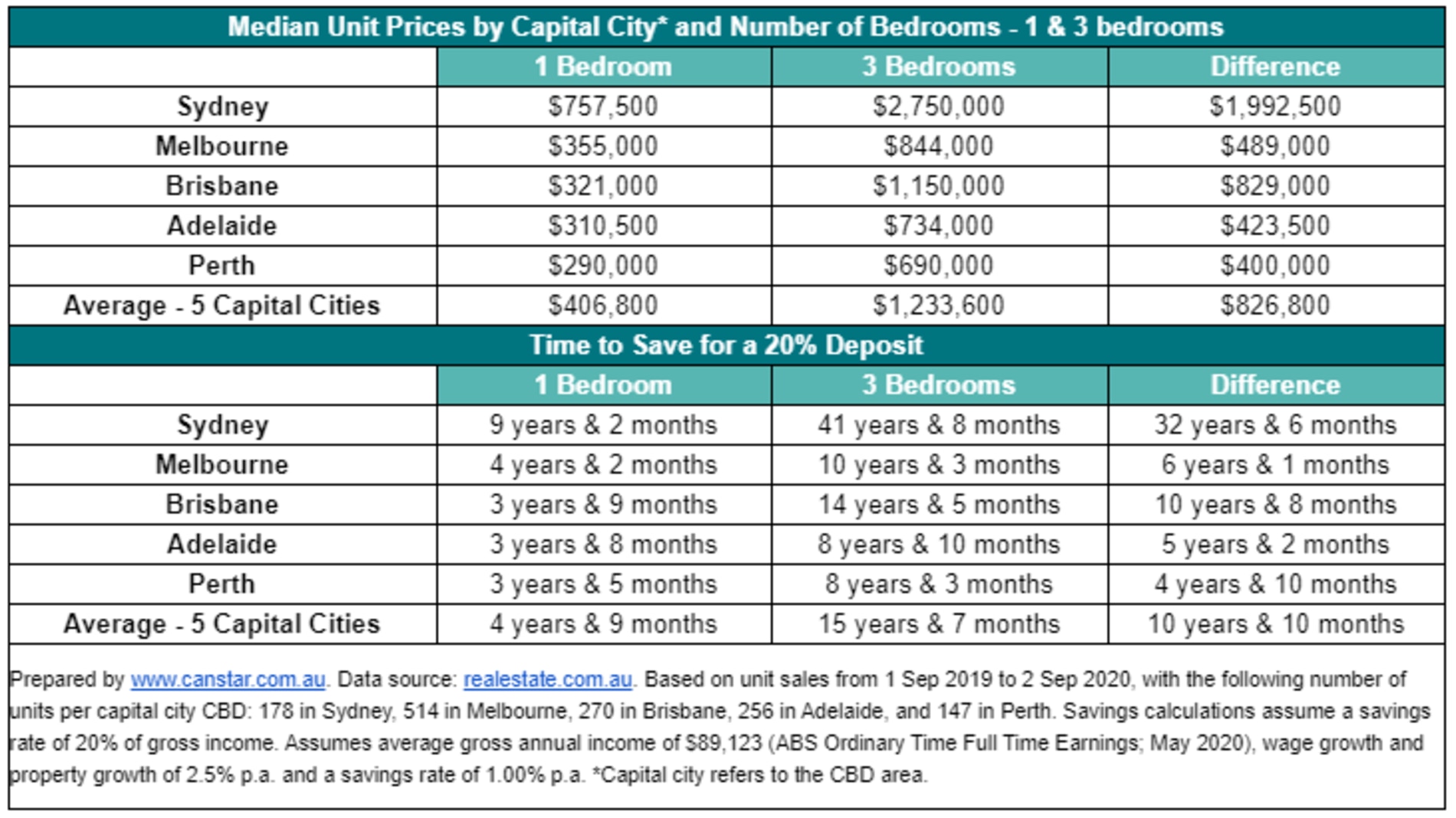

The analysis showed that a two-bedroom unit – where one bedroom is used as a study – could cost an average of $250,400 more when compared to a one-bedroom unit.

