Stage 3 tax cuts to make rich even wealthier with $5300 boost

New analysis has revealed how the controversial stage 3 tax cuts are going to smash the disposable income of those less well off.

Australia’s rich – the top 20 per cent of income earnings – will be $5378 better off in the coming financial year and the next due to tax cuts and will receive bigger benefits than all other workers.

New research showed that the stage three tax cuts will deliver just an extra $509 in disposable income for the bottom 20 per cent in financial year 2023-2024 and the next.

Middle income earners – those earning around $100,000 – will score an extra $1243 but will have less income to spend compared to 2019.

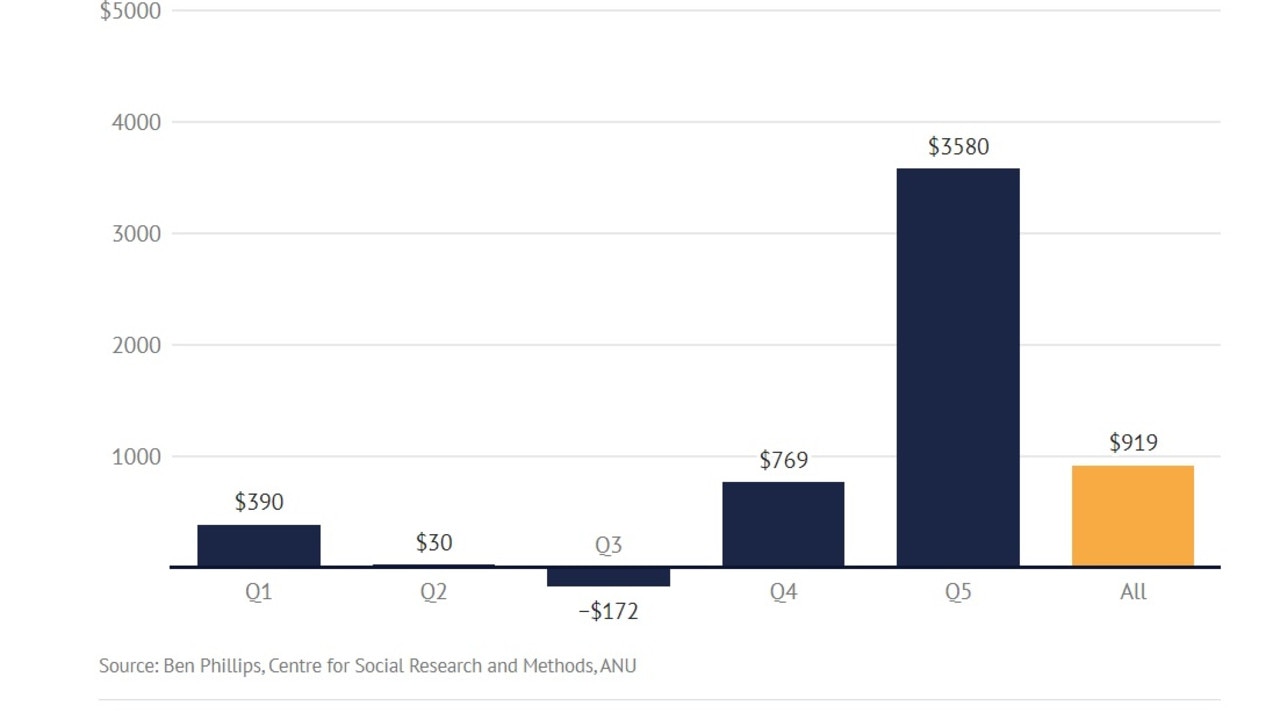

Analysis from Australian National University’s Centre for Social Research and Methods economist Professor Ben Phillips revealed that middle-income earners will be up to $172 worse off in 2025 than they were in 2019.

But the nation’s richest people, those earning $160,000 and above, will be the clear winnings, netting a bonus worth nearly $5400.

The stage three tax cuts are also going to cost the government a whopping $69 billion over the next four years, including $21 billion in their first year of operation.

However, when they were first announced by the Morrison government they had been forecast to add up $15.7 billion in costs in 2024-25.

But the analysis showed that middle income earners in particular will be hard hit by bracket creep meaning a greater proportion of their income is taxed at a higher rate.

It found those earning between $40,000 and $75,000 would be left with just $30 extra as a result of the tax cuts in 2024-25, compared to $3580 for the rich and $390 for the bottom 20 per cent of households.

Mr Phillips said many of the budget measures were targeted towards the lowest-income and most financially stressed households.

“(But) in combination with the stage three tax cuts, or the 10-year tax plan, the impact is more regressive and the dollar benefits flow heavily to higher income households,” he told the Sydney Morning Herald.

H&R Block director of tax communications Mark Chapman said the legislated tax cuts will come into effect on 1 July 2024 and will largely benefit the most wealthy.

“There was no reprieve also for the Low- and Middle-Income Tax Offset, which expired last year – and leaves millions facing an effective tax increase in the current year of up to $1500,” he added.