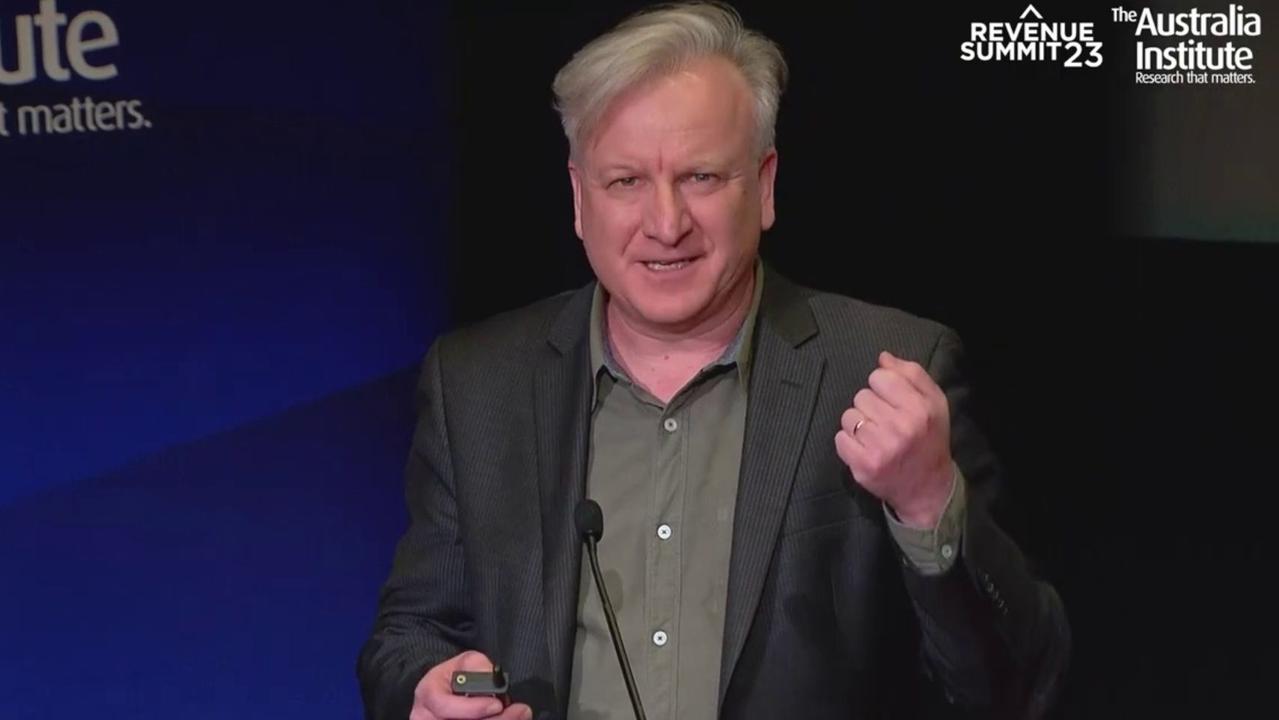

‘They fall at the first hurdle’: Chief economist tears apart ‘pathetic’ stage three tax cuts in searing industry address

A leading Aussie economist has torn apart the controversial stage three tax cuts in a searing address, as calls mount to scrap them.

One of Australia’s leading economists has pulled apart and exposed the “pathetic” shortfalls of the incoming stage three tax cuts as calls grow for the government to roll back the controversial system.

Stage three, introduced by then-Treasurer Scott Morrison in 2018 and supported by Labor since 2021, will see a flat rate introduced to the income tax system from July 1, 2024.

From that date, any Australian earning between $45,000 and $200,000 will pay 30 per cent in tax, with the most significant cut going to higher income earners, who have paid up to 45 per cent in tax until then.

Now, nine months out from being brought into effect, Australia Institute chief economist Greg Jericho has torn the whole thing apart in a searing address at the think tank’s annual Revenue Summit.

He said the tax cuts were a “badly constructed system” full of failed promises that are not only “economically out of date, economically stupid, they’re also politically terrible”.