That hefty difference is the average across all major capital cities, however the cost climbs as high as $570,000 for an extra room in Sydney’s CBD.

For Melbourne, the additional bedroom would only set buyers back $202,000 while in Brisbane it was $209,000.

In Adelaide another bedroom would cost an extra $136,000, and in Perth $126,500.

For first-home buyers, opting for a two-bedroom unit instead of a one-bedroom not only comes with a dramatic price increase, but would translate to an additional three years and two months of saving to get to a 20 per cent deposit.

MORE: The trendy beachside town as popular as Byron

My Chemist owner buys famed Aussie Kimderella estate

In Sydney, that time difference comes to a whopping seven years and five months.

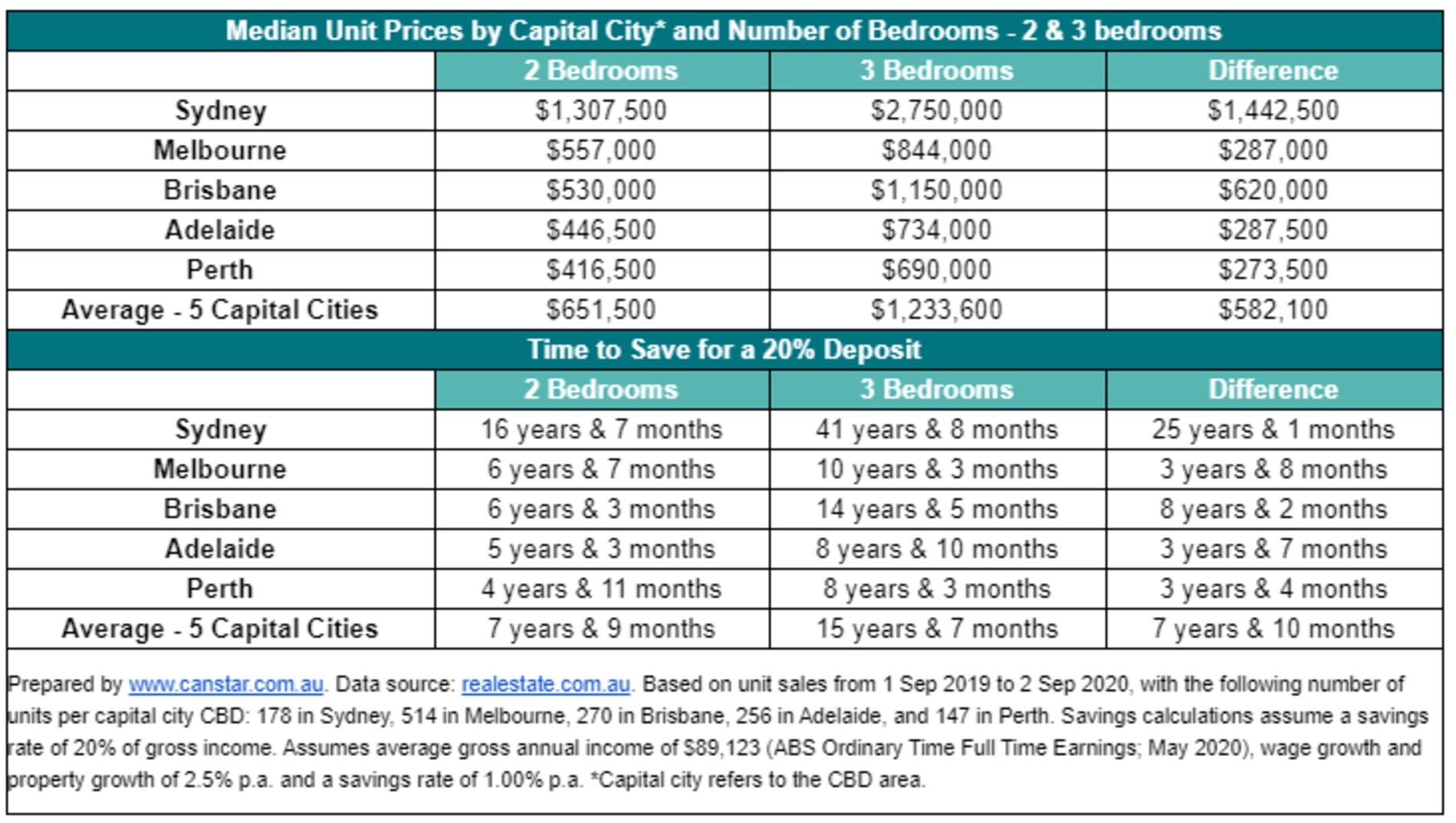

The contrast in purchase price between a two-bedroom and three-bedroom unit in the major capitals averages to $582,100. In inner Sydney that gap averages $1.44 million, in Melbourne it is a more modest $287,000, for Brisbane it was calculated at $620,000, Adelaide came in at $287,500 and Perth’s difference was $273,500.

Crunch the numbers for the long-term

The study highlights the need for potential buyers to weigh up what more space is really worth to them, according to Canstar’s editor-at-large Effie Zahos.

“A lot of people won’t realise what that extra bedroom actually adds on. When we saw the numbers, that was quite confronting. If you’re in an inner city area and you want to go from one to two bedrooms, it is a considerable cost if you want to stay within that same suburb,” she said.

“Some people’s immediate reaction is ‘I need to have study, I need another bedroom’. But that comes at a price. Consumers need to sit down and work it all out. Consider where they’ll be relocating to, what the price difference is, and how much more it’ll mean on the mortgage,” Ms Zahos said.

In years to come, if our record low interest rates start to climb, then upsizing the home means upsizing the mortgage, she added.

