Reality of looming stage three tax cuts explained as Aussies rage

Aussies have slammed looming stage three tax cuts as a “war on the poor”, but a financial planner has revealed the truth behind the changes.

Aussies are up in arms over looming tax cuts that are set to give the biggest boost to the country’s wealthiest – however a financial planner has exposed some misconceptions around the change.

James Wrigley, principal at First Financial in Melbourne, went viral on TikTok after he published a video about the stage three tax cuts being introduced July 1, 2024.

The move, which was introduced by the Morrison government and has been supported by Labor, will see the 32.5 per cent tax rate lowered to 30 per cent and the threshold for this bracket increased.

This means everyone earning $45,000 and $200,000 will be paying 30 per cent in tax. The 37 per cent bracket will also be removed and the lower threshold for the 45 per cent bracket raised from $180,000 to $200,000.

In his video, Mr Wrigley explained these changes and suggested there were some ways of structuring income and planning for expenses that Aussies could take advantage of before the stage three cuts come into play.

Many commenters flocked to the video to share their anger at the changes, claiming they benefit wealthier Australians above anyone else.

“How the hell it’s $45,000 and $200,000 in the same bracket it’s just insane,” one person wrote.

“War on the poor,” another said.

“The rich get richer,” a third added.

Speaking to news.com.au, Mr Wrigley said that, despite the belief from some Aussies that these cuts will only help the rich, these changes will help the majority of tax payers.

“low-and-middle income earners have benefited from all the changes in stages 1 & 2, they will also benefit from the changes in Stage 3 – if they earn over $45,000 pa,” he said.

“The main impact is a reduction in tax for the vast majority of Australians.”

He responded further to some of the misconceptions in a follow-up video, saying that comments suggesting someone earning $45,000 and someone on $200,000 are going to be paying the same amount of tax under the cuts are “not right”.

“They might be paying the same marginal tax rate but the percentage of their income that is going in tax is vastly different,” he said.

“The higher your income is, the percentage of your income that goes towards tax is far higher than someone earning a lower income.”

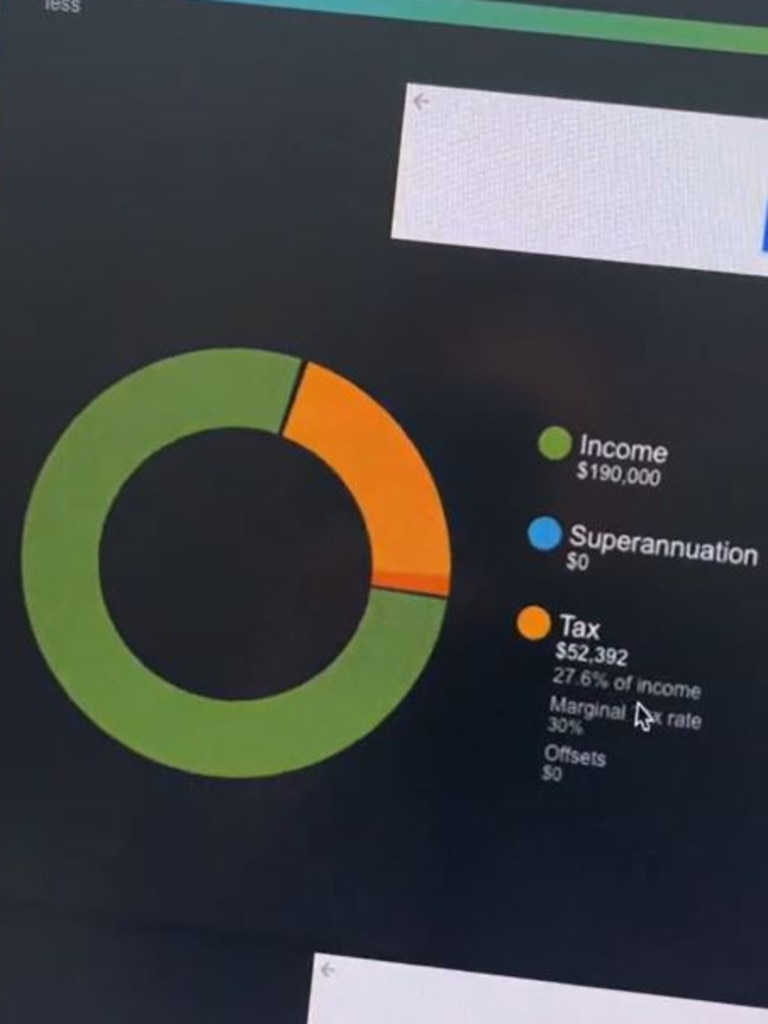

Using a tax calculator set to the 2024-25 tax year, Mr Wrigley showed that a person earning $50,000 will pay about $7300 in tax or 14.7 per cent of their income, while a person earning $190,000 will pay more than $52,300 in tax – about 27.6 per cent of their income.

“This is all to do with the marginal tax rate system. So there is a tax-free threshold, there’s some lower tax thresholds and then we get into this great big flat tax bracket of 30 per cent – but the more of your income that is in that 30 per cent tax bracket the higher your effective tax rate is,” he said.

So while the suggestion from some Aussies that low-and-middle income earners won’t benefit at all from the stage three cuts is not accurate, Sydney tax lawyer Harry Dell says it is fair to say it will benefit high income earners “much more”.

“On one hand, the LMITO in stage one was temporary, but the stage three tax cuts are permanent. How is that fair?” he told news.com.au.

“Stage one benefited middle-income earners with the temporary LMITO and slight adjustments to the middle brackets, stage two and stage three benefited high-income earners.

“All of the stages benefited high-income earners much more than any other group.”

Introduced as a temporary measure in the 2018/19 federal budget, the low-and-middle income tax offset meant those earning between $37,000 and $126,000 were eligible for a tax cut of up $1500.

That has now been scrapped, meaning many Aussies have been getting less cash back in their tax return this year than they have become accustomed to.

“The LMITO ending is the cause of lots of outrage this tax time,” Mr Dell said.

He explained that the stage three cuts were expected to have a $20.4 billion impact on the Federal Budget in its first year

“$14.9 billion of this benefit will go to people earning over $120,000 and $5.5 billion to those earning under $120,000,” he said.

Mr Dell noted that it was within the government’s power to reintroduce the LMITO as a permanent offset or adjust the tax rates to benefit low-and-middle income earners long term.

“While it is bad politics energy to change laws introduced by the previous government – Parliament certainly could change them and most experts agree they aren’t appropriate with the current economic environment.”