For one, the cuts will be eye-wateringly expensive and are expected to cost $21 billion in their first year and about $320 billion after 10 years.

“Believing that losing that much revenue is not going to have an impact on ongoing government services and funding is incredibly naive,” Mr Jericho said.

But more than being costly, the economist said the cuts fail to do what they were ever promised: “cure us of bracket creep”.

Mr Jericho explained bracket creep as when workers’ wages rise with inflation, so under Australia’s “nominal tax system” they pay more tax even if their “real wages” and living standards remain the same.

“What this really means, though, is that bracket creep mostly affects people on low and middle income,” he added.

“Because more of their income is either untaxed or taxed at a low rate, so when it goes up a bit the impact is much greater than for those on very high incomes who already are getting massively taxed”.

The stage three tax cuts, however, do the “complete opposite”; and in fact, Mr Jericho noted, the Parliamentary Budget Office found 80 per cent of Aussies – those earning less than $120,000 – will lose more to bracket creep than they will get back from any currently proposed tax cut.

Not to mention, the tax cuts were introduced well before Australians were facing a brutal cost of living crisis.

But, more than being an economic sinkhole, he said they’re a political catch-22, too: The government can’t dump them, that would give the Opposition a free hit, but voters “hate” them.

Polling by the Australia Institute found most Aussie workers either wanted to dump the cuts (37 per cent of respondents) or had on opinion about them (39 per cent). Only 24 per cent of people want to keep the cuts.

And the more they knew about the cuts, the more they opposed them and, Mr Jericho said: their “ambivalence turned to outright hatred”.

Beyond opposing them, more than two in five (44 per cent) wanted to change the cuts to give lower and middle-income earners a greater cut.

“Now to me that’s an extraordinary lack of support for such a high-profile policy,” Mr Jericho said.

Even Teal seats, whose workers are set to benefit most from the cuts, overwhelmingly reject them.

Prominent Independent MP Monique Ryan also attended The Summit, where she called out the “booby trap” of the stage three cuts to demand a “fairer” system that benefits all Australians.

“I feel that it is inappropriate and almost immoral for politicians to support the stage three tax cuts; tax cuts which would give an $8,000 tax cut to people like myself, and CEOs, while we are refusing to give enough support to raise Australians out of poverty,” Dr Ryan said.

“That‘s not the Australia that any of us want to live in.”

Her call for a fairer tax system was echoed by fellow Independent politicians at the summit, including ACT senator David Pocock and Fowler MP Dai Le.

A “better stage three” is precisely what Mr Jericho and his Australia Institute colleague, senior economist Matt Grudnoff, challenged themselves to create, hypothetically, for the government before the July 1 rollout.

They set out to make a model that provided greater tax cuts to more Aussies, save more money than the current cuts, and, “just to make things a little tougher”, would allow JobSeeker payments to be raised by $250 a fortnight.

“I have to say I actually wish it was harder than it was,” Mr Jericho told The Summit, introducing his four alternative models.

“Forget monkeys at typewriters working for you, you need one monkey just bashing at a typewriter and you’ll come up with a better tax income cut than stage three.”

Each model saved the government tens if not hundreds of billions over the next 10 years, unlike the current stage three cuts, all while raising JobSeeker payments and delivering bigger tax cuts to more Aussies – especially those on lower incomes who have been “smashed by cost of living”.

Here are the four alternatives (compared with the stage three tax cuts as it stands) that the economists came up with:

“I think that’s a pretty juicy thing to take to an electorate, especially given all the changes to the economy,” Mr Jericho said.

He added that the examples proved economists could “do literally anything and you come up with a better (tax scheme)” than stage three; but also that it was a $320 billion “once-in-a-generation opportunity”.

“It‘s a $320 billion gift to deliver better tax cuts, tax cuts that actually go to low to middle-income earners,” he said.

“Those who have suffered the suffer the most from bracket creep, those who have suffered the most from cost of living crisis.”

“Stage three is not a problem. It is an opportunity, a massive political, economic, $320 billion election-winning opportunity. I mean, it‘s right there. Just grab it!”