“The pain of upsizing at the moment is disguised a little bit because interest rates are so low, but it’s definitely a cost that’s got to be factored in,” she said, adding that working from home is beginning to lose its novelty for some.

“I think it’s a case of be careful what you wish for. Reports now show a lot of people are actually yearning to go back to the office in some capacity. If you don’t have that right set up, you may feel like you’re constantly in the office.”

Like many Sydneysiders, Danna Brown found herself working remotely after the arrival of COVID-19.

The TAFE NSW employee also took the extended time at home to adopt a puppy and is now considering upsizing to a three-bedroom home.

Currently in a two-bedroom Petersham apartment she bought 10 years ago, Ms Brown says that despite any additional space in Sydney costing a premium, she feels pandemic-priced property is good value.

“It think it’s pretty good, I’ve been watching the semi market around the inner west and there’s a lot of stock coming on. I’ve only just started looking, but I’d estimate it would cost me about $300,000 to $400,000 for an extra room in my area,” she said, adding that prior to the pandemic she hadn’t any plans to upsize.

“I probably wouldn’t have because I used to travel a lot for work. I’d spend months at a time away, but I can’t see myself doing that anymore. Especially not I’ve got my puppy.”

“Now that I’m at home so much, I thought it was time to get a bit more space. I’d like a study and a bit of a backyard for the dog to run around in,” she said.

Difference in median unit prices by bedroom

National average (capital cities combined)

Between one and two bedrooms = $244,700

Between two and three bedrooms = $582,100

Sydney CBD

Between one and two bedrooms = $550,000

Between two and three bedrooms = $1.442 million

Melbourne CBD

Between one and two bedrooms = $202,000

Between two and three bedrooms = $287,000

Brisbane CBD

Between one and two bedrooms = $209,000

Between two and three bedrooms = $620,000

Adelaide CBD

Between one and two bedrooms = $136,000

Between two and three bedrooms = $287,500

Perth CBD

Between one and two bedrooms = $126,500

Between two and three bedrooms = $237,500