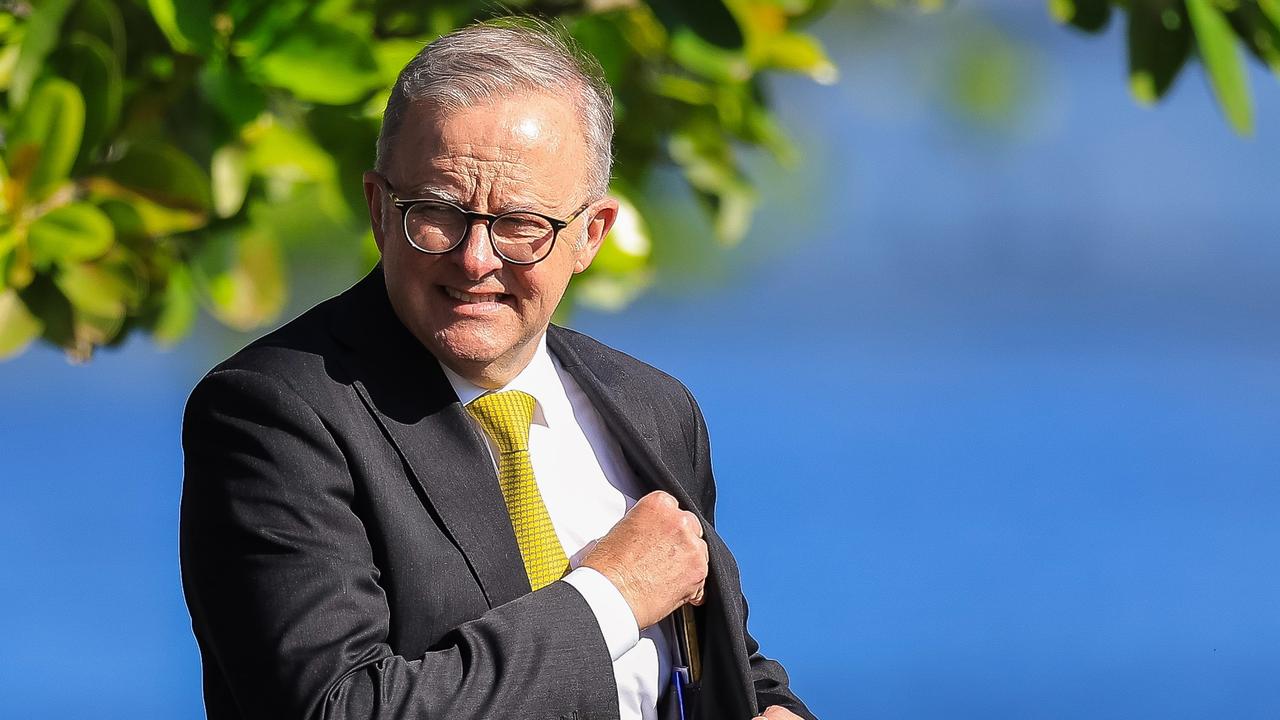

Anthony Albanese’s huge tax boost from renting out coastal home

The PM has officially found a tenant for his new clifftop mansion and it’s going to cost taxpayers big.

Prime Minister Anthony Albanese’s decision to rent out his $4.3m coastal retirement home will deliver him a whopping tax saving.

It’s a five-figure amount that has been estimated to eclipse the entire annual earnings of everyday Australians.

And it comes at a time when a looming federal election looks set to drag negative gearing tax benefits back under a microscope.

The Labor leader bought The Central Coast home in the middle half of last year, revealing at the time that the four-bedroom residence would be a home for him and wife-to-be Jodie Haydon “one day”.

MORE: Bold moves that got Albo $8.8m property empire

MORE: Inside the private homes of Aussie prime ministers

The couple snagged the home for $350,000 below the price the vendors had paid for it in 2021.

Mr Albanese has since quietly listed it for lease, with the rent listed at $1500 per week in November, down from an original amount of $1900 per week.

The PM updated his official register of interests in January to include unspecified “rental income” for the clifftop mansion in the coastal suburb of Copacabana, 90km north of Sydney.

The undisclosed rent is estimated to be in the region of $1000-$1500 per week, with an automated rental valuation from CoreLogic pinning the likely rent at $1400.

The estimates were based on rents for similar homes in the area and, if correct, would mean the Prime Minister would be collecting nearly $73,000 in annual rental income.

With this rent and his prime ministerial salary at about $564,000, the home would allow Mr Albanese anywhere from roughly $45,000 to nearly $90,000 in annual tax savings through negative gearing concessions.

MORE: Surprise mark of a ‘good’ salary in each capital

Analysis from accounting group MCG Quantity Surveyors showed the amount he would be eligible to claim would vary depending on the size of the deposit he used for the purchase – which has not be disclosed.

Were he to have used a 50 per cent deposit, which is a common scenario for those purchasing houses at the top-end of the market, the claim would be in the region of $45,000 a year.

If he used a 20 per cent deposit – rare but not unheard of for those purchasing properties priced over $4m – the claim would be close to $90,000.

These figures included estimated costs for repairs, maintenance, property management fees, interest at an average loan rate and other tax deductible items.

The median salary across Australia is currently $88,000 a year, according to the ABS.

It’s worth noting that Mr Albanese’s exact tax claim is not a matter of public record and has not been released.

The Prime Minister’s rent charges remain well above the typical Australian investor, who usually owns just one property and pockets about $600-$700 per week in average rent.

Albanese’s rental portfolio could be a target in the upcoming election, with the Greens having previously taken aim at the Prime Minister for owning investment properties.

Greens housing spokesman Max Chandler-Mather has said that negative gearing should be scrapped.

“We could be investing that money in building public housing but instead it is going to people like the Prime Minister with his three investment properties,” Mr Chandler-Mather told media.

The Greens spokesman has also said that negative gearing, which allows investors to offset the losses incurred on their properties against their tax, “rigged the system” in favour of banks and landlords.

“These tax handouts might help property investors like the prime minister to buy up multimillion-dollar mansions, but they are locking over 770,000 renters out of home ownership by driving up prices,” he said.

Labor itself has looked into the issue, with the Prime Minister confirming in September that treasury officials had been seeking advice on potential reforms to the tax concessions.

A month later, the Albanese government ruled out revisiting negative gearing and capital gains tax concessions.

Deputy prime minister Richard Marles said at the time that public debate about Anthony Albanese’s Copacabana home purchase was not a factor in the government’s position.

“No doors have been opened here,” Mr Marles told Sky News. “We’re not doing negative gearing. That’s been made manifestly clear and none of that has changed.”

Labor took proposals to limit negative gearing to new homes to the 2016 and 2019 federal elections, while grandfathering in the benefits for existing negatively geared properties. It lost both elections.

Originally published as Anthony Albanese’s huge tax boost from renting out coastal home